CBDT further extends the income tax return filing due date (IT return due date) for FY 2020-21 from 31st Dec 2021 to 15th March 2022 for individuals whose accounts do not require an audit. This extension comes in light of the difficulties faced by taxpayers due to the COVID-19 pandemic.

Latest Update:

Table of Contents

Last Date to file ITR Extended

The CBDT has extended the last date to file ITR for salaried individuals to 15th March 2022. Previously the last date to file ITR was 31st December 2022.

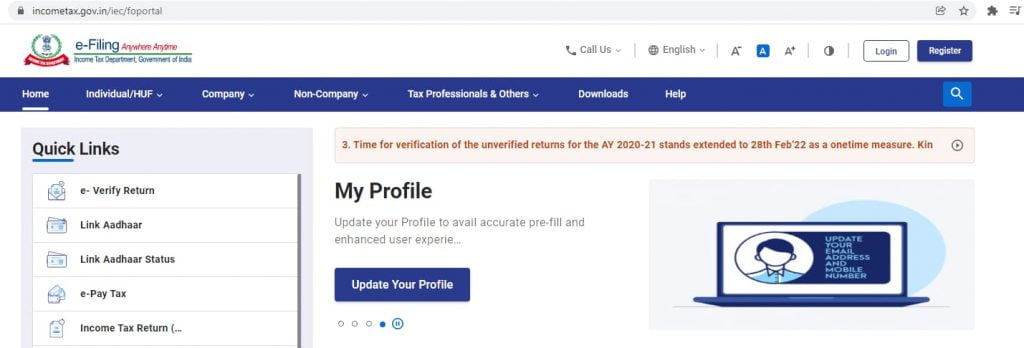

E-Verify ITR Last Date Extended

The income tax department has extended the time to verify unverified ITR for AY 2020-21 to 28th Feb 2022. This is a one time measure adopted by the department. Go ahead and e-verify your ITR through EVC or ITR-V.

Key Points

| Income Tax Login | https://eportal.incometax.gov.in/iec/foservices/#/login |

| Income Tax Return Last Date | 15th Mar 2022 |

| Income tax Refund Status | https://eportal.incometax.gov.in/iec/foservices/#/login |

| Queries related to Forms 3CA-3CD or 3CB-3CD for AY 2021-22 | TAR.helpdesk@incometax.gov.in |

The story behind the multiple extensions of income tax return filing due date

Initially, due to the difficulties faced by the taxpayers in the electronic filing of income tax returns on the new portal.

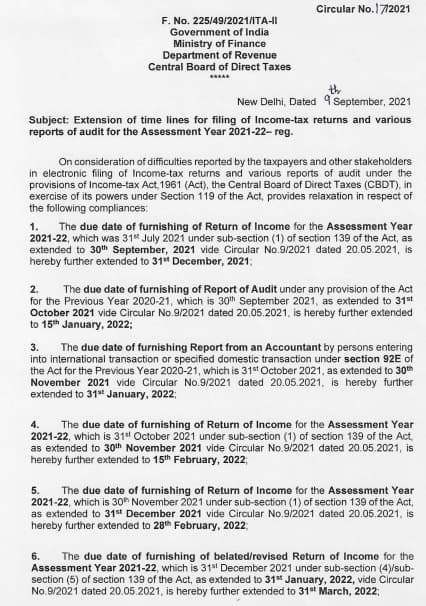

Earlier, CBDT had extended the Income Tax Return filing date for individuals whose accounts do not require an audit to 30th September 2021 from the original due date, 31st July 2021 due to the COVID-19 pandemic.

As per the CBDT Notification on 9th September, the last date for filing income tax return for AY 2021-22 is extended for Salaried employees and Pensioners from the original 31st July 2021 to 31st December 2021.

Also, the income tax return due date for FY 2020-21 for companies which was extended from 31st October 2021 to 30th November 2021 is further extended to 15th February 2022. Again, it is extended to 15th March 2022.

Almost all the categories of taxpayers have been given extensions in the income tax return filing due date.

