ROC Compliance filings are mandatory for all companies and LLPs.The Companies registered under the Companies Act, 2013 and LLPs registered under the Limited Liability Partnership Act, 2008 must file their annual returns with the ROC. Non-adherence to the compliances may attract penalties.

Listed below is the ROC filing due date for FY 2023-24 and ROC filing due date for FY 2022-23 for various forms.

MCA Latest News 21st Aug 2024

ROC Compliance Calendar 2024-25 (FY 2023-24)

Below is the ROC Compliance Calendar 2024-25/ MCA Compliance Calendar 2024-25 (FY 2023-24).

| Description & Forms | Dates |

| AOC-4 Due Date for FY 2023-24 | 30 October 2024 |

| MGT-7 Due Date for FY 2023-24 | 29 November 2024 |

| MGT-7A Due Date for FY 2023-24 | 29 November 2024 |

| DPT-3 Due Date for FY 2023-24 | 30 June 2024 |

| DIR-3 KYC Due Date for FY 2023-24 | 30 September 2024 |

| MGT-14 Due Date for FY 2023-24 | 30 October 2023 |

| MSME Form Due Date for FY 2022-23 | 30 April 2024 and 31 October 2024 |

| ADT-1 Due Date for FY 2023-24 | 14 October 2024 |

| LLP Form 11 Due Date 2024 | 30 May 2024 |

| Form 8 Due Date for FY 2023-24 | 30 October 2024 |

| Form PAS-6 Due Date for FY 2023-24 | 30 May 2024 and 29 November 2024 |

| Form CRA-4 Due Date for FY 2023-24 | Announcement awaited |

| Form 29C Due Date | Announcement awaited |

| Form 3CA-3CD/ 3CB-3CD Due Date | Announcement awaited |

MCA Latest News 9th Jan 2023

Table of Contents

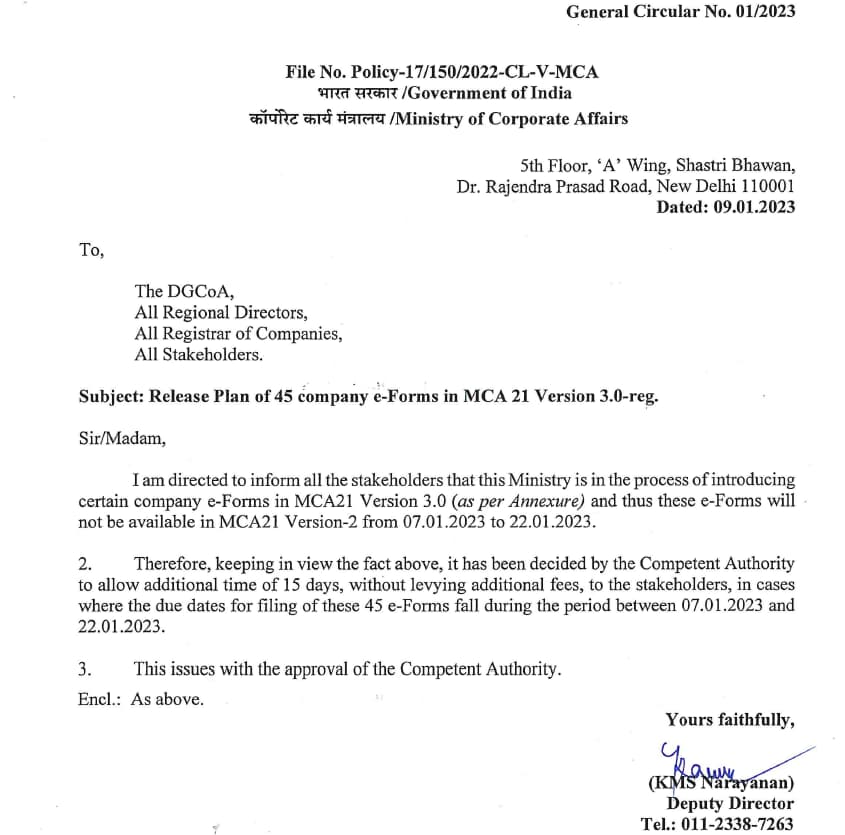

MCA Due Date Extended for Filing Company e-forms by 15 days

MCA is in the process of introducing 45 company e-forms in MCA-21ver 3.0. Therefore, these e-forms will not be available in MCA21 version-2 from 7th Jan 2023 to 22nd Jan 2023. MCA due date is extended by 15 days for all those e-forms whose filing due date falls during the period 7th Jan 2023 and 22nd Jan 2023.

