Form GSTR 3B is a simple summary of GST liabilities for a particular tax period. A normal taxpayer must self-declare and discharge these liabilities. The government has released new guidelines for filing GSTR-3B for the convenience of the taxpayer. We shall see in detail GSTR 3B under the QRMP scheme.

Table of Contents

GSTR 3B under QRMP Scheme

Under the QRMP scheme, a taxpayer must make a monthly payment of tax and file GSTR-3B and GSTR1 every quarter. The Government brought this in to ease the compliance requirements of taxpayers.

QRMP Scheme Payment

Under Quarterly Return Monthly Payment (QRMP) Scheme, the taxpayer must pay his tax liability monthly through Form PMT 06 Challan.

Steps to make QRMP Scheme Payment

1.Login to GST portal by visiting https://www.gst.gov.in/

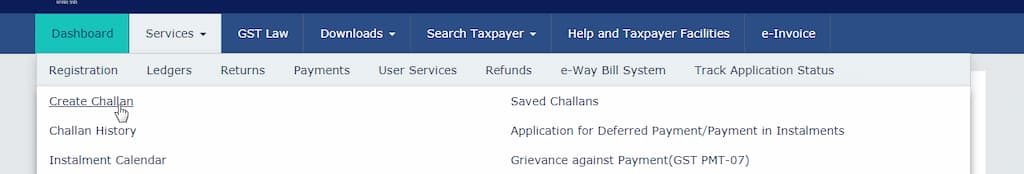

2.Under the Services tab drop down, Select Payment and under payment click on Create Challan.

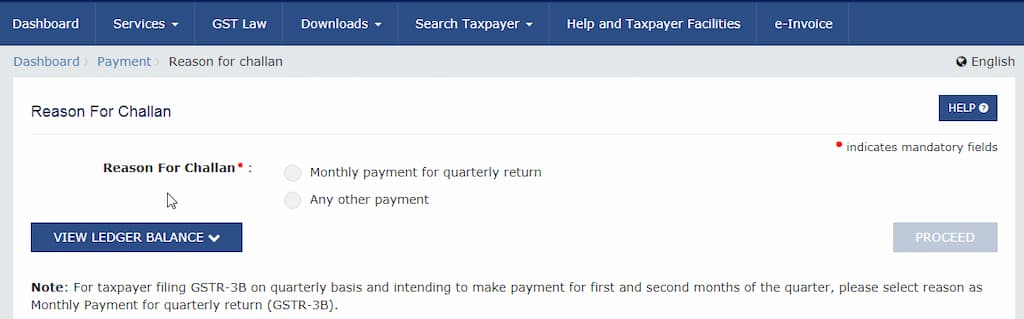

3.You are directed to the Reason for challan page.

Select the 1st option Monthly payment for quarterly return as reason for Challan

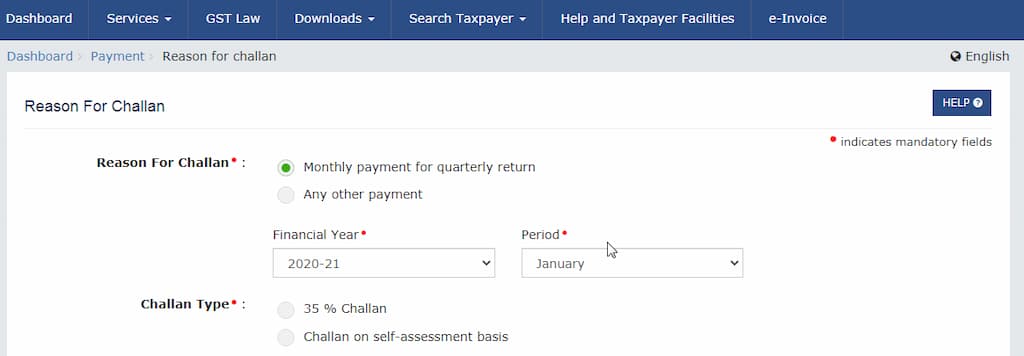

4.Once you select Monthly payment for quarterly return, you will get the below details.

5. Challan Type:

As a taxpayer you can make the payment in either of the following ways:

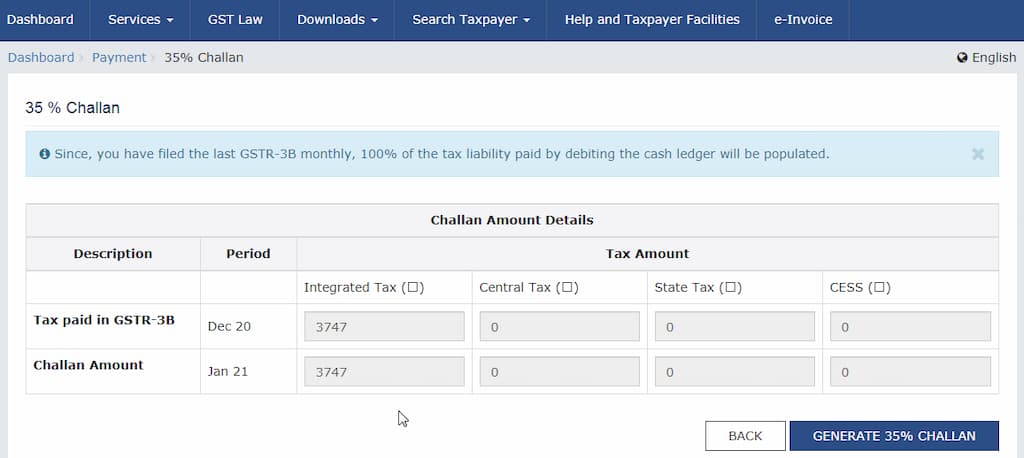

(a) 35% Challan

If you select the 35% challan option and click on proceed, you will get system generated challan.

