UDIN refers to Unique Document Identification Number.

ICAI came up with a Unique Document Identification Number to prevent Non-CAs from impersonating CAs and providing certification. The system generates an 18 digit unique number for any document that a Chartered Accountant certifies.

In addition to this, the Regulators or Banks, or others can quickly check the genuineness of the certificates with the Unique Document Identification Number.

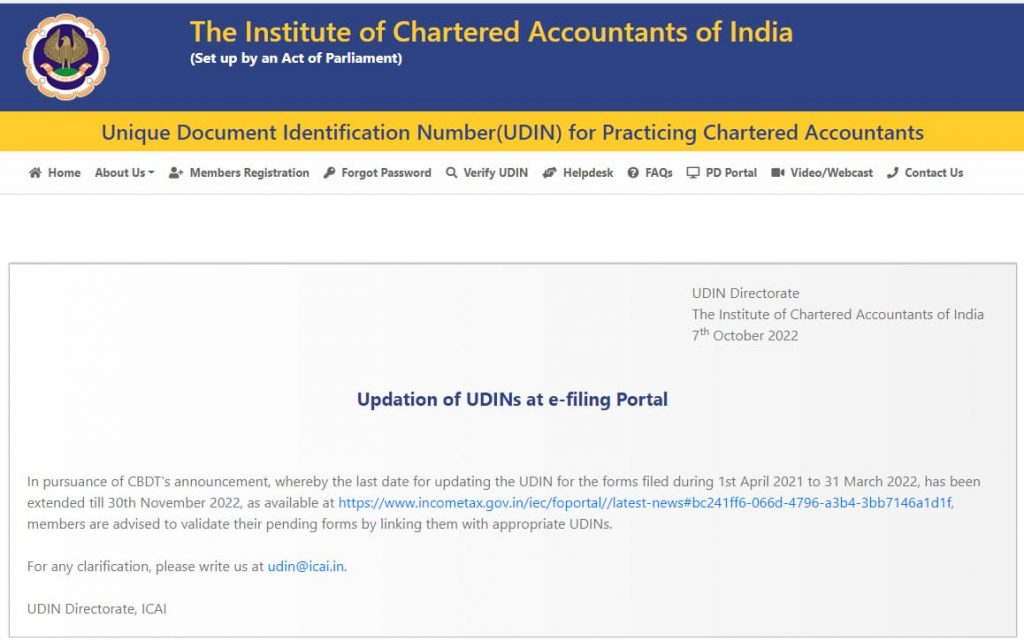

Latest News on 7th Oct 2022

Table of Contents

UDIN Last Date Extended

UDIN Last date extended to 30th Nov 2022. As per the latest news, the last date for updating UDINs at the e-filing portal is extended.

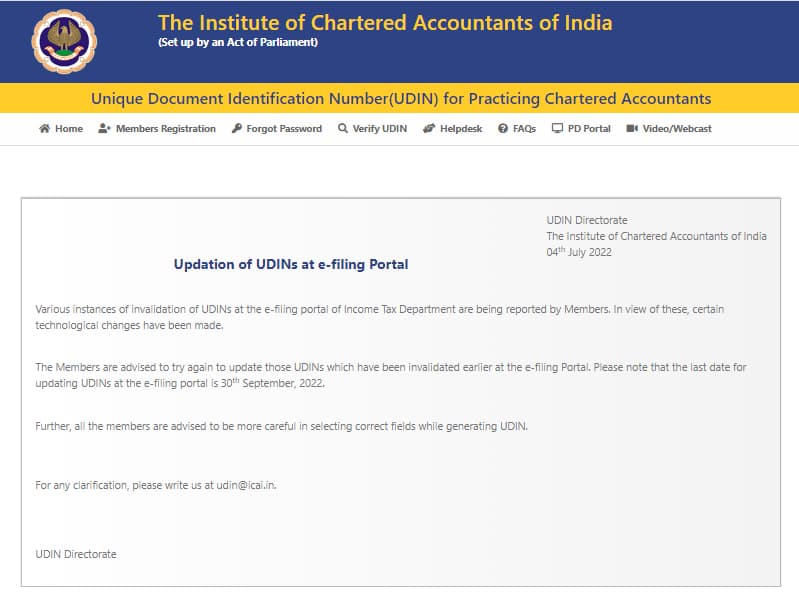

Latest News on 4th July 2022

UDIN Last Date Extended

UDIN Last date extended to 30th Sept 2022. As per the latest news, the last date for updating UDINs at the e-filing portal is extended.