Below is the list of MCA e-forms whose due date is extended:

| Sl. No | Form No |

| 1 | DIR-12 |

| 2 | DIR-11 |

| 3 | DIR-3 |

| 4 | DIR-3C |

| 5 | DIR-5 |

| 6 | DIR-6 |

| 7 | INC-12 |

| 8 | INC-18 |

| 9 | INC-20 |

| 10 | INC-20A |

| 11 | INC-22 |

| 12 | INC-23 |

| 13 | INC-24 |

| 14 | INC-27 |

| 15 | INC-28 |

| 16 | INC-4 |

| 17 | INC-6 |

| 18 | MGT-14 |

| 19 | MR-1 |

| 20 | MR-2 |

| 21 | NDH-4 |

| 22 | SH-7 |

| 23 | SH-11 |

| 24 | SH-8 |

| 25 | SH-9 |

| 26 | NDH-1 |

| 27 | NDH-2 |

| 28 | NDH-3 |

| 29 | GNL-3 |

| 30 | PAS-6 |

| 31 | MGT-3 |

| 32 | PAS-2 |

| 33 | DIR-9 |

| 34 | DIR-10 |

| 35 | AOC-5 |

| 36 | FC-1 |

| 37 | FC-2 |

| 38 | FC-3 |

| 39 | FC-4 |

| 40 | GNL-2 |

| 41 | GNL-4 |

| 42 | MSC-1 |

| 43 | MSC-3 |

| 44 | MSC-4 |

| 45 | RD-1 |

MCA Circular

ROC Compliance Calendar 2023-24 (FY 2022-23)

Below is the ROC Compliance Calendar 2023-24/ MCA Compliance Calendar 2023-24 (FY 2022-23).

| Description & Forms | Dates |

| AOC-4 Due Date for FY 2022-23 | 30 October 2023 |

| MGT-7 Due Date for FY 2022-23 | 29 November 2023 |

| MGT-7A Due Date for FY 2022-23 | 29 November 2023 |

| DPT-3 Due Date for FY 2022-23 | 30 June 2023 (Extended to 31st July 2023) |

| DIR-3 KYC Due Date for FY 2022-23 | 30 September 2023 |

| MGT-14 Due Date for FY 2022-23 | 30 October 2023 |

| MSME Form Due Date for FY 2022-23 | 30 April 2023 and 31 October 2023 |

| ADT-1 Due Date for FY 2022-23 | 14 October 2023 |

| LLP Form 11 Due Date 2023 | 30 May 2023 |

| Form 8 Due Date for FY 2022-23 | 30 October 2023 |

| Form PAS-6 Due Date for FY 2022-23 | 30 May 2023 and 29 November 2023 |

| Form CRA-4 Due Date for FY 2022-23 | Announcement awaited |

| Form 29C Due Date | Announcement awaited |

| Form 3CA-3CD/ 3CB-3CD Due Date | Announcement awaited |

MCA Updates: Latest News 31st May 2022

As per the latest circular, MCA has extended the last date to 30th June 2022 for all the event based eforms that were to be filed from 25th February to 31st May 2022 for LLPs. Therefore, you need not pay any additional fees for filing eform till 30th June 2022.

MCA Updates: Latest News 27th May 2022

LLP Form 11 Due Date 2022 Extended to 30th June 2022

As per the latest MCA circular, LLP Form 11 Due Date is extended to 30th June 2022 for the financial year 2021-2022. Form 11 is the annual return of Limited Liability Partnership.

MCA Updates: Latest News 31st March 2022

There is a high probability that the ROC filing due date for FY 2020-21 will be extended.

