GST Return Due Date for financial year 2023-24 and GST Return Monthly Calendar helps businesses and professionals to keep a track of the GST return filing dates. With the GSTR-3B due dates and GSTR-1 due dates, you can avoid paying any interest or penalty incurred on late filing. Below is the list of GST Return Due Date for FY 2024-25.

ROC Compliance Calendar 2024-25 – Filing Due Date (FY 2023-24) – Updated

ROC Compliance filings are mandatory for all companies and LLPs.The Companies registered under the Companies Act, 2013 and LLPs registered under the Limited Liability Partnership Act, 2008 must file their annual returns with the ROC. Non-adherence to the compliances may attract penalties.

Listed below is the ROC filing due date for FY 2023-24 and ROC filing due date for FY 2022-23 for various forms.

Letter of Undertaking Under GST: A Comprehensive Guide for 2024-25

LUT is an essential document that allows exporters of goods and services to export goods and services without the payment of GST.

In this article, we will explore the meaning of LUT, Purpose, Eligibility and procedure to file LUT for 2024-25.

Director Identification Number (DIN) | Know All About it

What is DIN number?

Director Identification Number or DIN is a unique eight-digit number provided by the central government to the director of a company or the individuals who intend to be the company’s director. Each director will have a unique DIN. And DIN has lifetime validity. You can have only one DIN and be the Director of two or more companies. In this article, we shall see how to get DIN number, Importance of Director Identification Number, check your DIN status , and more.

Advance Tax Due Date for AY 2024-25 | FY 2023-24

Advance Tax Due Date for AY 2024-25 and for AY 2023-24 is listed below for easy reference. We will discuss what is advance tax, its applicability, Calculation of Advance tax instalment, challan details and how to pay online.

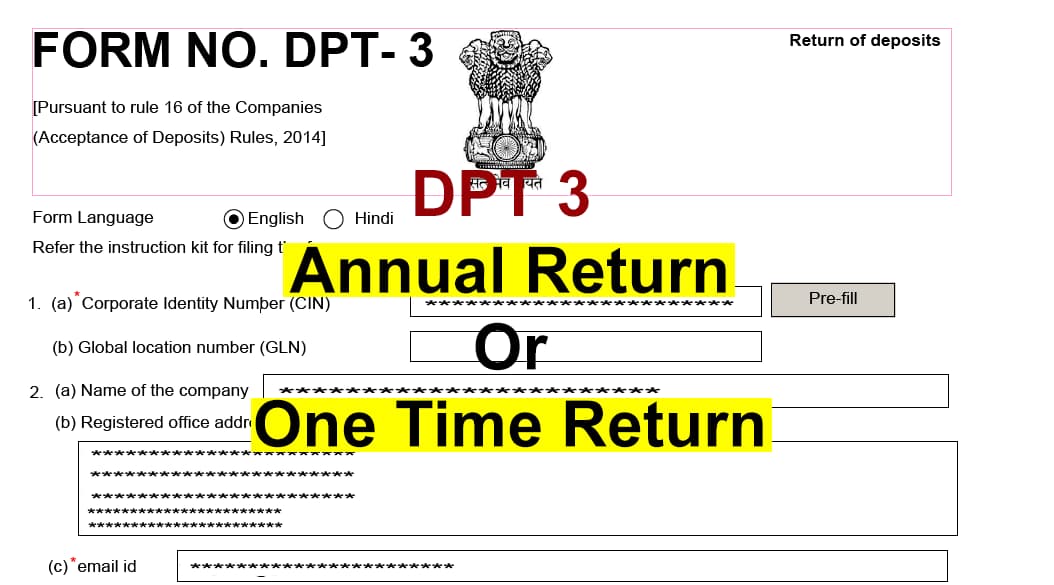

DPT 3 Due Date, Notification, Last Date 2023 [Extended]

DPT 3 Due Date for FY 2022-23 is 31st July 2023. As per Companies (Acceptance of Deposits) Rules, 2014 DPT3 is to be filed 30 days from 1st May of that financial year that is 30th June of every financial year.

MCA released an official circular extending the DPT-3 due date from 30th June 2023 to 31st July 2023.

DPT 3 Due Date

The due date for online filing of form dpt 3 is 30-06-2023 which is now extended to 31st July 2023.

Below are the details:

- One time Return for disclosure of details of outstanding money or loan received by a company but not considered as deposits in terms of rule 2(1)(c) of the Companies( Acceptance of Deposits) Rules, 2014- due date is Within 30 days from 1st May 2019.

- Return of deposits’ or ‘Particulars of transactions by a company not considered as deposit as per rule 2 (I) (c) of the Companies (Acceptance of Deposit) Rules, 2014’ Or ‘Return of Deposit and Particulars of transactions by a company not considered as a deposit.

TDS Return Due Date – Filing Online – Status 2023

TDS Return Due Date is useful for both Government and other Deductors. You can easily keep track of the TDS due dates and file TDS return on time. In this article we will discuss what is TDS, who should file TDS return, frequency of filing of TDS return, TDS Return Due Date and TDS rates applicable.

Leave Encashment: Tax Exemption Increased to Rs 25 Lakhs

Leave Encashment tax exemption limit is increased to Rs 25 lakhs as per the latest CBDT notification.

The Central Board of Direct Taxes (CBDT) increases the tax exemption limit on leave encashment for non-government employees from Rs 3 lakhs to Rs 25 lakhs. The honourable Finance Minister Ms. Nirmala Sitharaman proposed the increase in tax exemption limit on leave encashment for non-government salaried employees in the Budget Speech 2023. The new tax exemption limit will come into effect from 1st April 2023.

Depreciation As Per Companies Act 2013 – [Updated]

Depreciation as per companies act 2013 measures the wearing out or loss of value of a depreciable asset from use or obsolescence. Depreciation on assets can be claimed as an expense in the Profit and Loss A/c of a business.

Depreciation as per Companies Act, 2013 is applicable for assets purchased on or after 1st April 2014. It only prescribes the useful life of different assets and does not provide any specific depreciation rates.

You can use the depreciation formula and the useful life given in Schedule II of Companies Act, 2013 to calculate the rate of depreciation as per companies act. Besides, we have calculated and given the mca depreciation rates under Depreciation Rates as per companies act 2013 for AY 2023-24.

In this article, we will delve into the intricacies of depreciation as per Companies Act 2013, unraveling its significance and implications.

LLP Form 11| Due Date, E-Filing

LLP Form 11 is the annual return that a Limited Liability Partnership registered under the LLP Act 2008 must file every year. It is crucial that you keep yourself up to date with the latest compliance requirements to provide top-notch services to your clients and to avoid penalties.

In this article, we will delve into the meaning of Form 11, due date and also how to file the form 11 online. Let’s dive in!