LLP Form 11 is the annual return that a Limited Liability Partnership registered under the LLP Act 2008 must file every year. It is crucial that you keep yourself up to date with the latest compliance requirements to provide top-notch services to your clients and to avoid penalties.

In this article, we will delve into the meaning of Form 11, due date and also how to file the form 11 online. Let’s dive in!

Table of Contents

What is LLP Form 11?

LLP Form 11 is a webform used to file annual return by LLP to Registrar of Companies (ROC). LLP Form 11 must be filed within 60 days of the close of the financial year as per section 35 of the Limited Liability Partnership Act, 2008 along with necessary attachments.

LLP Form 11 Due Date

LLP Form 11 Due Date for FY 2022-23 is 30th May 2023. LLP Form 11 is due to be filed on 30th May every year.

LLP Form 11 Due Date for filing Annual Return

| Financial Year | LLP Form 11 Due Date |

| LLP Form 11 due date for FY 2022-23 | 30th May 2023 |

Pre-requisites to file Form 11

- You must have the LLP details such as LLPIN handy.

- Both the partners DSC is mandatory.

- Contributions received from all the partners.

- Annual return of LLP.

How to file LLP Form 11?

Follow the below steps to e-file Form 11:

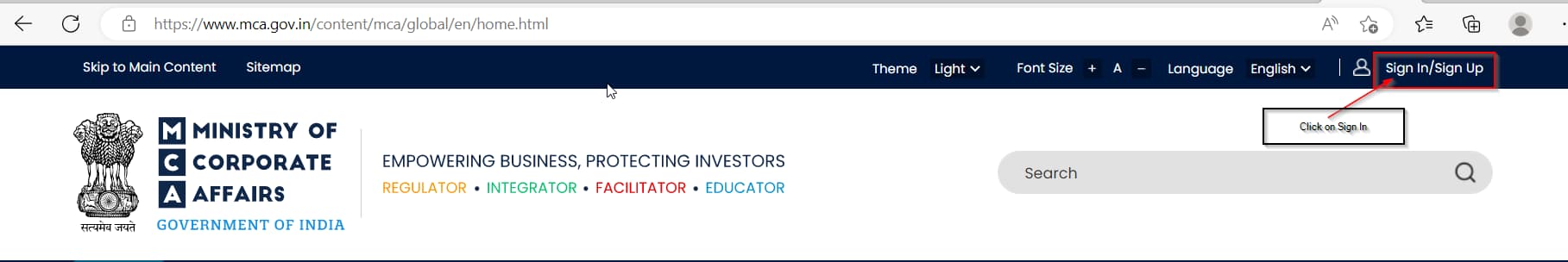

1. Registration on MCA Portal

Go to the link https://mca.gov.in and click on Sign in.

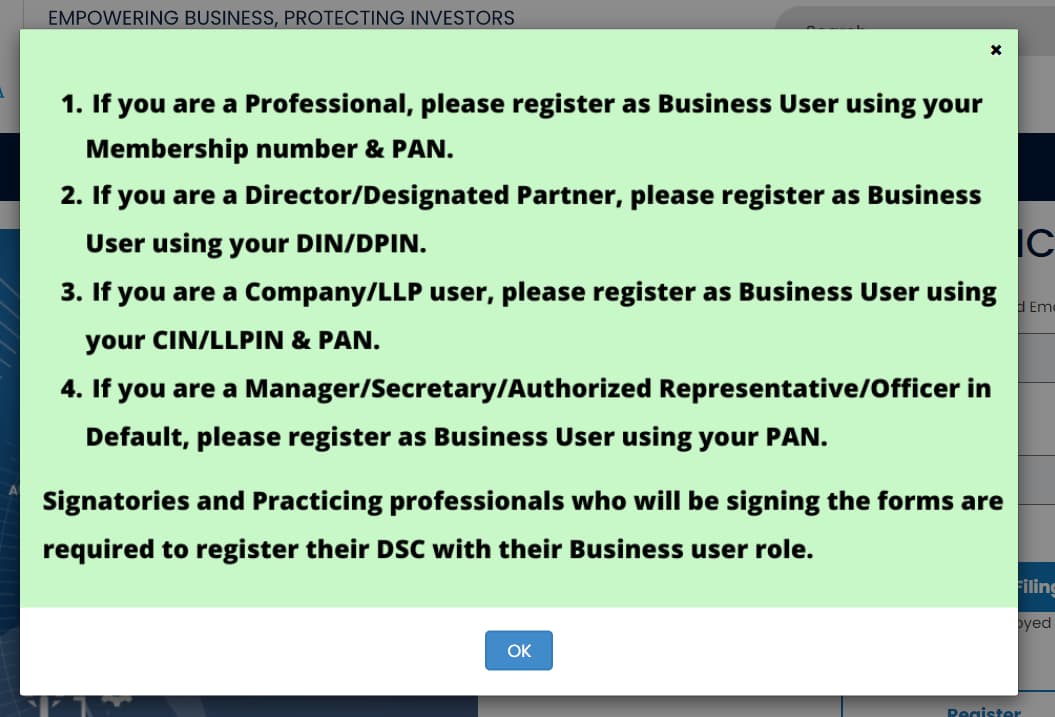

2. Selection of Role

You will get the below screen, select the appropriate option and click Ok.