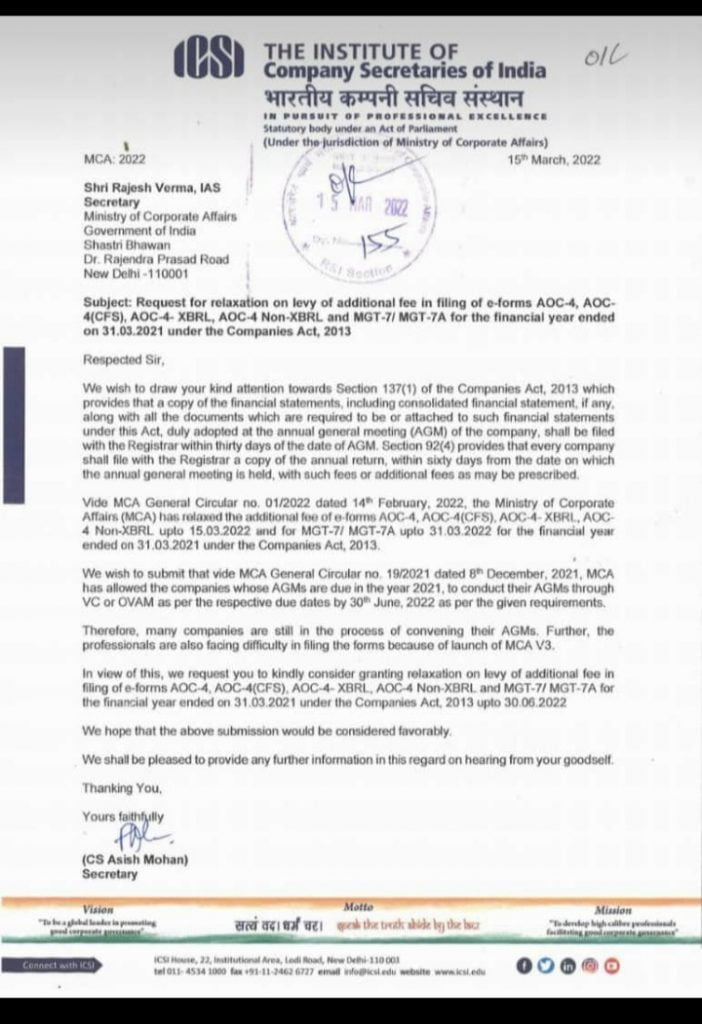

The Institute of Company Secretaries of India have requested the Ministry of Corporate Affairs (MCA21) relaxation on levy of additional fee in filing of forms AOC-4 and MGT-7 up to 30th June 2022.