For the taxpayers who have filed GSTR-3B monthly for Dec 2020, a 100% challan of tax liability is generated for Jan 2021.

In the below example, the taxpayer paid IGST of Rs 3747 in Dec 2020. As per the official notification, a taxpayer is to pay 100% of the tax liability of the preceding month, that is Dec 2020.

Therefore, system generates challan for Rs 3747 for the month of Jan 2021.

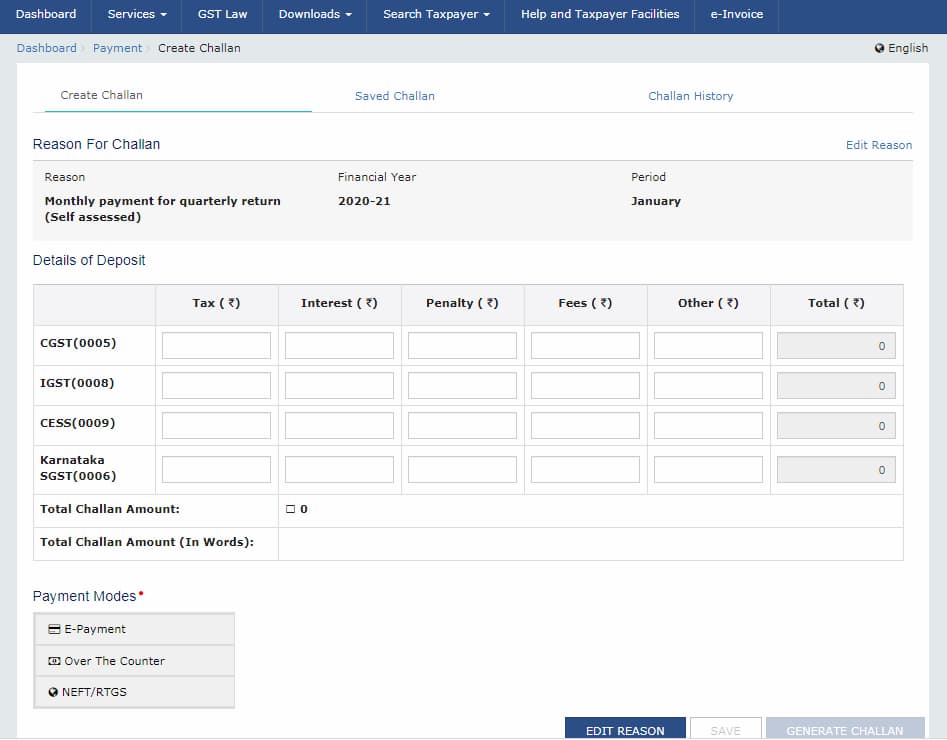

(b) Challan on self-assessment basis

If you select the challan on a self-assessment basis, you will get a blank form where you need to enter the tax amount manually under the heads IGST, CGST, SGST, Interest, Penalty, Others.

How this works?

The GST Portal will generate a challan for the total amount entered by you. Therefore, you will be paying the challan amount. Consequently, you must ensure that you correctly assess your tax liability for each month of the quarter so that the total amount of tax paid by you matches exactly with your total tax liability for the quarter when you file your GSTR 3B at the end of the quarter. Otherwise, you may have to pay interest on the shortfall amount.

QRMP Due Date

QRMP Due Date for making the payment is 25th of the next month.

| Month | Due Date |

| Jan 2022 | 25th Feb 2022 |

| Feb 2022 | 25th Mar 2022 |

| Mar 2022 | 25th April 2022 |

| April 2022 | 25th May 2022 (extended to 27th May 2022) |

| May 2022 | 25th June 2022 |

| June 2022 | 25th July 2022 |

| July 2022 | 25th Aug 2022 |

| Aug 2022 | 25th Sept 2022 |

| Sept 2022 | 25th Oct 2022 |

| Oct 2022 | 25th Nov 2022 |

| Nov 2022 | 25th Dec 2022 |

| Dec 2022 | 25th Jan 2023 |

GSTR 3B Due Date for Oct 2022

| Class of registered persons who have opted for | Principal place of business | Due Date |

| Monthly filing of Form GSTR-3B | All States and UTs | 20th Nov 2022 |

| Quarterly filing of Form GSTR-3B (Oct-Dec 2022) | States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana and Andhra Pradesh, the Union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep | 22nd Jan 2023 |

| Quarterly filing of Form GSTR-3B | States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi | 24th Jan 2023 |

Prerequisites to filing GSTR 3B

(1)You must be registered on the GST portal with a valid GSTN number.

