INC 20A is a declaration of commencement of business that every company must file if the company’s date of incorporation falls on or after 2nd Nov 2018. Furthermore, the company must file INC-20A within 180 days of the company’s incorporation. And a Company Secretary or a Chartered Accountant or a Cost Accountant in practice shall verify the reform.

Latest News

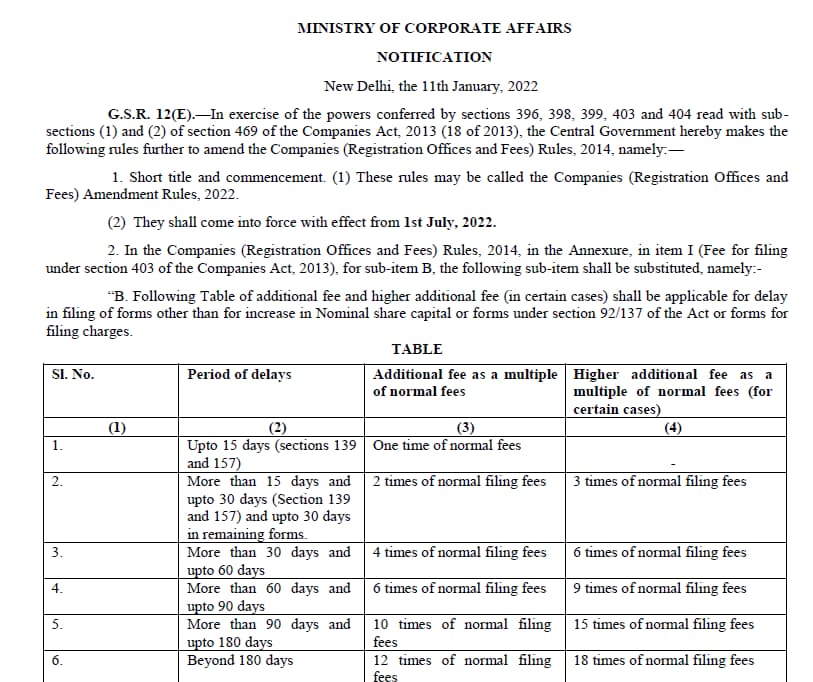

As per the latest Notification dated 11th January 2022, the ministry of corporate affairs has modified the additional fee payable on the delay of filing forms. Furthermore, a higher additional fee is applicable on forms INC- 22 and PAS-3. However, for form INC-20A only additional fees are applicable.

Table of Contents

INC 20A Applicability

It applies to

- Companies incorporated after 2nd Nov 2018 must file Form INC 20A.

- Companies with share capital.

Exempt Companies

Companies are exempt if

- Incorporated before 2nd Nov 2018.

- Limited by Guarantee

INC-20A Due date

INC-20A Due date is 180 days from the date of incorporation of the company.

INC 20A Fees

i.Fee for filing e-Forms or documents in case of the company has a share capital

| Nominal Share Capital | Fee Applicable |

| Less than 1,00,000 | Rs 200 |

| 1,00,000 to 4,99,999 | Rs 300 |

| 5,00,000 to 24,99,999 | Rs 400 |

| 25,00,000 to 99,99,999 | Rs 500 |

| 1,00,00,000 or more | Rs 600 |

ii. Fee for filing e-Forms or documents in case of a company not have share capital

| Fee applicable |

| Rs 200 |

Consequences if INC-20A not filed?

- A company cannot commence its business.

- Registrar may initiate action for the removal of the name of the company from the register of companies.

- A company cannot borrow funds.

Penalty if INC-20A not filed?

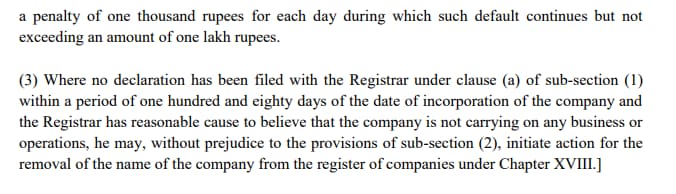

The company is liable to a penalty of fifty thousand rupees. And every officer who is in default liable to a penalty of one thousand rupees for each day during which such default continues but does not exceed one lakh rupees.