Latest News on 6th June 2022

UDIN Last Date Extended

UDIN Last date extended to 30th June 2022. As per the latest news, the last date for updating UDINs at the e-filing portal is extended.

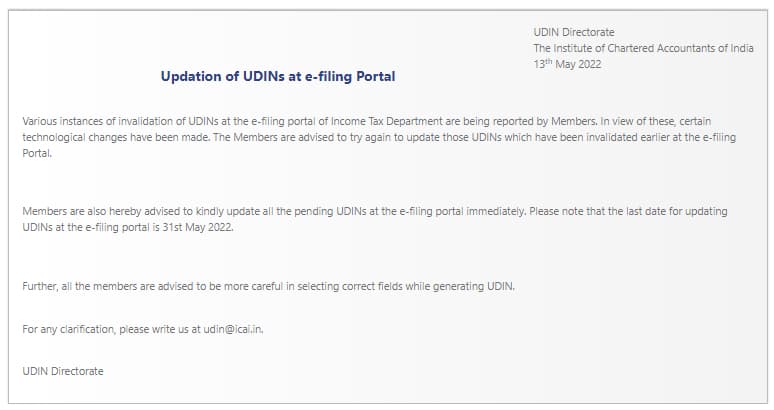

Latest News on 13th May 2022

UDIN Last Date Extended

UDIN Last date extended to 31st May 2022. As per the latest news, the last date for updating UDINs at the e-filing portal is extended.

UDIN generation last date

The CBDT extends the UDIN generation last date for all IT forms filed after 1st April 2021 at the efiling portal to 30th April 2022.

So, the last date for UDIN generation for company audit 2021 is 30th April 2022.

Latest news on 28th April 2022

Latest news on 12th April 2022

It is now mandatory to fill the value of the Memorandum of Changes (MOC) while generating UDIN for the Audit report for statutory Audit of Bank Branch under the category Audit & Assurance Functions for Statutory Audit-Bank Branch.

FRN Number in UDIN (Mandatory)

Latest news on 14th Feb 2022:

While generating UDIN, the related FRNs are not appearing in the drop-down. As a temporary measure, the portal suggests selecting Not Applicable (NA) option and mentioning the FRN in the document description.

As per the latest notification, it is mandatory to mention the Firm Registration Number (FRN) for generating UDIN. This is applicable for all Unique Document Identification Numbers generated from 12 am of 1st Feb 2022. If you are not carrying out an assignment on behalf of the firm you may mention NA/ Not Applicable/ Individual capacity in the FRN field.

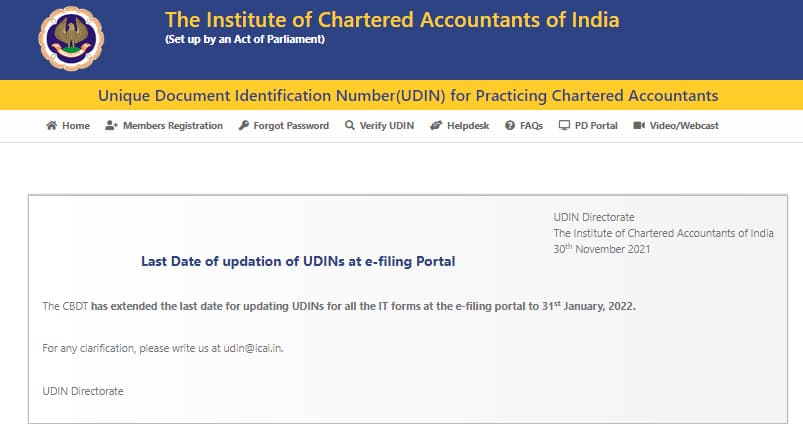

UDIN Date Extension Notification dated 30th Nov 2021

The UDIN Directorate issued a notification informing about the CBDT extending the last date to update UDINs for all the IT forms at the e-filing portal to 31st January 2022.