(2) For filing GSTR 3B return on behalf of the company, you may use the Digital Signature Certificate (DSC) of the authorised signatory or EVS facility.

Important Points to note

- Every taxpayer must file GSTR 3B monthly regardless of your business activity if you have opted for Monthly filing of GSTR-3B. That is to say, if there is no business in a particular month, yet the taxpayer must file a ‘Nil Return’ for that specific month. However, the taxpayer under the QRMP scheme is to file GSTR-3B only quarterly.

- The GST Portal does not allow amendment of GSTR 3B return once you file it. Therefore, ensure that your GSTR 3B filing is correct the first time you file it.

- If you opt to file GSTR-1 on a monthly frequency, then the system autogenerates your GSTR3B (pdf) and is available on your GSTR 3B dashboard page after you file your GSTR-1.

GSTR 3B Due Date

Previously, every taxpayer had to file GSTR 3B by the 20th day of the subsequent month. However, there might be times when the Government extends GSTR 3B due date.

Late fee for GSTR 3B

If you file GSTR 3B after the due date then you must pay late fee and interest. The details of Late fee and interest is as follows

- Rs. 50 per day of delay

- Rs. 20 per day of delay for taxpayers having Nil tax liability for the month

- Interest @ 18% per annum is payable on the amount of outstanding tax.

How to file GSTR 3B monthly?

Below are the Steps

GST Login

1.Visit the official GST website https://www.gst.gov.in/.

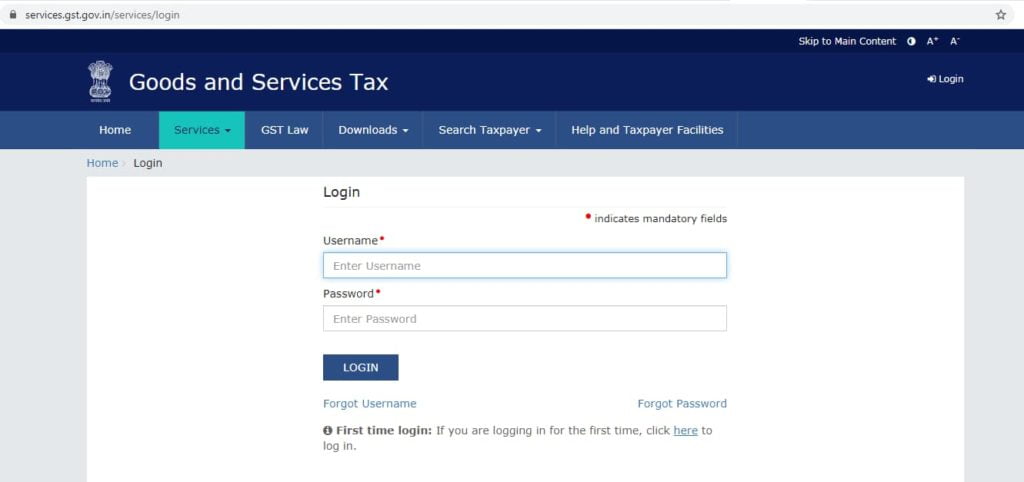

2.Click on Login. As you click on login, you will reach the below screen. Input your credentials and click on Login.

GSTR 3B Form Filing

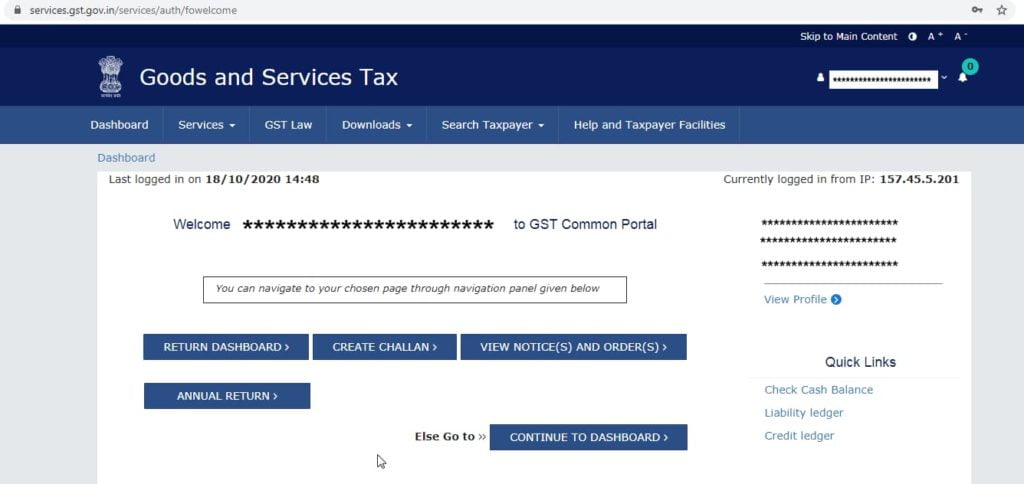

3.Now, the gst portal displays the Dashboard. Here, click on Return Dashboard to file GSTR3B.

