Form 16 is a certificate of tax deduction at source. In simple words, it is proof of the tax deducted from your salary by your employer. As a taxpayer, you need form16 to file your income tax return for the financial year.

Also, it is mandatory for the employer to issue Form 16 under section 203 of the Income Tax Act, 1961. In this article, we will see what is Form 16, Eligibility salary, and how to get Form16 online.

Table of Contents

What is Form 16?

Form 16 is a TDS certificate that an employer must issue to his employees. The employer deducts income tax from your salary and deposits the tax with the Income Tax Department. You need this form to know the exact TDS amount deducted from your salary to claim a TDS refund.

Key Points

| – Form 16 is proof of TDS deducted from your salary. |

| – Only an Employer can issue Form 16 to his employees/ ex-employees. |

| – You are eligible to get Form 16 if your salary is above Rs 2,50,000 per annum. |

| – Due date to issue Form16 is 31st May of the next financial year. |

| – You can claim a refund of the TDS amount while filing your income tax return for the financial year. |

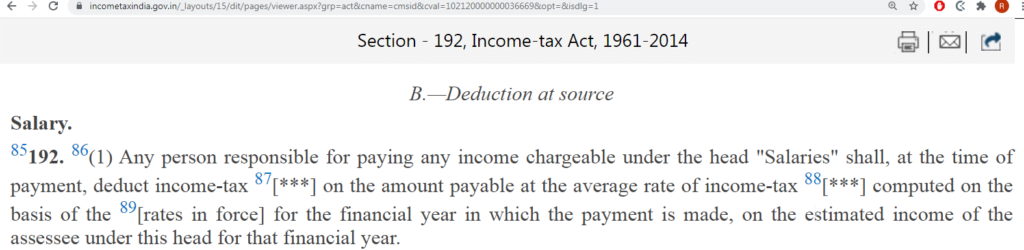

| – Section 192 of the Income Tax Act, 1961 relates to Form16. |

Form 16 Eligibility Salary

Every salaried individual whose income comes under the taxable slab is eligible to get form 16. So, if your income from salary exceeds Rs 2,50,000 per annum you come under the taxable slab and you need to file your income tax return. Also, your employer is obliged to issue Form16 to you so that you can claim the TDS refund.

However, if your salary is exactly Rs 2,50,000 you are exempt from income tax and hence, you are not eligible to get Form16.

How to Download Form 16 for Salaried Employees?

Are you a Salaried Employee looking to download Form 16? Well, you cannot download Form 16 directly from TRACES. However, the employer can download form 16 from TRACES. You can request your employer to issue Form 16 to you, provided your salary exceeds Rs 2,50,000.

Assessee employed under more than one Employer

If you worked only under one employer during a financial year, you will Form16 which has details of TDS for all the quarters of the financial year.

However, if you worked for two or more employers in a financial year, you will receive Part A of Form16 from each of the employers for the period you worked under them. Also, you can choose to receive Part B (Annexure) from all the employers you have worked under or receive only from the last employer.

How to Get Form 16 Online? [For Employer]

As a deductor/ employer, you can raise a request for Form 16 on TRACES. Furthermore, You will also have the option to sign the certificate digitally.

TDS CPC generates form16 & 16A on processing the quarterly TDS/ TCS statements filed by the deductor.

If you cannot get it from TRACES, check if you have filed form 24Q for Quarter 4 with Annexure-II. Filing Annexure-II with actual particulars for the entire financial year is mandatory. Moreover, Information in Annexure-II forms the basis to generate Form16.

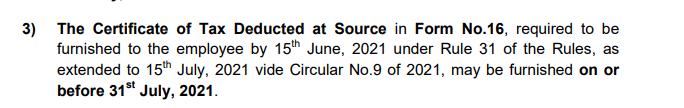

Due Date for Issue of Form 16 Extended

The Central Board of Direct Taxes (CBDT) extends the due date for issue of form 16 due to the pandemic.

| Particulars | Periodicity | Due Date | Due date for FY 2021-22 |

| Form 16 | Annual | 31st May of the financial year immediately following the current financial year in which the salary or other income was paid & TDS was deducted. | 31st May 2022 |

| Form16A | Quarterly | Within 15 days from the TDS statement filing due date. | 15th May 2022 |