Key Points

| UDIN ICAI Login | https://udin.icai.org/ |

| UDIN Generation Time Limit | Within 60 days of Signing the document |

| Last Date for UDIN generation | 30th April 2022 (Extended to 30th June 2022) |

| UDIN Applicability | Mandatory for all Certificates certified by a Chartered Accountant |

| UDIN Verification | https://udin.icai.org/search-udin |

| Helpdesk | https://udin.icai.org/complaints |

UDIN Number Means

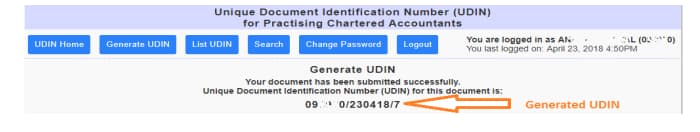

Unique Document Identification Number is in the format

Two digits-Current Year, Six digits ICAI Membership No and Ten digits Random Alpha-Numeric number.

For example 19305416RSTWBN1261

UDIN Generation

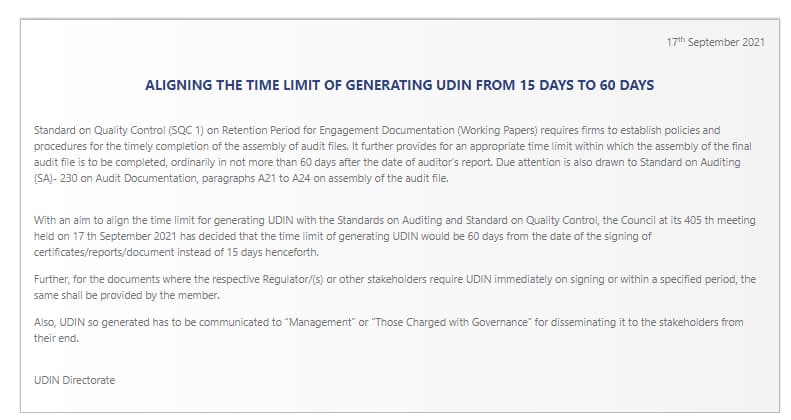

It is general practice to generate a Unique Document Identification Number when the Chartered Accountant signs the certificate. However, he can generate a Unique Document Identification Number within 60 days of signing the certificates as per the recent update compared to the previous time limit of 15 days.

UDIN Applicability

Unique Document Identification Number is mandatory for certificates containing financial information to certify as accurate and fair. A registered member must select the certificate they will issue from the drop-down.

Below is the list of certificates

| Sl No. | Certificates |

| 1 | Certification released additionally by Concurrent Auditors not forming part of Concurrent Audit Assignment. |

| 2 | Certificate of Capital Contribution or Certificate of Net Worth. |

| 3 | Certificate released by Statutory Auditors of Banks. |

| 4 | Certificate released by Statutory Auditors of Insurance Companies. |

| 5 | Certificate released to banks confirming sole proprietorship for KYC purpose. |

| 6 | Certificate released under RERA. |

| 7 | Liquid Asset Certificate U/S 45-IB of RBI Act, 1945. |

| 8 | Certificate released by Concurrent Auditors of Treasury Department of Bankaboutto physical verification of securities. |

| 9 | Certificate released by Concurrent Auditors of Treasury Department of Banks regarding Short Sale of Securities. |

| 10 | Sources of Income Certificate. |

| 11 | Certificates to claim Deductions and Exemptions. |

| 12 | Grants or Funds utilisation Certificates for a Charitable Institution or a Trust. |

| 13 | Grants or Funds utilisation Certificates for NGO’s. |

| 14 | Grants or Funds utilisation Certificates for Statutory Authority. |

| 15 | Grants or Funds utilisation Certificates under FEMA or FERA or Other Laws. |

| 16 | Form 15CB Certificates. |

| 17 | Initial Public issues Certificates or Compliances under ICDR and LODR Certificates. |

| 18 | Statutory Records-based Certificates released under Companies Act, 2013. |

| 19 | Certificates released under LLP Act. |

| 20 | Certification, required to claim a refund under other Indirect Taxes. |

| 21 | Certification required to claim GST refund. |

| 22 | Arms-length Price Certificate under section 92 of the Income Tax Act, 1961. |

| 23 | Certification regarding Fair Value of Shares of Company for Buy-Back. |

| 24 | Certification regarding Fair Value of Shares of Company for merger or de-merger. |