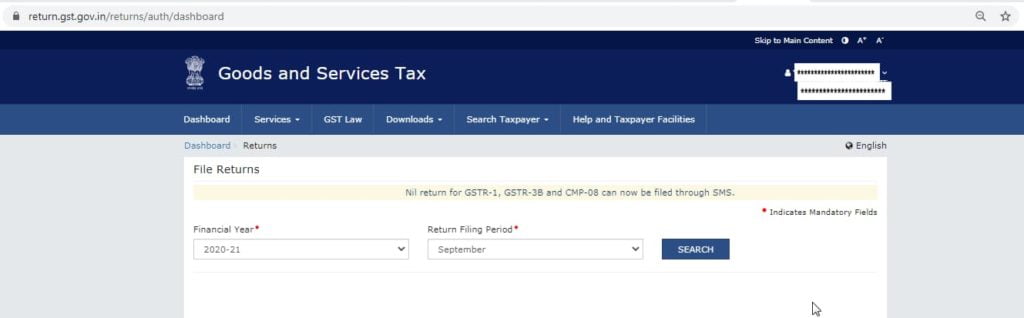

4.In the Financial year, select the appropriate financial year. And in the Return Filing Period, select the period for which you are filing your GSTR3B. Then, click on Search.

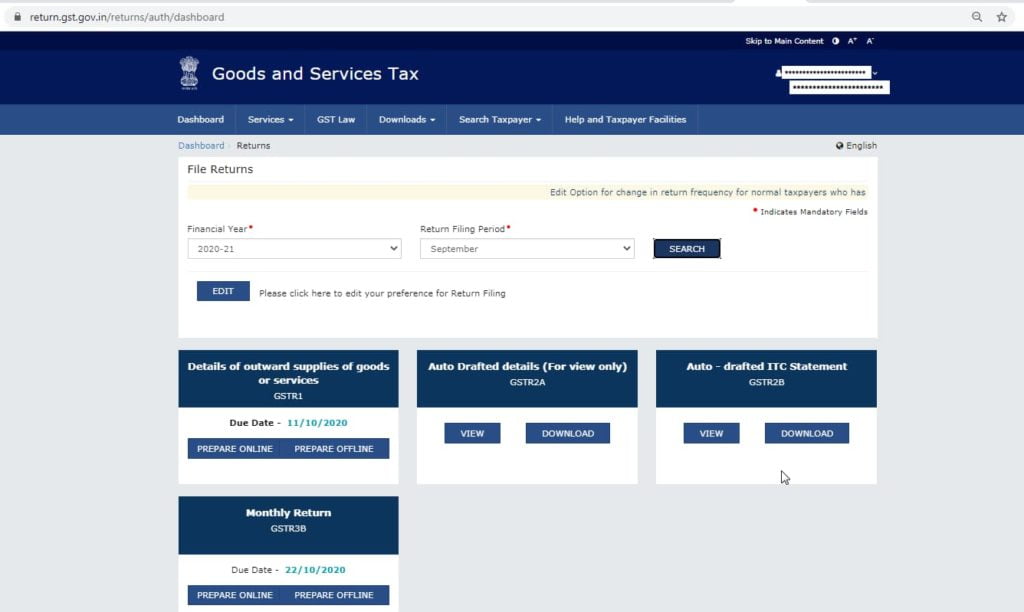

5.GST Portal displays the below screen. Click on Prepare Online under the tab Monthly return GSTR3B.

