GSTR-3B form which is to be filed monthly by all registered dealers on the GSTN portal can now be filed through SMS from the registered mobile number.

With effect from 8th June 2020, the government is enabling the filing of GSTR-3B NIL return through SMS directly.

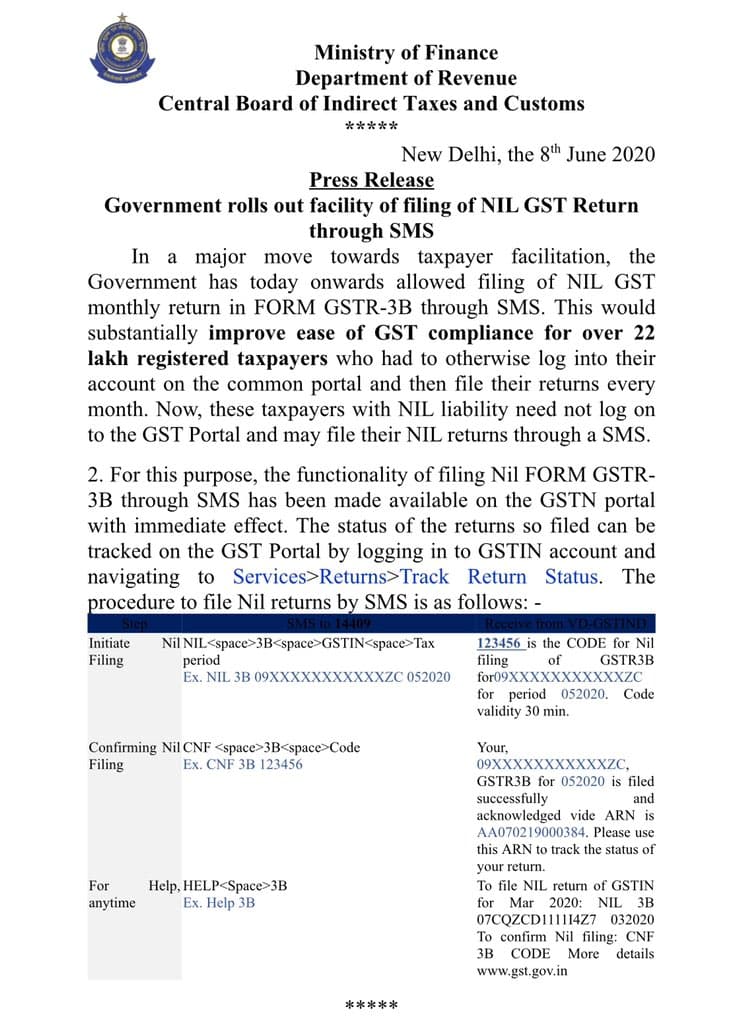

In a significant move towards taxpayer facilitation, the Government is allowing the filing of NIL GST return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through an SMS.

For this purpose, the functionality of filing Nil FORM GSTR-3B through SMS has been made available on the GSTN portal with immediate effect. The status of the returns so filed can be tracked on the GST Portal by logging in to the GSTIN account and navigating to Services>Returns>Track Return Status.

Table of Contents

The Step-by-step procedure to file GSTR-3B Nil return by SMS is as follows:

STEP 1 : Initiate GSTR-3B NIL return SMS filing

Send an SMS in the following format to 14409

NIL<space>3B<space>GSTIN<space>Tax period

Here: GSTIN is your GST number

Tax period is month in MMYYYY format

Example: NIL 3B 09XXXXXXXXXXXZC 052020

Send this as sms to 14409

You will receive an SMS response from VD-GSTIND to your registered mobile number as shown below:

123456 is the CODE for Nil filing of GSTR3B for09XXXXXXXXXXXZC for period 052020.

Code validity 30 min.

STEP 2 : Confirmation of NIL Return Filing

Now send another SMS in the below format to 14409 to confirm the filing of NIL Return

CNF<space>3B<space>Code

Here: Code is the 6 digit number which you received on your registered mobile

number after you sent the first SMS:

Example: CNF 3B 123456

Send this sms to 14409

You will receive a confirmation sms from VD-GSTIND on your registered mobile number as shown below:

Your, 09XXXXXXXXXXXZC, GSTR3B for 052020 is filed successfully and acknowledged

vide ARN is AA070219000384. Please use this ARN to track the status of your return.

https://pib.gov.in/PressReleasePage.aspx?PRID=1630258

Who can file GSTR-3B NIL Return through SMS

- Taxpayer must be registered as normal taxpayer/ Casual taxpayer/ SEZ unit/ SEZ Developer and must have valid GSTIN

- Authorized signatory and phone number must be registered on the GST Portal(gst.gov.in).

- There is no pending liability of Tax, interest or late fee for previous periods.

- All previous GSTR 3B returns must be filed.

- No data should be in saved stage, in online version of GSTR-3B

FAQs

(1) How may times is the nil GST return acceptable?

There is no restriction on the number of times nil GST return can be filed.