| 25 | Certification regarding Fair Value of Shares of Company for transferring resident’s shares to a non-resident. |

| 26 | Certification regarding Fair Value of Shares of Company for further Share Allotment. |

| 27 | Certification required under Exchange Control Legislation |

| 28 | Certification that is required under the Income-Tax Laws to claim Deductions. |

| 29 | Certificates of Net worth required for Bank finances |

| 30 | Certificates of Net worth needed for Bank Guarantee |

| 31 | Certificates of Net worth required for Student Study Loan |

| 32 | Certificates of Net worth needed for Visa by Foreign Embassy |

| 33 | Certificate regarding RBI Statutory Auditor for NBFCs. |

| 34 | Certificate of Turnover. |

| 35 | Certificate of Working Capital or Net Working Capital. |

| 36 | Others |

From 1st July 2019, it is mandatory to obtain a Unique Document Identification Number for the below certificates.

- Auditor’s Opinion or Reports released by a CA (e.g: GST Audit, , Transfer Price Audit, Company Audit, Society Audit, Tax Audit, Trust Audit.

- The Reports on Valuation.

- The Quarterly Review Reports

- The Limited Review Report

- The Audit regarding Information System

- The Audit of Forensic nature

- The Stock Audit

- The Revenue Audit

- The Credit Audit

- The Assignments on Monitoring Borrower.

- The Internal or Concurrent Audit

- Other reports such as Management Report, Due Diligence Report, Diligence Report, Viability Study Report.