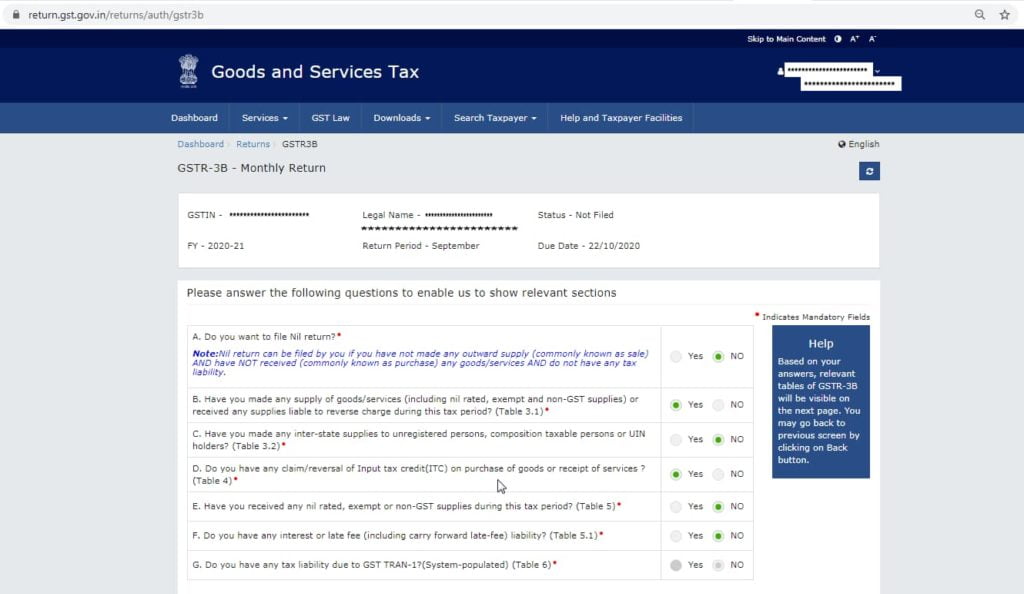

6. You reach the below screen. Click on the options that apply to you and click on Next.

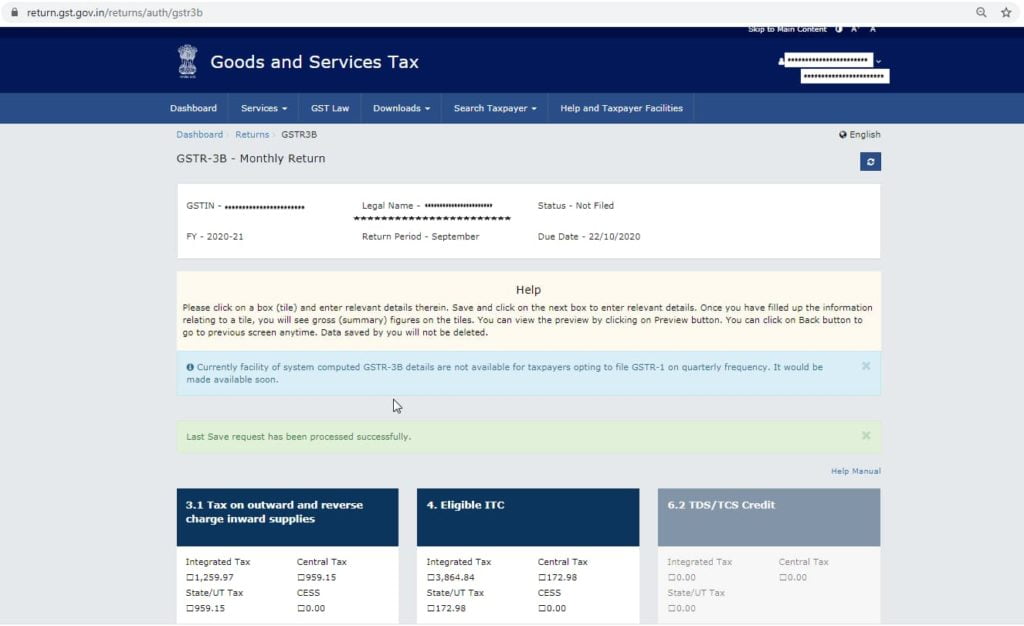

7.Based on the options you selected previously, the tabs are displayed here.

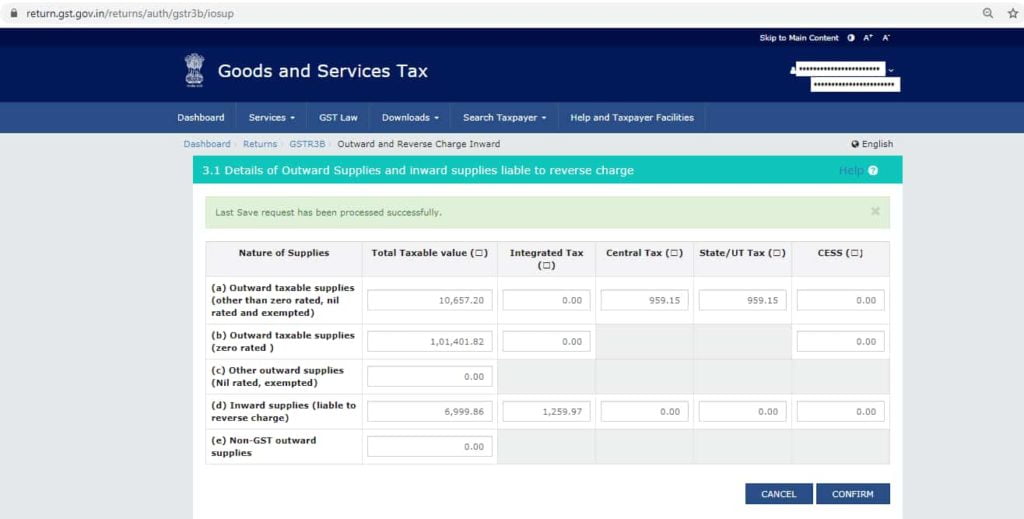

3.1 Tax on outward and reverse charge inward supplies

8.Click on the tab ‘3.1 Tax on outward and reverse charge inward supplies’

9.It displays details of outward supplies and inward supplies liable to reverse charge.

Segregate Sales amount under different heads as below and input total taxable value, integrated tax, central tax and state tax and Cess. Then click on Confirm.

Lets us go through each one of the heads in detail and see what comes under each of them.