Below is the letter of ICSI

MCA Updates: Latest News 14th Feb 2022 @ 4:14 pm

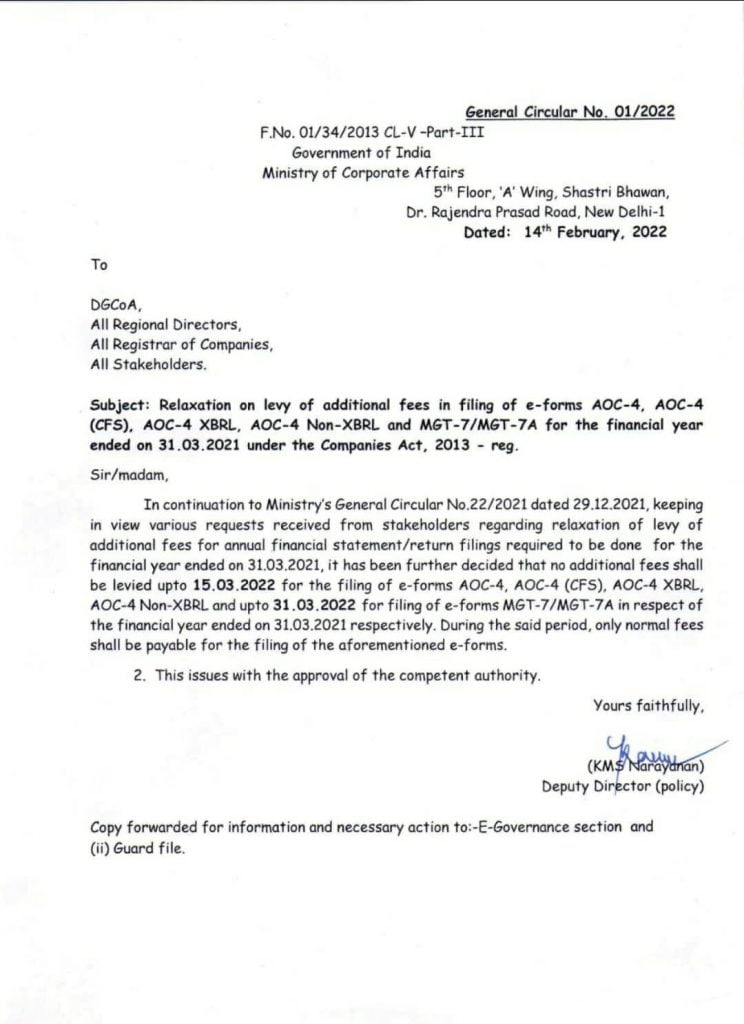

MCA Due Date Extended for Annual Filing

As per the latest MCA Circular, the AOC-4 due date is extended to 15th March 2022 and the MGT-7 due date is extended to 31st March 2022.

Relaxation on levy of additional fees is given till 15.03.2022 for filing of e-forms AOC-4, AOC-4 (CFS), AOC-4, AOC-4 XBRL AOC-4 Non-XBRL and 31.03.2022 for MGT-7/MGT-7A for the financial year ended on 31.03.2021

MCA Circular dated 14 Feb 2022

ROC Filing Due Date Extended | Quick View

- LLP e-filings will not be available from 25th February 2022 to 5th March 2022, 11:59 pm due to the proposed launch of LLP modules in MCA21 V3.

ROC Compliance Calendar FY 2021-22

Below is the ROC Compliance Calendar for FY 2021-22.

| Description & Forms | Dates |

| AOC-4 Due Date for FY 2021-22 | 30 October 2022 |

| MGT-7 Due Date for FY 2021-22 | 29 November 2022 |

| MGT-7A Due Date for FY 2021-22 | 29 November 2022 |

| DPT-3 Due Date for FY 2021-22 | 30 June 2022 |

| DIR-3 KYC Due Date for FY 2021-22 | 30 September 2022 |

| MGT-14 Due Date for FY 2021-22 | 30 October 2022 |

| MSME Form Due Date for FY 2021-22 | 30 April 2022 and 31 October 2022 |

| ADT-1 Due Date for FY 2021-22 | 14 October 2022 |

| LLP Form 11 Due Date 2022 | 30 May 2022 (extended to 30 June 2022) |

| Form 8 Due Date for FY 2021-22 | 30 October 2022 |

| Form PAS-6 Due Date for FY 2021-22 | 30 May 2022 and 29 November 2022 |

| Form CRA-4 Due Date for FY 2021-22 | Announcement awaited |

| Form 29C Due Date | Announcement awaited |

| Form 3CA-3CD/ 3CB-3CD Due Date | Announcement awaited |

ROC Compliance Calendar FY 2020-21

Below is the ROC Compliance Calendar for FY 2020-21.

| Description & Forms | Dates |

| AOC-4 Due Date for FY 2020-21 | 15 March 2022 |

| MGT-7 Due Date for FY 2020-21 | 31 March 2022 |

| MGT-7A Due Date for FY 2020-21 | 31 March 2022 |

| DPT-3 Due Date for FY 2020-21 | 31 August 2021 |

| DIR-3 KYC Due Date for FY 2020-21 | 30 September 2021 |

| MGT-14 Due Date for FY 2020-21 | 30 December 2021 |

| MSME Form Due Date for FY 2020-21 | 30 April 2021 and 31 October 2021 |

| ADT-1 Due Date for FY 2020-21 | 14 December 2021 |

| Form 11 Due Date for FY 2020-21 | 31 August 2021 |

| Form 8 Due Date for FY 2020-21 | 30 December 2021 |

| Form PAS-6 Due Date for FY 2020-21 | 30 May 2021 and 29 November 2021 |

| Form CRA-4 Due Date for FY 2020-21 | 30 November 2021 |

| Form 29C Due Date | 15 February 2022 |

| Form 3CA-3CD/ 3CB-3CD Due Date | 15 February 2022 |

Other ROC Filing Due Date/ ROC Compliance

Below are the other MCA forms that are to be filed to adhere to ROC Compliance.

| MCA Forms | ROC Filing Due Date |

| Form INC-20A | Within 180 days from the date of incorporation of the company. |

| DIR-3C | Within 15 days of receiving intimation of DIN inform the Registrar. |

| DIR-3B | Within 30 days of allotment of DIN inform the companies in which he/she is a director. |

| Form INC-6 | Within 6 months of exceeding the OPC threshold limit. |

| Form INC-22 | Within 30 days from the date of incorporation of the company if the registered address is not mentioned in the incorporation form. |

| Form INC-22 | Within 15 days of any change in the situation of the registered office of the company. |

| Form SH-7 | Within 30 days of passing the resolution for alteration or increase in share capital or redemption of preference shares. |

Above we saw the ROC filing due date for FY 2020-21 for the various forms. Now, we will discuss each MCA form in detail, who should file it and the purpose of filing the form.