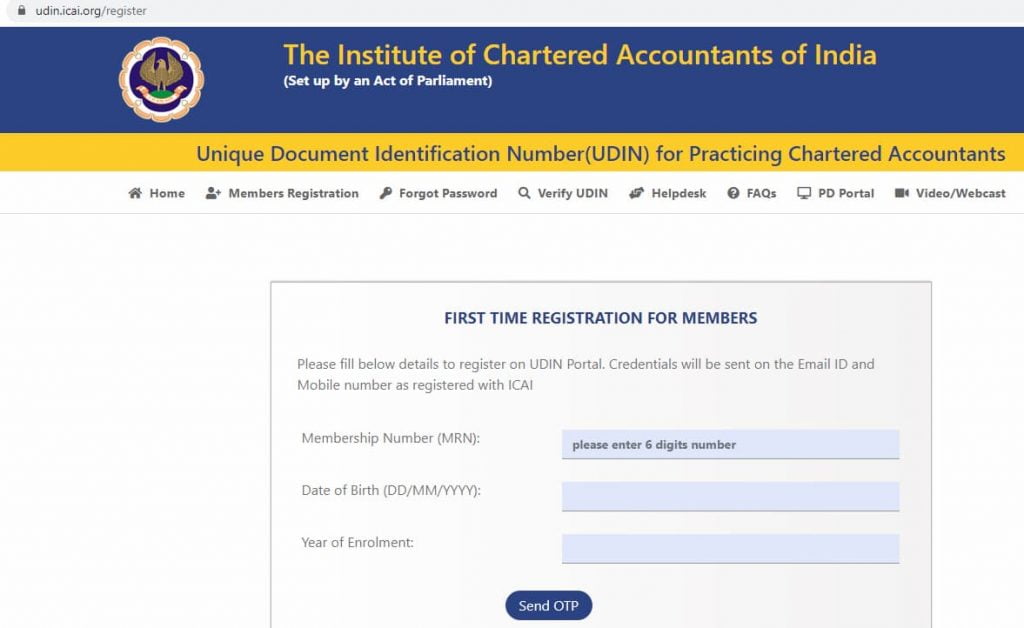

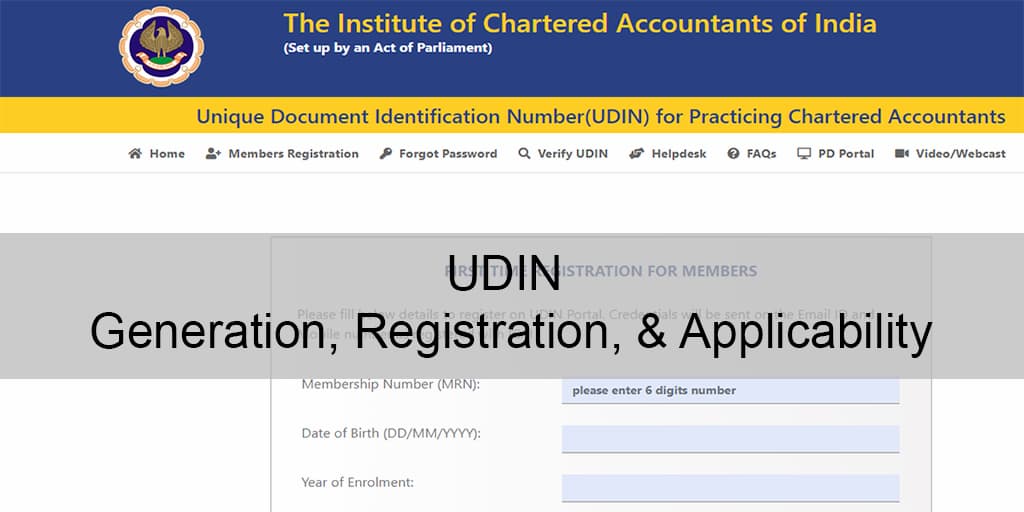

How to register on UDIN Portal?

Chartered accountants must compulsorily register themselves on this portal to generate the Unique Document Identification Number.

Below are the steps to register

(1)Go to official website https://udin.icai.org/

(2)Click on Member Registration.

(3) You reach the screen First Time registration for Members. Enter details such as your six-digit Membership number (MRN), Date of Birth (dd/mm/yyyy), and year of enrolment.

(4)Now, click on Send OTP. An OTP will be sent to your registered email id. and mobile number.

(5)Once you confirm the OTP, your credentials, such as your username and password, are sent to your registered email id and mobile.

How to generate UDIN for a document?

Below are the steps:

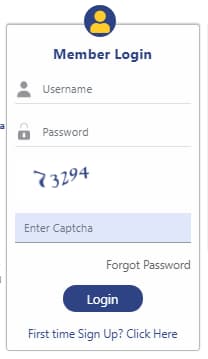

(1) Visit https://udin.icai.org/

(2) UDIN Login:

Use your MRN credentials on the Login page.

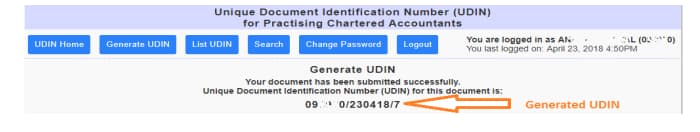

(2)Click on Generate UDIN from the Menu bar.

(3)Select the document type.

(4)You must enter the date of signing the document.

(5)You have to enter the act/ law/ regulation based on which you are issuing the report or certifying.

(6)You need to fill other vital fields.

(7)Under Document description, you must enter the description of the document in 15 to 50 characters.

(8)Click on Send OTP.