(a) Outward taxable supplies (other than zero-rated, nil rated and exempted)

(b) Outward taxable supplies (zero-rated )

(c) Other outward supplies (Nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

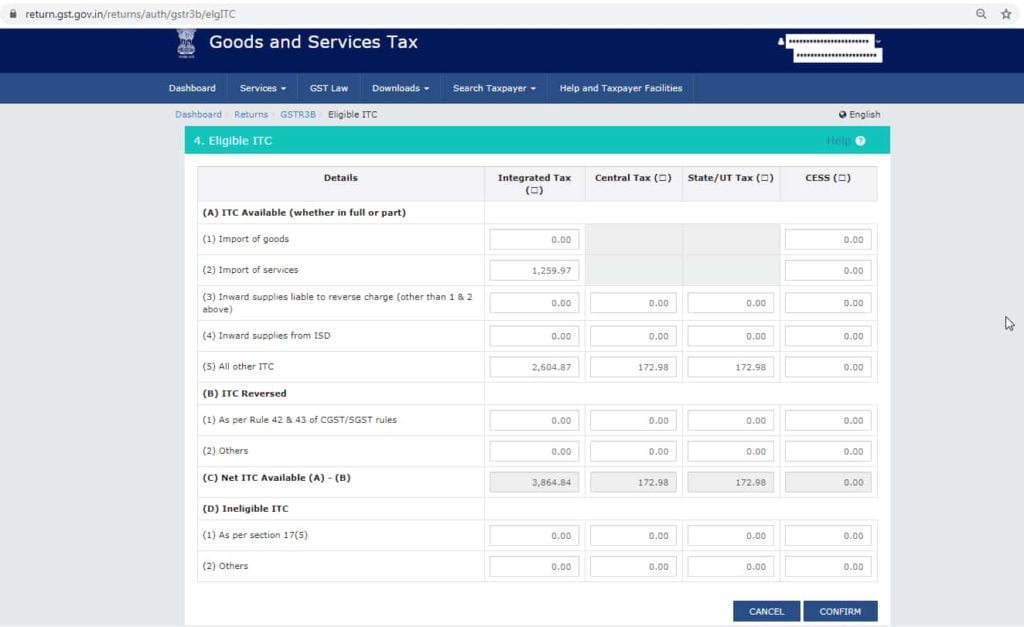

4.Eligible ITC

10.Click on ‘4. Eligible ITC’ if you want to claim any ITC or reverse ITC. Enter IGST, CGST, SGST and Cess amounts in appropriate fields and click on confirm.

In the below screen, we shall see each one of the fields in detail to understand what needs to be entered in which field.

(A) ITC Available (whether in full or part)

(1) Import of goods

(2) Import of services

(3) Inward supplies liable to reverse charge (other than 1 & 2 above).

(4) Inward supplies from ISD

(5) All other ITC

(B) ITC Reversed

(1) As per Rule 42 & 43 of CGST/SGST rules

(2) Others

(C) Net ITC Available (A) – (B)

(D) Ineligible ITC

1) As per section 17(5)

(2) Others

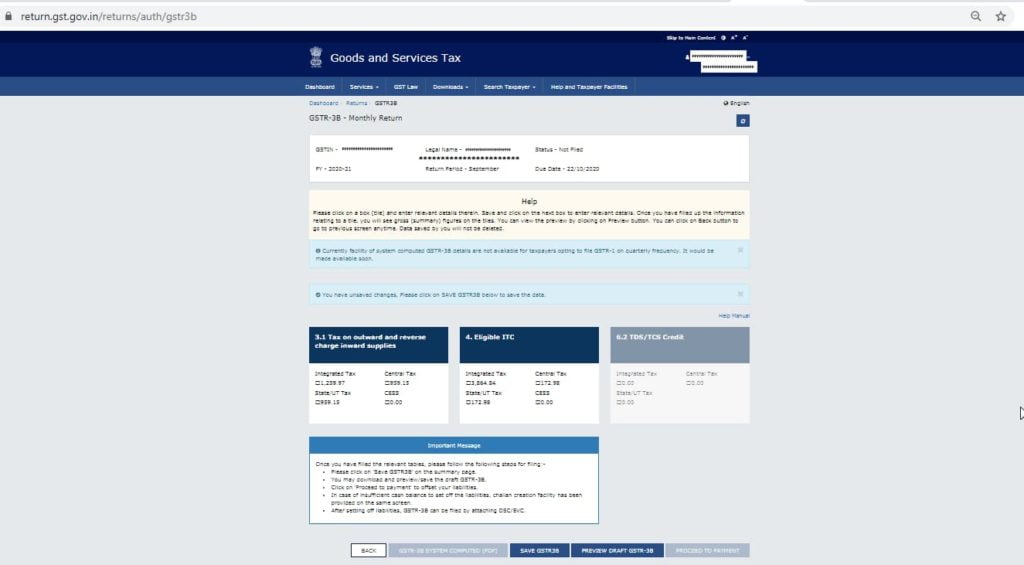

11.You reach the below screen. Click on Save GSTR3B to save the details entered in the form.