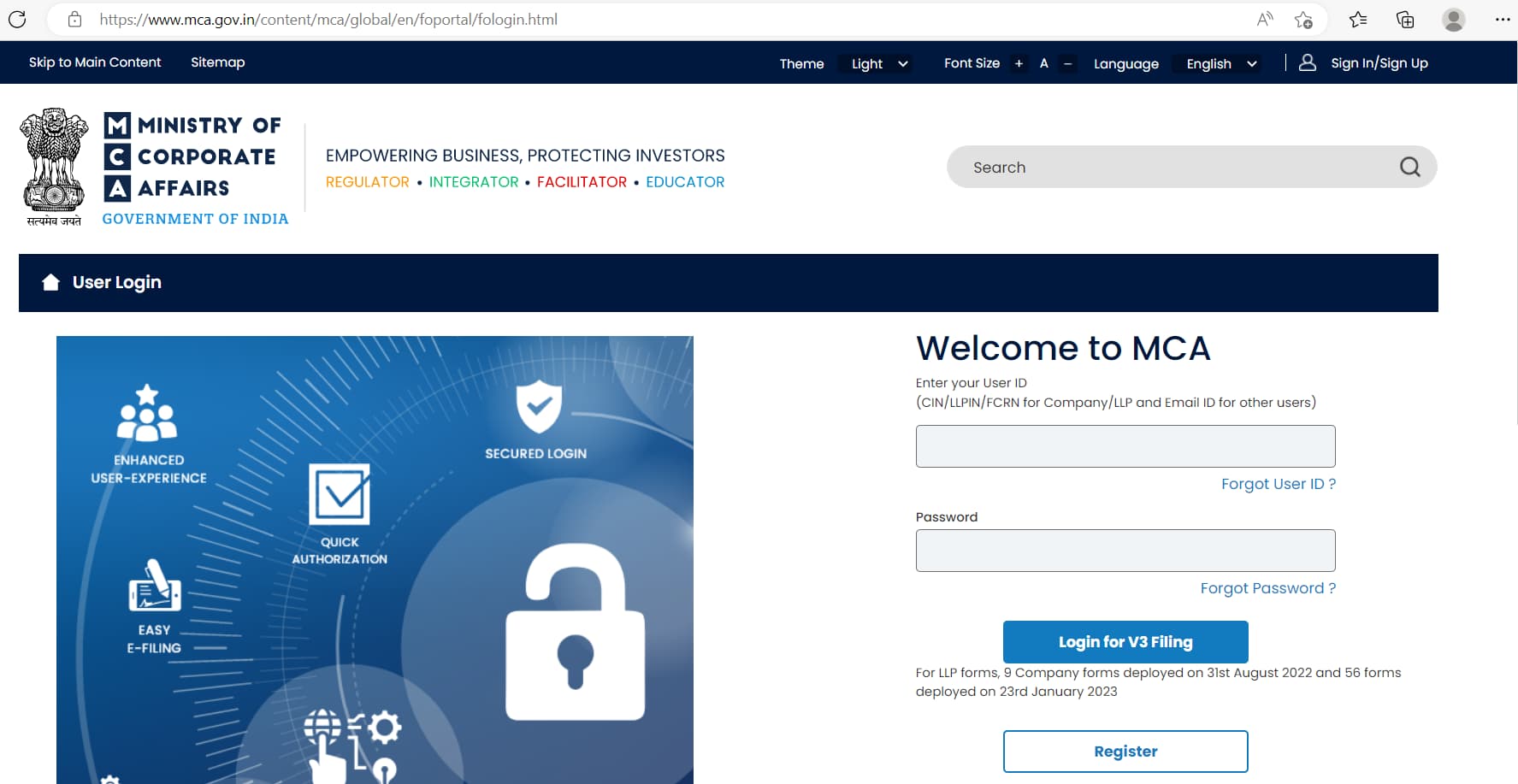

3. Login to the MCA Portal

Enter your LLPIN or email in the User id field and password in the respective field and click on “Login for V3 Filing”.