CBDT press release on 25th June 2021 extract

Section 192 of the Income Tax Act, 1961 Extract

Read all provisions related to Section 192 of the Income Tax Act. 1961

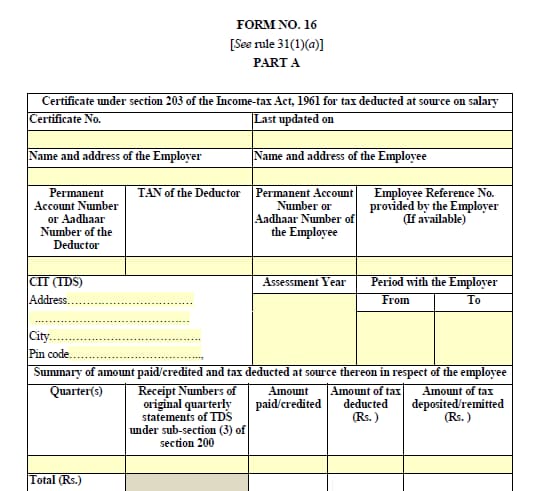

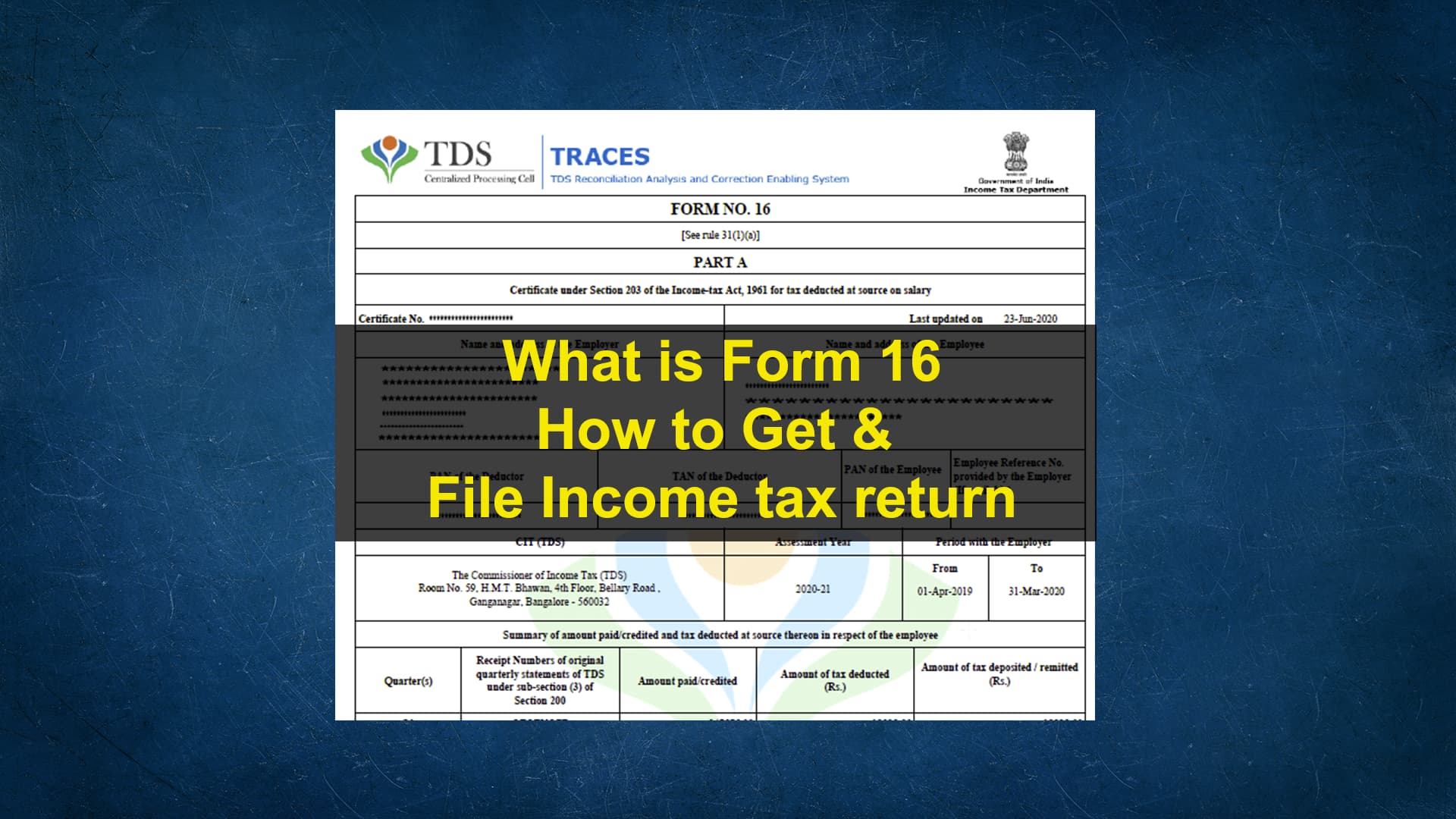

Form 16 Format

Below is the Form 16 Format that the employers can use to generate form 16 for their employees.

As per rule31(1) (a), below is the general format that government Deductors and Non-Government Deductors must fill.

Below are the components of Part A of Form16

(i) Name and address of the Employer

(ii) Name and address of the Employee