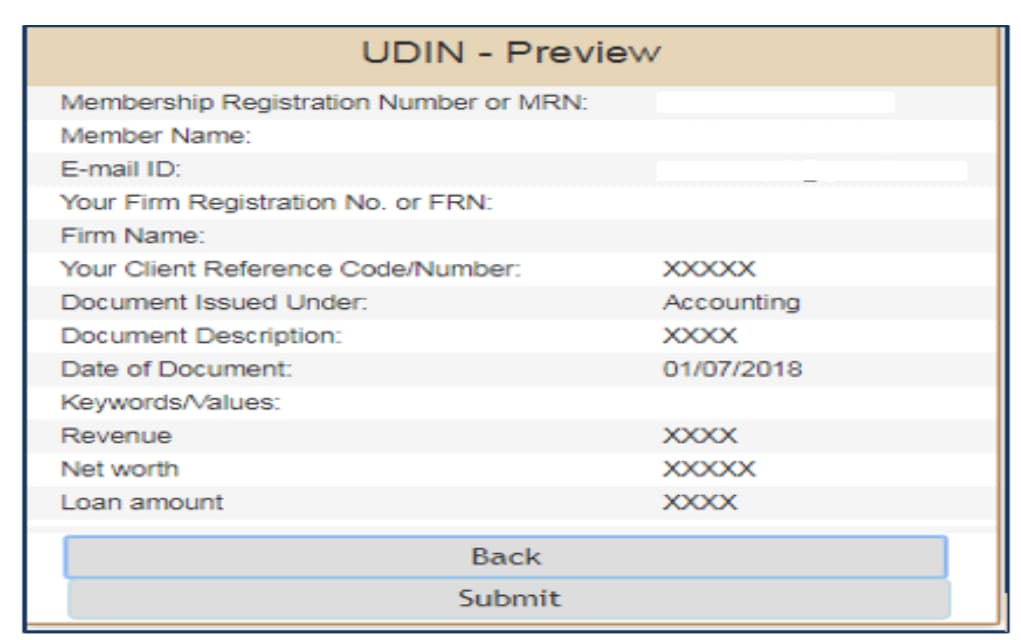

(9)You will receive the OTP on your registered mobile and email. You will be able to see the below screen.

(10)Enter the OTP you have received and click on submit. The system will generate the 18 digits Unique Document Identification Number.

You can use the unique document identification Number on the specific document using a pen or a watermark.

Requirements to generate UDIN

Below is the UDIN requirement:

- You must select the Correct Document type.

- Ensure that you mention the document signing date.

- There are three fields to enter the financial figures from the document. However, only two fields are mandatory if there are no financial figures in the document, mention zero.

How to update UDIN in Income Tax Portal?

In case you have uploaded a form on the income tax portal without Unique Document Identification Number. You will see a link “View/ Update UDIN details” available under the My Account tab. Click on the same to update.

UDIN Validation Process

E-filing and ICAI portal integration is complete. So, the Unique Document Identification Number generated for the form will be validated in real-time.

ICAI UDIN Verification

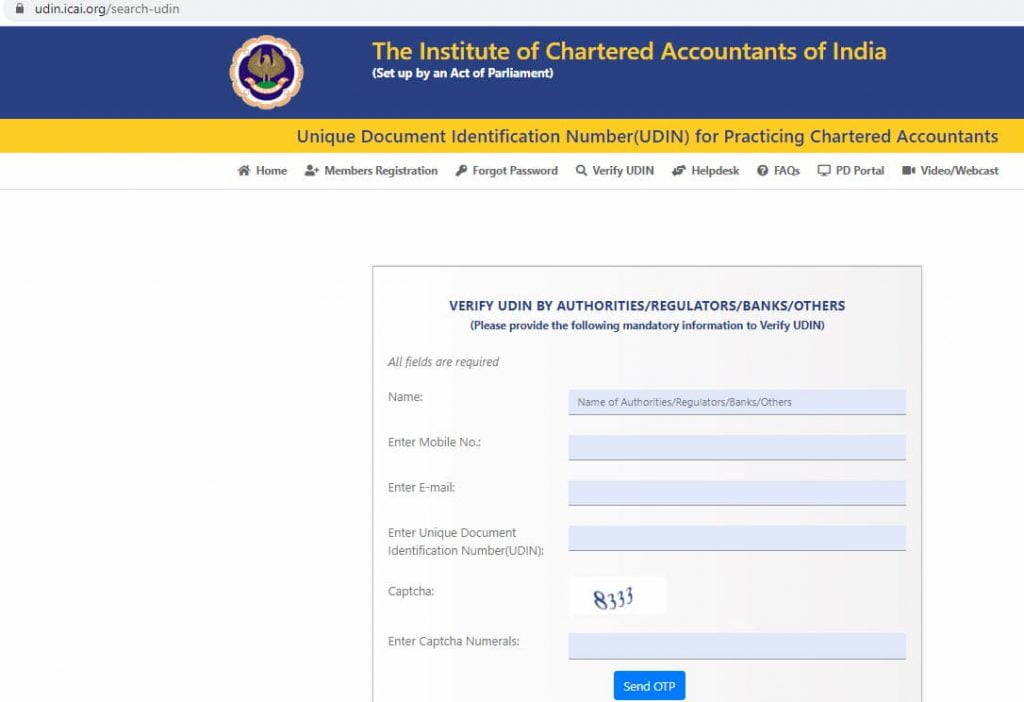

Banks and other Regulatory Authorities can verify if the documents issued by the Chartered Accountant is genuine and valid through the Unique Document Identification Number. UDIN verification can be done by the below steps:

1. Go to UDIN Portal.

2. Click on Verify UDIN.

3. In the below screen, enter the name, mobile number, email id, unique document identification number, and captcha. And click on send OTP.