4. Navigate to Access Form 11

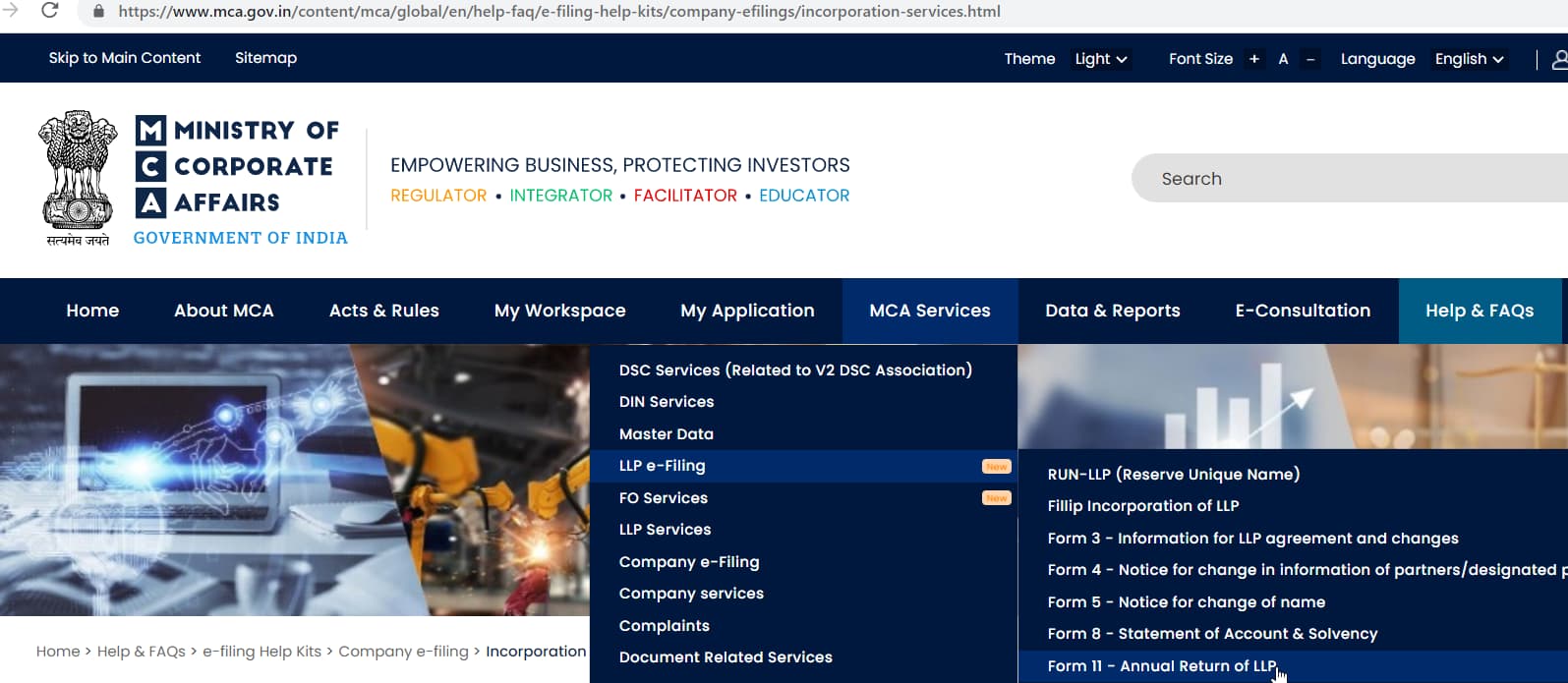

Follow the path MCA Services>LLP e-Filing>Form 11- Annual Return of LLP to start e-filing of Form 11.