Let’s get into the details.

Income Tax Return Filing Due Date

| Taxpayers | Original Due Date | Extended Due Date |

| Salaried Taxpayers | 31st July 2021 | 15th Mar 2022 |

| Pensioners | 31st July 2021 | 15th Mar 2022 |

| Taxpayers whose accounts require an audit | 31st Oct 2021 | 15th Mar 2022 |

| Private & Public Company | 31st Oct 2021 | 15th Mar 2022 |

| Taxpayers who must furnish reports of international/ specified domestic transactions. | 30th Nov 2021 | 15th Feb 2022 |

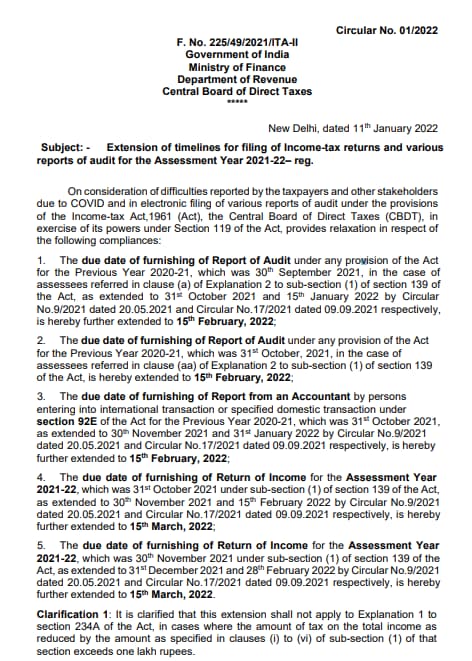

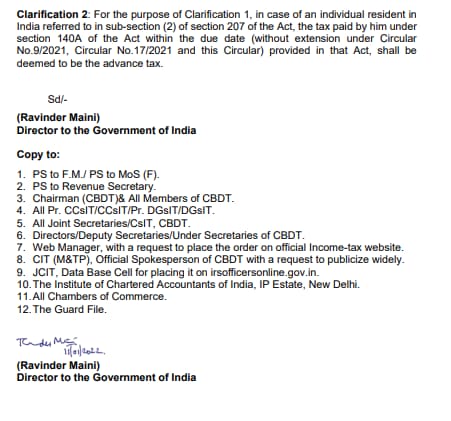

CBDT Notification for Extension of IT return Due Date for AY 2021-22 dated 11th January 2022

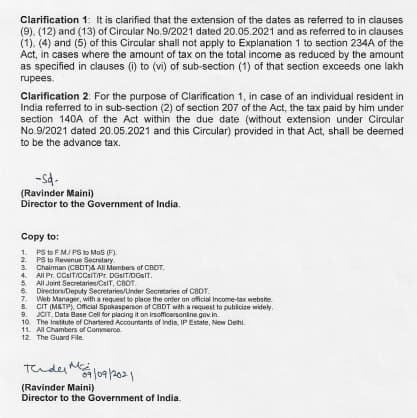

CBDT Notification for Extension of Due Date for AY 2021-22 dated 9th September 2021

The outbreak of COVID-19 created havoc among different sectors. Consequently, the Government brought in the Taxation and Other Laws Ordinance, 2020, on 31st Mar 2020 to provide a helping hand to the taxpayers at challenging times. It also included relaxation of specific provisions such as extended time limits for various statutory and regulatory compliance. However, The Taxation and Other Laws Act now replace the Ordinance.

Furthermore, CBDT issued income tax relaxation to all the taxpayers by extending the income tax return filing date due to the COVID-19 second wave. So what is the latest extension concerning income tax return filing last date?