5. You will receive OTP to the mobile number you entered in the above form.

4. Enter the OTP, and you will see the details of the Unique Document Identification Number as shown in the below screen.

Revoke UDIN

The Unique Document Identification Number, once generated, may be revoked or canceled by providing a reason. Revocation does not have any time limit.

Here is how to revoke a Unique Document Identification number

- Go to the “List UDIN” menu and click on revoke UDIN.

- Select the Unique Document Identification Number you want to revoke from the list and assign your reason for revocation.

- Submit through OTP.

Generating Bulk UDIN

Unique Document Identification Number Portal has a facililty to generate the UDIN in bulk for certificates. Below is the process to generate Bulk Unique Document Identification Number.

- Login to the official website https://udin.icai.org/

- Click on Bulk UDIN for Certificates from the Menu bar.You can now download template file from the Download template button. And open the file in excel

- Select the Certificate type.

- Enter the date in the format mm/dd/yyyy manually.

- Ensure that you fill in all the parameters and values correctly

- Save the file.

- Now, go to the UDIN portal and upload the file on the certificate form.

- Click on the file that you just saved now.

- The portal will auto populate the data in the form.

- Verify the data and click on submit if the data is correct.

FAQ

(1)What is UDIN?

It is a unique 18 digit number generated for a document certified or signed by a practicing chartered accountant. UDIN full form is a Unique Document Identification Number.

(2)Is UDIN mandatory?

It is mandatory for any certificate filed by the chartered accountant with the income tax department.

(3)Who can generate a Unique Document Identification Number?

Only practicing chartered accountants can generate it.

(4)Can anyone register at the UDIN portal?

No, Only practicing chartered accountants can at the Unique Document Identification Number portal.

(5)How to generate UDIN?

You must register yourself on the Unique Document Identification Number portal to generate the Unique document Identification Number.

(6)Can I check the validity of a document from the Unique Identification Number?

The Banks, RBI, Income Tax Department, and other regulators can check the document’s validity attested by the Chartered Accountant with the Unique Identification Number.

(7)What is the UDIN generation time limit within which a document should be linked with a Unique Document Identification Number?

UDIN generation time limit for FY 2020-21 is 60 days of submitting the form on the portal. After that, the form will not be valid.

(8)What will happen to my tax form if the Unique Document Identification Number is not linked?

Suppose the Unique Document Identification Number is not linked to the document. In that case, even if the form is uploaded and accepted by the taxpayer, it will be treated as null and void.

(9) The CAs can generate a unique Document Identification Number in how many days?

Unique Document Identification Number can be generated within 60 days of submitting the document.

(10)Is the Unique Document Identification Number mandatory for the balance sheet?

It is mandatory for a balance sheet if the financial statements are subject to statutory audit. However, it is not required if a balance sheet is submitted under 44AD, which is presumptive taxation where you need not maintain books of accounts.

(11)Can we edit the Unique Document Identification Number after 15 days?

Earlier Unique Document Identification number had to be generated within 15 days of signing the document. As per the recent update, the time limit to generate a Unique Document Identification Number is increased from 15 days to 60 days. Furthermore, after 60 days, you cannot edit the same unique document identification number, and you need to generate a new one.

(12)Is new registration required for every financial year?

No, new registration is not required.

(13)Can I edit Unique Document Identification Number?

Unique Document Identification Number, once generated, cannot be edited. A preview option is available to you after entering all the details.

(14) What is the last date for UDIN generation for company audit for FY 2022-2023?

The UDIN generation last date is extended to 30th Oct 2023.

(15)Can UDIN be generated backdated?

There is no option to generate it in advance. And however, it can be generated within 60 days of signing the document.

(16) What is the validity of the Unique Document Identification Number generated?

There is no expiry date for the Unique Identification Number generated unless revoked.

(17) How to check if the Unique Document Identification Number is valid?

You can verify the document’s validity by clicking on “Verify UDIN” on the portal.

(18) What if I forgot to generate Unique Document Identification Number?

Unique Document Identification Number is mandatory for certain documents. If you forget, it amounts to non-compliance with the Council Decision. In such a case, disciplinary action may be taken for non-compliance.