Late Fees

| Period of delays | Fees |

| Up to 15 days | One time of normal fees |

| More than 15 days and Up to 30 days | 2 times of normal filing fees |

| More than 30 days and up to 60 days | 4 times of normal filing fees |

| More than 60 days and up to 90 days | 6 times of normal filing fees |

| More than 90 days and up to 180 days | 10 times of normal filing fees |

| More than 180 days | 12 times of normal filing fees |

How to file INC 20A?

(1)Enter a Valid and ‘Active’ CIN of the company having a share capital

(2)Click the Pre-fill button. The system will automatically display the name, address of the registered office, and the company’s email ID.

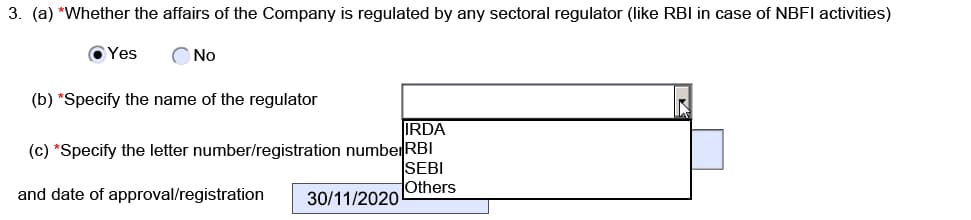

(3)Whether the affairs of the Company is regulated by any sectoral regulator (like RBI in case of NBFI activities)

(a)If you select the option Yes, then you will see the options IRDA, RBI, SEBI or Others

(b)Select the option applicable to you.

(c)Specify the letter-number/registration number and date of approval/registration.

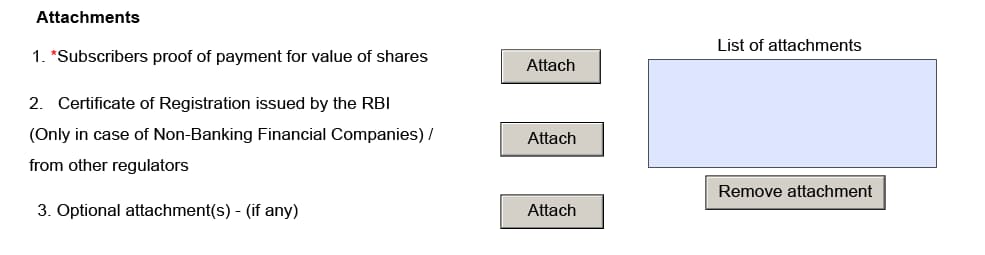

Attachments for INC-20A

- Subscribers proof of payment for the value of shares

You can attach the Companies Bank Account Statement with credit entries for receipt of subscription money from subscribers. This serves as Subscribers’ proof of payment for the value of shares.

- Certificate of Registration issued by the RBI (Only in Non-Banking Financial Companies) /from other regulators.

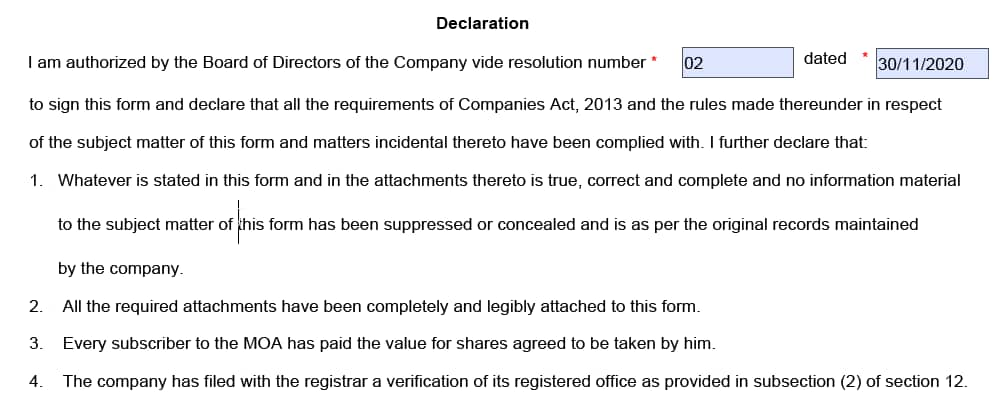

Declaration

- Enter the board resolution’s serial number and date, authorising the signatory to sign and submit the form.