(iii)Permanent Account Number of Deductor & TAN of Deductor

(iv)Permanent Account Number (PAN) of Employee

(v)Assessment Year

(vi)Period with the Employer

(vii)CIT (TDS) Address

(viii)Summary of the amount credited and tax deducted at source in respect of the employee.

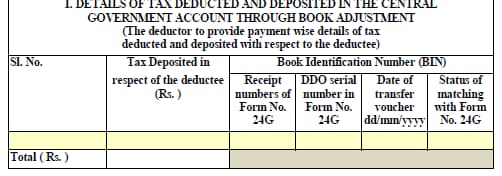

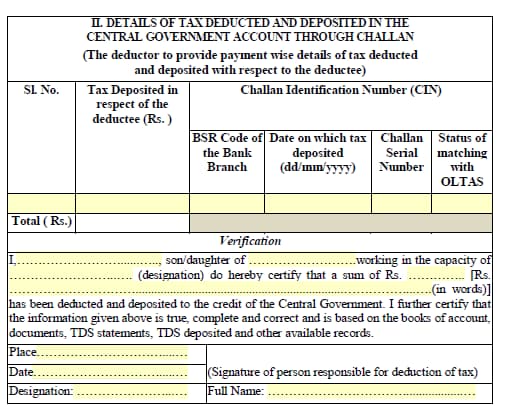

Government deductors must fill the below item I if payment of tax is made without producing an income-tax challan.

Non-Government deductors must fill in the information in item II—also, Government deductors to fill item II if tax payment is made accompanied by an income-tax challan.