You get a message immediately, ‘Save request received’ Once saved, the status changes to GSTR3b details saved successfully.

12.Click on Proceed to payment.

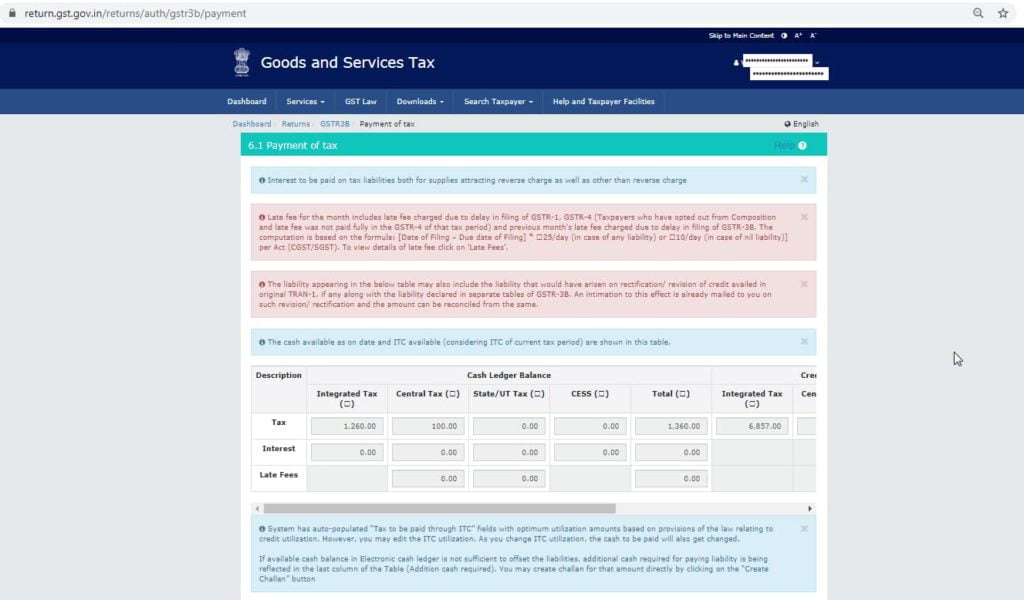

GST Payment

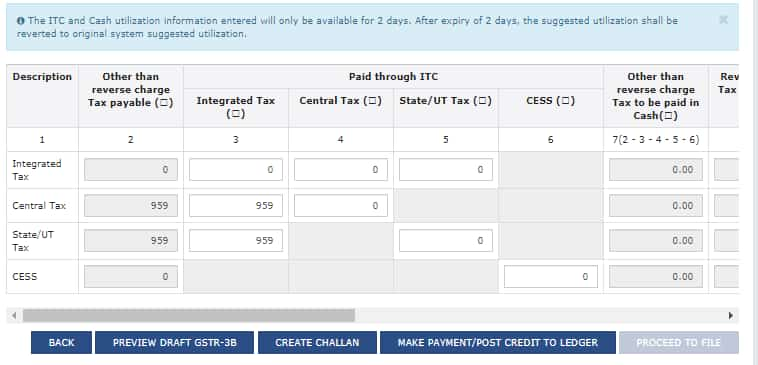

13.GST portal displays the’ Payment of tax’ screen. Now, click on the option Make payment/ post the credit to the ledger.

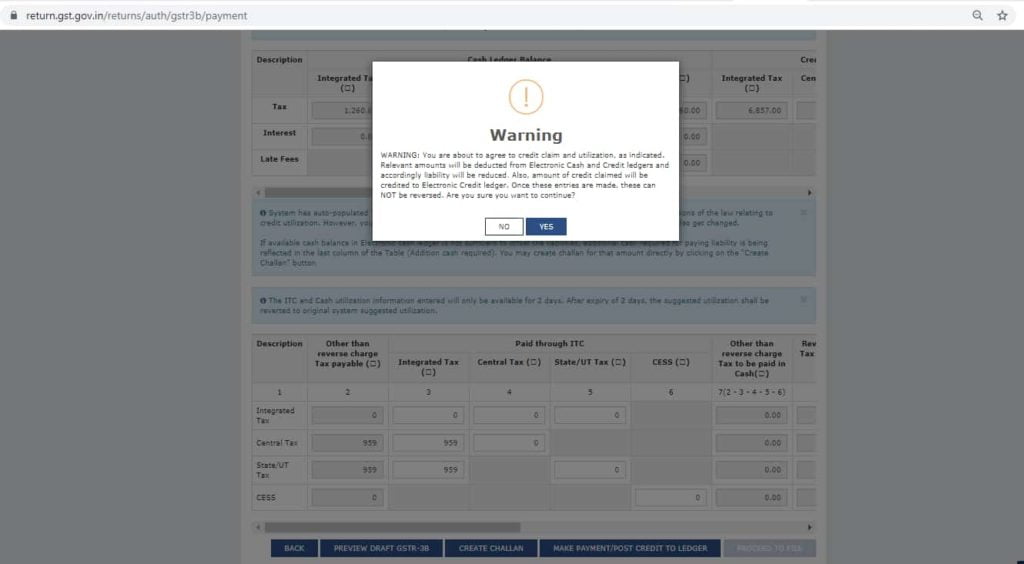

14.If you have sufficient cash credit in your GST electronic cash ledger, it displays the below message. Click on Yes.