Let us get into the details.

| Particulars | Original Due Date | Extended Due Date |

| Application for registration, intimation or approval U/S 10(23C), 12A, 35(1)(ii)/(iia)/(iii) or 80G in Form No. 10A | 30th Jun 2021 | 31st Mar 2022 |

| Application for registration, intimation or approval U/S 10(23C), 12A, 35(1)(ii)/(iia)/(iii) or 80G in Form No. 10AB | 28th Feb 2022 | 31st Mar 2022 |

| The Equalization Levy Statement in form 1 for FY 2020-21 | 30th Jun 2021 | 31st Dec 2021 |

| Quarterly Statement in form 15CC for remittances made for the quarter ending 30th Jun 2021 | 30th Jun 2021 | 30th Nov 2021 |

| Quarterly Statement in form 15CC for remittances made for the quarter ending 30th Sep 2021 | 15th Oct 2021 | 31st Dec 2021 |

| Uploading of declarations received in Form 15G/15H for the quarter ending 30th Jun 2021 | 15th July 2021 | 30th Nov 2021 |

| Uploading of declarations received in Form 15G/15H for the quarter ending 30th Sep 2021 | 15th Oct 2021 | 31st Dec 2021 |

Income tax return filing Due Date extended For

(A)Taxpayers whose accounts require audit

Initially, the due date for filing income tax returns for taxpayers who need to get their accounts audited was 31st Oct 2021. Now, the extended last date to file an income tax return is 30th Nov 2021. This extension is applicable to the following:

- As per Sec 44AB, any person carrying on business if his total sales, turnover or gross receipts in business for the year is above Rs 1 Crore.

- As per Sec 44AB, any person carrying on the profession if his gross receipts in profession for the year is above Rs 50 Lakhs.

- As per Sec 44AD, any person who opts for a presumptive taxation scheme if his total sales or turnover is above Rs 2 Crores.

- A Private Limited Company

- A Public Limited Company

- A Working Partner

(B) Taxpayers who must furnish report with regard to international/ specified domestic transactions

Initially, the due date for filing income tax returns for taxpayers who must furnish a report regarding international/ specified domestic transactions under section 92E was 31st October 2021. However, this has been extended to 30th November 2021. In addition to this, the extension is also applicable to the furnishing of various audit reports, inclusive of the tax audit report.

(C) Normal Taxpayers with income from salary or pensioners

Initially, the due date for filing income tax returns for taxpayers with income from salary or pensioners under section 139 (1) was 31st July 2021. However, as per the recent circular, CBDT extends the income tax return filing last date to 31st December 2021. So, if you are filing ITR-1 or ITR-4 for the financial year 2020-21 then you may file before 31st December 2021.

(D)Small and Middle-class taxpayers concerning payment of self-assessment tax

Small and Middle-class taxpayers are taxpayers whose self-assessment tax liability is below Rs 1 lakh. This is the second time that the Government has provided relief concerning the payment of self-assessment tax. Accordingly, the extended due dates are as follows

Self Assessment Tax Liability Below 1 Lakh

| Taxpayers | Original Due Date | Extended Due Date |

| Taxpayers whose accounts require audit | 31st Oct 2021 | 15th Feb 2022 |

| Private & Public Company | 31st Oct 2021 | 15th Feb 2022 |

| Taxpayers who must furnish reports of international/ specified domestic transactions. | 31st Oct 2021 | 31st Jan 2022 |

| Salaried Taxpayers | 31st July 2021 | 31st Dec 2021 |

| Pensioners | 31st July 2021 | 31st Dec 2021 |

(E)Taxpayers who must furnish statement of Financial Transactions (SFT)

Taxpayers were required to furnish the statement of financial transactions under Rule 114E of the Income Tax Rules, 1962 on or before 31st May 2021. However, the income tax department has extended the deadline to furnish the SFT report for the financial year 2020-21 to 30th June 2021.

CBDT Press Release on Extension of Income Tax Return Filing Due Date

Other Compliance Dates Also Extended

The Central Government extends the other compliance due dates due to the severe pandemic and subsequent hardship faced by the stakeholders. The CBDT extends furnishing of report of audit for AY 2021-22 to 31st Oct 2021.