5. Complete the Form 11

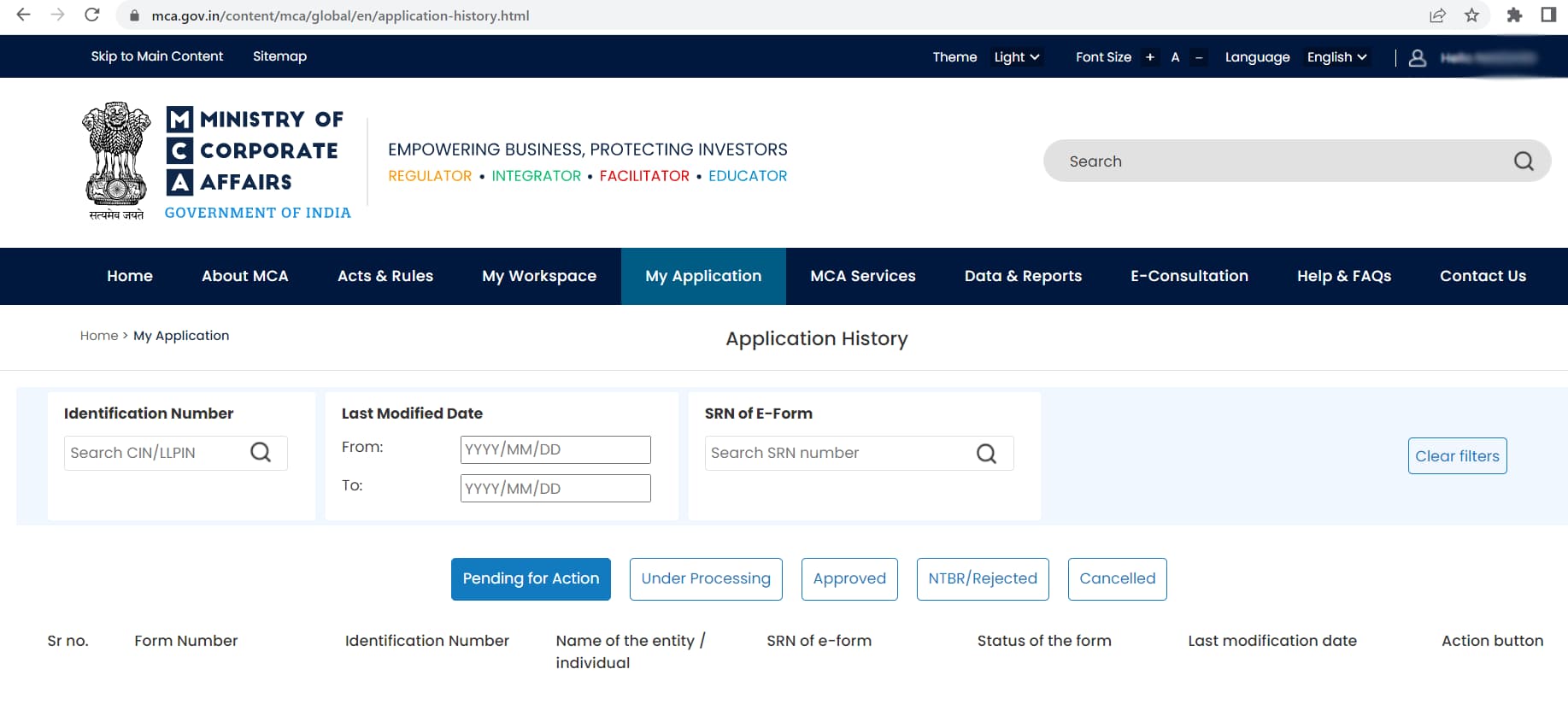

a. Enter your LLPIN in the Identification Number field and click on Search.

Fill in the LLP’s details, such as LLPIN, LLP name, and financial year-end date.

b. Provide accurate and updated information regarding partners, designated partners, and their details.

c. Enter the LLP’s registered office address and contact information.

d. Fill in the financial details, including the statement of accounts and solvency.

6. Attach the required documents

Prepare and attach the necessary documents such as audited financial statements, balance sheet, profit and loss statement, and cash flow statement.

7.Verify the form 11

Use the DSC of a partner to verify the form.

8. Digitally Sign the form

Use the DSC of the designated partner to sign the form 11.

9.Submit the form

Submit the form and SRN is generated.

10.Pay the fees

Refer the fees corresponding to your contribution amount and pay the fees.

11. Acknowledgement

On successful payment of fees, you will receive an acknowledgement for the same.

LLP Form 11 E-Filing Fees

Normal Fees

| Contribution Amount (in INR) | Normal Fees (in INR) |

| Up to 1,00,000 | 50 |

| More than 1,00,000 to 5,00,000 | 100 |

| More than 5,00,000 to 10,00,000 | 150 |

| More than 10,00,000 to 25,00,000 | 200 |

| More than 25,00,000 to 100,00,000 | 400 |

| More than 100,00,000 | 600 |

Additional Fees

You must pay additional fees in case of delay in filing of form 11.

| Period of Delay | Additional Fee payable for Small LLPs | Additional Fee payable for Others |

| Up to 15 days | 1 times of normal filing fees | 1 times of normal filing fees |

| More than 15 days and up to 30 days | 2 times of normal filing fees | 4 times of normal filing fees |

| More than 30 days and up to 60 days | 4 times of normal filing fees | 8 times of normal filing fees |

| More than 60 days and up to 90 days | 6 times of normal filing fees | 12 times of normal filing fees |

| More than 90 days and up to 180 days | 10 times of normal filing fees | 20 times of normal filing fees |

| More than 180 days and up to 360 days | 15 times of normal filing fees | 30 times of normal filing fees |

| Beyond 360 days | 25 times of normal filing fees | 50 times of normal filing fees |

Faqs

1. What is LLP Form 11 Last date?

LLP Form 11 Last date is 30th May 2023. As of today, there is no extension in the due date for filing LLP Form 11.

2.Is it mandatory to file Form 11?

Yes, even if the LLP has no business, it is mandatory for all LLPs to file form 11 on 30th May of the upcoming financial year.