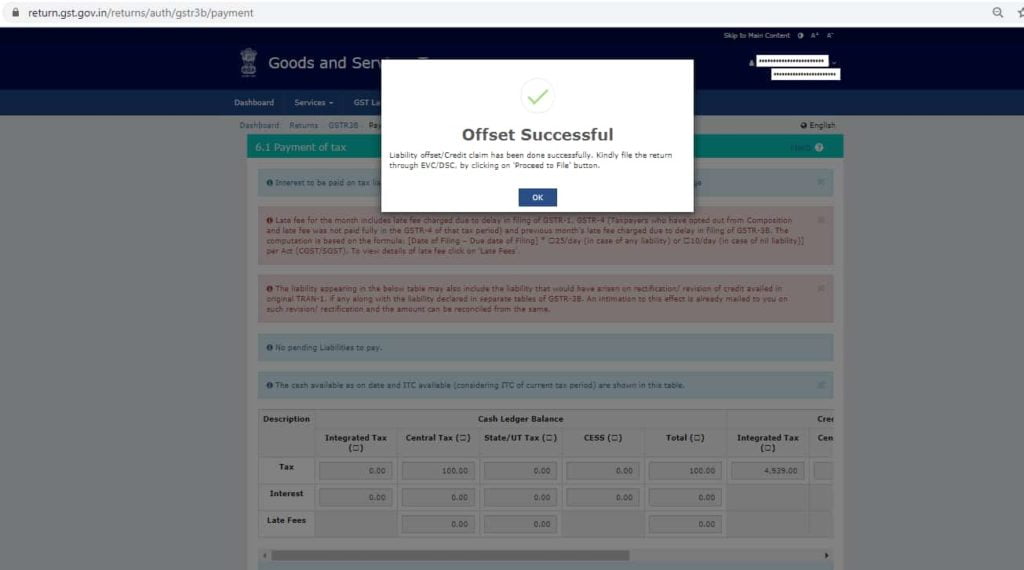

15.You get the message Offset Successful. Click Ok.

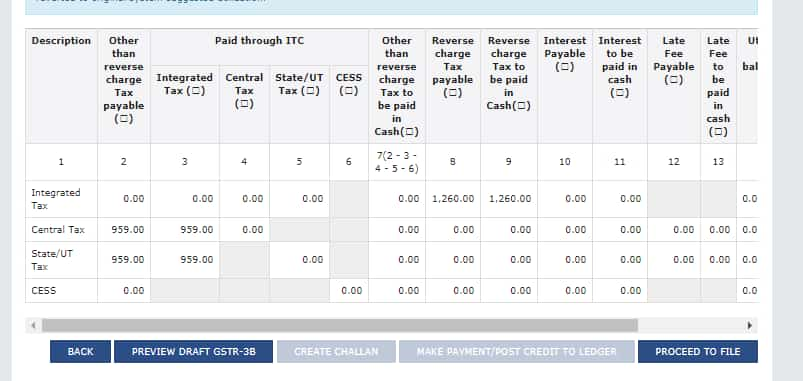

16.It will reflect the tax amount to be paid. Click on Proceed to file.

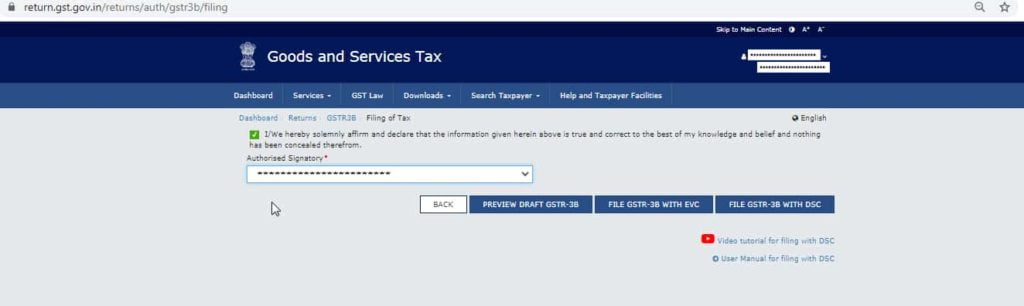

17.Authenticate the GSTR3B by affixing your sign via DSC or EVC.

How to file GSTR 3B under the QRMP Scheme?

Filing form GSTR 3B under the QRMP scheme is same as the monthly filing of GSTR-3B. The only difference is that under the QRMP scheme, you will be entering the details of a quarter. Since, you are already making monthly payment of tax, you will only be paying the balance amount of tax for the last month of the quarter.

FAQs

(1) Is GSTR-3B filed monthly?

Businesses that have opted for GSTR-3B under the QRMP Scheme need to file GSTR-3B on a quarterly basis while depositing monthly challans.

However, businesses that have opted for monthly filing must file GSTR-3B by 20th of every month.