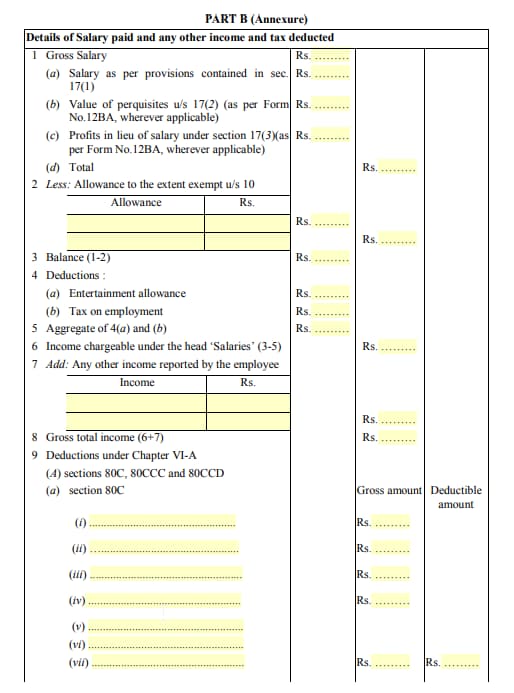

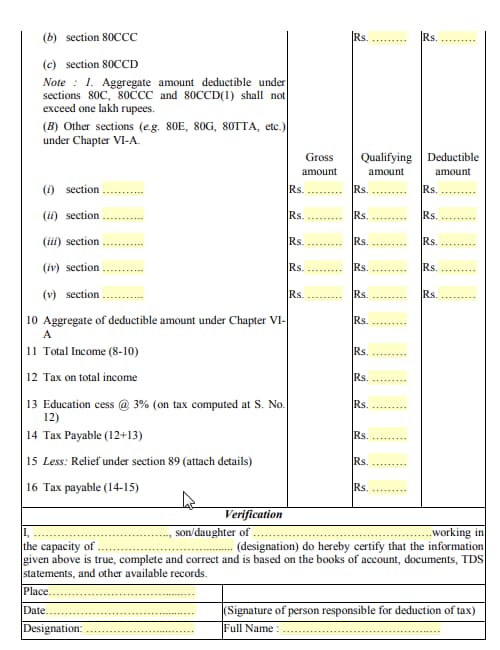

Part B is an annexure to Form16.

Below are the components of Part B of Form16

(i)Detailed breakup of Salary

(ii)Allowance to the extent exempt u/s 10

(iii)Deductions under Chapter VI-A

It covers deductions under

(A)sections 80C, 80CCC and 80CCD

(B)sections 80E, 80G,80TTA

(iv)Education cess @ 3%

(v)Relief u/s 89

(vi)Tax payable

(vii) Verification by Deductor by attesting his signature.

FAQs

(1)What is Form 16?

It is a certificate of tax deduction at source from taxable salary income. Deductor issues this form on tax deduction by the employer on behalf of the employee under section 192 of Income Tax Act, 1961.

(2) What is Form16A?

It is a certificate of tax deduction at source from non-salary earnings. Deductor issues this form on tax deduction under any other provision except sec 192 of Chapter XVII-B of Income Tax Act, 1961.

(3)How can I get Form 16?

Only your employer can download from TRACES and issue Form 16 to you. You cannot directly download form16 from TRACES using the PAN number.

(4) Who is eligible to get Form 16?

All salaried individuals with taxable income are eligible. That is, if your income from salary exceeds Rs 2.5 lakhs, you must receive form16.

(5) If the employer does not issue the TDS certificate, can I still claim TDS?

Yes, you can claim your TDS while filing the Income-tax return. However, the IT department will raise demand and enforce it on your employer and not you.

(6) What is the use of form 16?

You need this form to file your income tax return for the financial year.

(7)When is form 16 issued?

Employer issues the form by 15th June of the next financial year. However, for the financial year, the deadline to issue form 16 is extended to 31st July 2021.

(8) What happens If I lose the original TDS certificate?

You can approach your employer for a duplicate certificate.

(9) As a pensioner, where can I get my Form16?

You can approach your Bank where your pension is credited and the Bank will issue form16.

(10)Is Form16 & Form 26AS the same?

Form16 gives you details of your deductor/ employer. Furthermore, it provides a detailed breakup of your salary and details of any deductions.

(11) How to get Form 16 for previous years?

Even if you have left an organisation, you can still ask your previous employer to issue you a duplicate Form16. And it is a good idea to preserve your form16 for earlier years for at least six years as TDS proof.

(12) How to file income tax return from multiple form16s?

If you are employed under two different employers during one financial year, you will receive two form16s. That is, each employer will issue you form16 for the respective period of employment.

While filing your income tax return bear the following points in mind

(a)You must combine the incomes shown in each of the form16s.

(b)Combine the deductions with respect to HRA, Health insurance and others.

(c)Cross check your income with form 26AS

(13)If I withdraw the PF amount, will I get form16?

Yes, the employer issues form16 if you withdraw your PF as TDS is deducted. While calculating your Income from Salary you must also consider the PF amount.

(14) If I do not receive Form16 from my employer, should I file my income tax return?

If you come under the taxable bracket then you are obligated to file your income tax return. And the IT department will only penalise your employer for not issuing Form16. You will not be at fault.

(15) What is the last date for Form 16?

The last date to issue form 16 to employees for FY 2021-22 is 31st May 2022.

I couldn’t file returns on line. How I can submit the return. My income is below taxable income. ( 3.5 l) per annum.