Furnishing of Audit Report for AY 2021-22 Extended

| Particulars | Extended Dates |

| Issue of Form 16 for FY 2020-21 | 31st July 2021 |

| Quarterly Statement of TDS Filing For Mar 2021 | 31st July 2021 |

| Other Compliances | 30th Sep 2021 |

| Furnishing of Audit Report for AY 2021-22 | 15th February 2022 |

CBDT Press release on 25th June 2021

Consequences of not filing an Income Tax Return

You may face the below consequences if you fail to file your income tax return within the due date

- You may not receive your refunds on time.

- If you have incurred any any loss in your business, you will not be able to carry forward the losses to the subsequent years.

- You have to pay a penalty if you file your income tax return after the due date.

Filing Belated ITR for AY 2021-22

If an individual taxpayer misses filing the income tax return before the deadline of December 31st, 2021 or the extended deadline of March 15th 2022, then he can still voluntarily file a belated ITR anytime before 31st March 2022. However, the taxpayer needs to pay the late fees while filing a belated ITR. The amount of late fees depends on the belated ITR filing date. After March 31st, 2022, he/ she cannot file ITR voluntarily. He can only file his income tax return in response to the notice from the Income-tax department.

Late fees on filing belated ITR

Late fees is levied on individuals based on the income bracket they fall into.

| Taxpayer Annual income | Date of filing ITR | Amount (in Rs) |

| < 5,00,000 | 1st October 2021 to 31st Dec 2021 | 1,000 |

| < 5,00,000 | 1st January 2022 to 31st January 2022 | 1,000 |

| > 5,00,000 | 1st October 2021 to 31st Dec 2021 | 5,000 |

| > 5,00,000 | 1st January 2022 to 31st January 2022 | 10,000 |

Individuals not liable to pay late fees

While filing belated ITR, certain individual taxpayers need not pay late fees whose gross income does not exceed the basic exemption limit.

| Individual Taxpayer Age | Exemption limit |

| Any Age | 2,50,000 |

| 60 years to 80 years | 3,00,000 |

| > 80 years | 5,00,000 |

TDS/ TCS Submission Date Extended

Section 203 requires the DDO to furnish to the employee a certificate in Form 16 detailing the amount of TDS and certain other particulars. The employer must furnish Form 16 to the employee by 15th June after the end of the financial year as per rule 31.

Furnishing of certificate to the employees for FY 2020-21 extended to 31st July 2021. The employer is to issue Form 16 to the employees (income from salary) only by 31st July 2021.

Quarterly Statement of TDS filing for Mar 2021 Extended

Under Section 200(3), the person deducting the tax (employer in case of salary income) must file duly verified Quarterly Statements of TDS in Form 24Q for the periods of each financial year to the TIN Facilitation Centres authorised by DGIT(Systems). The quarterly statement filing for the last quarter in Form 24Q is the same as the annual return of TDS. Therefore, CBDT extends the quarterly statement of TDS filing for Mar 2021 to 15th July 2021.

Income Tax Return Filing Due Date FAQs?

(1) What is the last date to file the return for a company registered with MCA?

The income tax return due date for private limited company is 15th March 2022.

(2) What is the last date to file a return for accounts requiring audit?

Income tax return last date for audit is 15th February 2022.

(3) Can I file ITR for AY 2021/ 22 now?

ITR Forms such as ITR-1, ITR-2, ITR-3, ITR-4, ITR-5 & ITR-7 is now available for AY 2021/ 22 on the official income tax website.

Visit https://www.incometax.gov.in/iec/foportal/ to e-file your returns.

(4) What is the due date for tax filing FY 2020/21 AY 2021 22?

The due date for ITR filing of Taxpayers whose accounts require audit and taxpayers who must furnish reports with regard to international/ specified domestic transactions is 15th February 2022. And due date to file ITR for salaried taxpayers and pensioners is 15th March 2022.

(5) Can I file ITR after the due date?

Yes, of course. Initially, the due date to file a belated return for the assessment year 2021-22 was 31st December 2021. However, CBDT has extended the deadline to file belated returns to 31st January 2022.

(6)What is the late fee for ITR filing?

The income tax department has reduced the penalty for late filing of ITR to Rs 5,000.