(19) Can I upload a form without the Unique Document Identification Number?

Yes, it is possible to upload. However, you must ensure that the CA generates the UDIN within 60 days of uploading the form. Otherwise, the form uploaded will become invalid.

(20) If certificates are signed by different partners of a firm, is a different Unique Document Identification Number required?

A separate Unique Document Identification Number has to be taken per assignment per signatory for a given date for the certificates signed by them.

(21) Is Unique Document Identification Number applicable on reports signed using Digital Signature?

Yes. As per ICAI’s announcement, a Unique Document Identification Number is applicable on digitally and manually signed reports, certificates and documents.

(22) Is Unique Document Identification Number required while giving a Consent Letter and Certificate under section 139?

Section 139(1) of the Companies Act 2013 relates to the appointment of an Auditor under the Companies Act 2013. A Unique Document Identification Number is not required for such certification.

(23) How to update your mobile no and email id in the UDIN portal?

Firstly, you must update your mobile number and email id in the ICAI SSP portal. Once the mobile no and email id are approved on the SSP portal, the details will be updated on the UDIN portal.

(24) What is MOC?

MOC refers to the Memorandum of Changes that an Auditor encloses along with the Bank Audit Report. It is enclosed whenever there is significant issues effecting the financial statements of the bank.

(25) Is MOC mandatory while generating Unique Document Identification Number?

Yes, as per the recent notification it is mandatory for the Auditor to fill the MOC details while generating Unique Document Identification Number for the Audit Report for Statutory Audit of the Bank Branch.

(26) What is udin full form?

UDIN full form is a Unique Document Identification Number.

In a Nutshell, Unique Document Identification Number provides authentication to the regulators who want to verify the accuracy of documents. Also, it protects the Chartered accountants from impersonating persons. Furthermore, the time limit to generate the Unique Document Identification Number is revised to 60 days from the initial 15 days, a significant relief to the CAs.

Sir,

Point No. 14 , What is the last date for UDIN generation for Company audit 2021 :-

Sir it is not correct 30.11.2021.

Please update .

The last date for UDIN generation for company audit for FY 2020-21 is extended to 31st January 2022.

Suppose UDIN generated after signing certificate, (within 60 days) – Certificate already issued to client, Now Whether it needs to be mentioned UDIN on the face of certificate?

Thank you in advance.

Yes, the UDIN must be mentioned on the certificate where the chartered accountant has affixed his/ her signature.

Whether udin no. To be generated for CA certified Book debts statements

Auditor’s Certificate on Book Debts contains the following information:

(1) The Total Book debts amount as on a specific date.

(2) The amount of Debtors/ Book debts not more than 6 months and not classified as doubtful debts along with Debtor Names.

(3) The amount of Debtors/ Book debts more than 6 months and not classified as doubtful debts along with Debtor Names.

(4) The amount of Debtors/ Book debts classified as doubtful along with Debtor Names.

It is mandatory to obtain UDIN for all certificates where financial information/ related contents are certified as true and fair/ true and correct. As the above details contain financial information, the UDIN has to be generated for the CA certified book debts certificate.

WHAT IS UDIN GENERATED BUT NOT MENTIONED IN FORM ANF FORM FILLED. IS IT ANY REQUIREMENT TO CONSUME OR UPDATE UDIN?

what to do if UDIN not generated within 60 days. is there any solution ?

If the documents were uploaded without UDIN, then it will become invalid if UDIN is not generated within 60 days. We suggest to get the documents certified/ signed again, upload the documents in the UDIN portal again and generate the UDIN. Also note that the UDIN generation last date is extended till 30th April 2022.

while generating udin, i selected wrong document type (Certification of form CEB arms length price u/s 92 instead of Form 3CEB in GST and Tax audit) and i filed that form on 29 january 2022, So can you please tell me what should i do now and what will be the consequences.

UDIN once generated cannot be edited. Therefore, the only option available is to revoke the wrongly generated UDIN and generate a new UDIN with the correct document type. There is no time limit to revoke an UDIN. The last date to generate UDIN is extended to 30th April 2022. If you are able to generate correct UDIN within this time frame, there should be no consequences.

What is CA fees for udin generation for provisional balance sheet ?