Firstly we will discuss the forms filed by a company registered under the Companies Act, 2013. These forms are to be filed by Private and Public companies.

ROC Compliance forms for Companies

(1) Form AOC-4 :

The Companies must file the form AOC-4 within 30 days from the Annual General Meeting (AGM) to adhere to ROC Compliance. AOC-4 provides the financial details of the companies. AOC-4 forms a part of the annual returns filed with ROC. To file the AOC-4 form, download it from the MCA website, fill it out, get it signed by an authorised person of the company and a practising professional and submit the form along with other enclosures.

AOC 4 due date for fy 2020-21 is Tuesday, February 15, 2022

(2) MGT-7:

The Companies must file the form MGT-7 within 60 days from the AGM to oblige with ROC Compliance. Form MGT-7 is an annual return form filed along with AOC-4. You can file the MGT-7 form by downloading it from the MCA website, filling it out, and getting it signed by the CEO of the company and a practising professional. MGT-7 also provides financial information of a company.

(3) MGT-7A:

The Ministry of Corporate Affairs announced the form MGT-7A with features similar to MGT-7 to reduce the compliance burden on OPC and Small companies. The One Person Companies (OPCs) and Small companies must file MGT-7A to adhere to ROC Compliance. Small companies must file the form MGT-7A within 60 days from the AGM date. And, for OPC, the AGM date is not applicable. However, the OPC must file within the extended ROC filing due date.

(3) DPT-3:

Private and Public companies must file one-time returns or Annual returns for outstanding Loans and return of deposits for accepting deposits. Every company must file DPT-3 Annual return or One Time Return annually. The due date to file DPT-3 annually is June 30 of every year. The due date for DPT-3 for FY 2022-23 is 30 June 2023. However, MCA has extended due date to 31st July, 2023 due to the transition of MCA-2 1 Portal from Version-2 to Version-3. You may file the form DPT-3 by logging into the V3 portal and navigating to MCA Services> Company e-filing> Deposits related Filings> Form DPT 3- Return of Deposits, filling the form, getting it signed by the company’s CEO or any authorised person and by a certified CS or CA and submitting it to ROC.

(4) DIR-3 KYC

Every Director of a company is allotted a DIN. If you are a DIN holder with an approved Director Identification Number (DIN), you must file form DIR-3 KYC every year as required to comply with ROC compliance. However, the disqualified directors must file the form DIR-KYC. The due date to file DIR-3 KYC is September 30 of every year. To file the form DIR-3 KYC, Login to the V3 portal of MCA website, download the DIR-3 KYC form, fill it out, sign it and submit.

(5) MGT-14

Resolutions are passed during the meetings held with the Board of Directors, Shareholders and Creditors. These may be Board resolutions, Special Resolutions or Ordinary Resolutions. Public Companies must file all resolutions with the ROC via form MGT-14. Furthermore, only public companies are to file this form. Private companies are exempt from filing MGT-14. To file the form, you may download the form from the MCA website, fill it out, get it signed and submit it.

(6) MSME Form

Companies who have outstanding dues towards MSME enterprises for more than 45 days from the date of receipt of services must file MSME form 1 with ROC to adhere to ROC Compliance. This is a half-yearly return that is to be filed by the specified companies. The due date to file MSME form 1 for the period October to March is April 30 and for April to September is October 31. To file the MSME form 1, download the form from the MCA website, fill it out, sign it by an authorised signatory, and submit it.

(7) ADT-1

It is mandatory ROC compliance for a company to inform the ROC about the appointment of its Auditor. It applies to private and public companies. The companies must file the form ADT-1 within 15 days from the Annual General Meeting in which Board appointed the Auditor. Form ADT-1 is filed every time a new Auditor is appointed or five years once. To file form ADT-1, download the form from the MCA website, fill it out, enclose the company’s board resolution, Written consent of the Auditor, Certificate from the Auditor, get it signed and submit it.