Board Resolution for INC-20A

(IN COMPANY LETTERHEAD)

EXTRACT OF THE RESOLUTION PASSED IN THE MEETING OF THE BOARD OF DIRECTORS OF ABC PRIVATE LIMITED HELD ON TUESDAY, THE 1ST DEC 2020 AT 11.00 AM AT OFFICE OF THE COMPANY AT ************* (enter the address of the company)

BOARD RESOLUTION FOR INC 20A

“ RESOLVED THAT approval of the Board be and is hereby accorded to severally authorise the (Designation of authorised person) to digitally sign and file the form INC 20A as per the requirements of the Companies Act 2013.

“RESOLVED FURTHER THAT (enter authorised person name), (Designation of authorised person) of the company, be and is hereby authorised and shall always be deemed to have been authorised to undertake all such acts and deeds, including but not limited to signing of Application, Forms, Resolutions, Deeds etc. in this regard and also issue of power of attorney in favour of any other person enabling such other person to appear before the various authorities under the aforesaid law in the matters of registration and the matters incidental thereto. ”

CERTIFIED TRUE COPY

FOR ABC PRIVATE LIMITED

(Enter Director Name)

******************************

MANAGING DIRECTOR

(Enter Director Name)

******************************

WHOLE-TIME DIRECTOR

DATE: 01/12/2020

PLACE : *********

2.Digital Signature

The Director of the company must digitally sign the form.

3.Certificate from Practicing Professional

A practising professional must certify the eform by providing details of the practising professional and attaching his digital signature.

4.Pre-Scrutiny

Click on Check Form. If any fields are incomplete in the form, it will show an error message. If you do not get any error messages, then click on Pre-scrutiny. You must get the message Pre-scrutiny Successful.

5. Once Pre-Scrutiny is successful; your e-form is ready to upload.

6.MCA Upload

Login to the MCA website. Then Go to E form upload and upload the eform.

7.SRN generation

After uploading successfully, SRN generates. Take note of the SRN.

8.Fee Payment

Click on Pay later / Pay Now option to pay the government fees.

Download INC-20A pdf

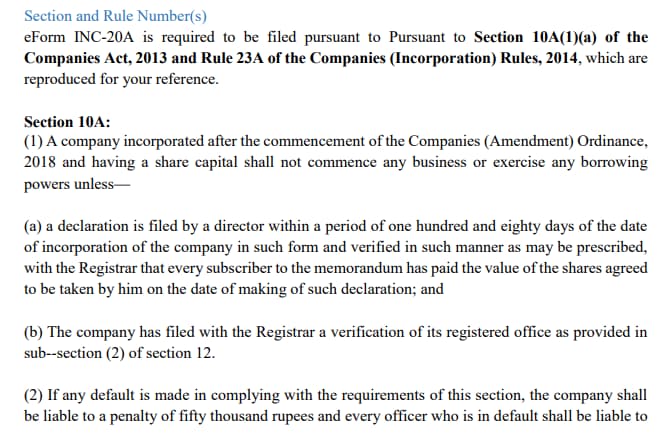

Section 10(1)(a) Extract

Rule 23A: Declaration at the time of commencement of business

INC 20A Faqs

(1)What is INC 20A Form?

INC 20A is an eform for declaration for commencement of business. Every company incorporated after 2nd Nov 2018 must submit the form INC-20A.

(2)Who is required to file INC 20A?

Directors of companies incorporated after 2nd Nov 2018 must file INC 20A.

(3)How do I file a condonation of delay for Inc-20A?

Currently, there is no foolproof process to file a condonation of delay for INC-20A. So, we must wait for MCA clarification concerning this matter.

(4) Can we file INC-22 before INC 20A?

Form INC-22 is filed to notify ROC of a change in the company’s registered office address. And form INC 20A is filed to declare the commencement of business. Therefore, form INC-22 must be filed prior to the filing of INC-20A.