ROC Compliance forms for LLPs

(1) Form 11

It is a mandatory ROC Compliance for the LLPs to file Form 11 annually. Form 11 is an annual return of LLP, which has to be filed 60 days from the year-end financial close. The due date to file Form 11 is May 30 of every year. To file Form 11, you can download the form from the MCA website, fill it out, enclose the required documents, certify and submit it.

(2) Form 8

Form 8 is a statement of Accounts and Solvency that is mandatory to file as per ROC Compliance. To file Form 8, you can download the form from the MCA website, fill it out, enclose the required documents, certify and submit it. LLPs must file Form 8 within 30 days from the year-end financial close. The due date to file Form 8 is September 30 of every year.

Audit Reports

(1) Form 29C

Form 29C is a report furnished by a chartered accountant under section 115JC of the Income Tax Act, 1961 for computing Adjusted Total Income and Minimum Tax of the person other than a company. If minimum alternate tax is applicable to the assesses other than Corporates, he has to obtain a certificate in form 29C from CA. The provisions of Alternative Minimum Tax applies to Individual, HUF, AOP or BOI if the adjusted total income exceeds Rs 20 lakhs.

The CBDT has extended the due date for filing Form 29C for FY 2020-21 to 15th February 2022.

(2) Tax Audit Report

A tax Audit Report is a report provided typically by a Chartered Accountant after conducting a tax audit of a company. He has to provide the findings of his tax audit in the Audit forms. Section 44AB specifies the applicability of tax audits to certain taxpayers. The Tax audit report may be furnished either in Form 3CA or Form 3CB. Furthermore, Form 3CD has to be furnished along with these forms.

Audit report under section 44AB of the income tax act, 1961 in form 3CA is furnished in the case where the accounts of the business or profession of a person have been audited under any other law other than the income tax act. Audit report under section 44AB of the income tax act, 1961 in form 3CB is furnished in the case where the accounts of the business or profession of a person are not required to be audited under any other law but audited under the income tax act. Additionally, the auditor has to furnish form 3CD which is a statement of particulars in detail.

The CBDT has extended the due date for filing the tax audit report for FY 2020-21 to 15th February 2022.

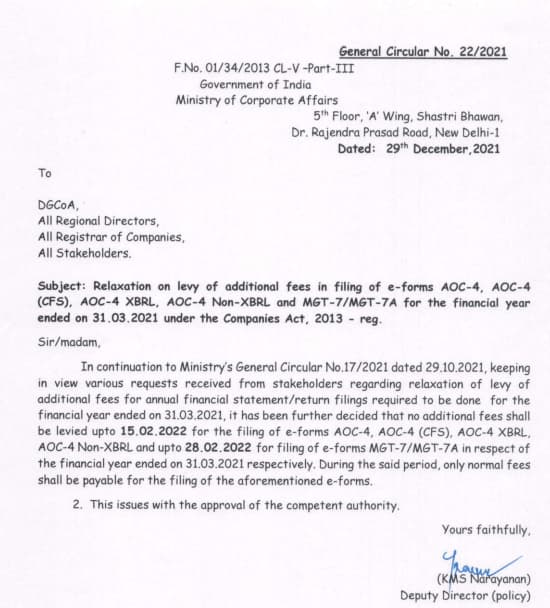

ROC Compliance MCA Circular

The Ministry of Corporate Affairs released a circular on 29th December 2021 to relax the annual filing of forms AOC-4 and MGT-7. The ROC filing due date for FY 2020-21 is extended for AOC-4 to 15th February 2022 and to 28th February 2022 for MGT-7. The companies will not be charged any additional fees if the forms are filed within the extended timelines.

Below is the ROC Compliance Relaxation

(1) Is the ROC Filing Due date for FY 2022-23 extended?

There is no extension with regard to ROC Filing Due Date for FY 2022-23.This is as per the latest mca updates.

(2) What is the AOC-4 Due date for FY 2022-23?

AOC 4 due date for FY 2022-23 is 30th October 2023.

(3) What is the MGT-7 Due date for FY 2022-23?

MGT-7 due date for FY 2022-23 is 30th November 2023.

(4) What is ROC filing?

ROC Filing refers to the filing of annual returns and audited financial statements with the Registrar of Companies (ROC).