LUT is an essential document that allows exporters of goods and services to export goods and services without the payment of GST.

In this article, we will explore the meaning of LUT, Purpose, Eligibility and procedure to file LUT for 2024-25.

Table of Contents

What is LUT in GST?

LUT refers to Letter of Undertaking given by an exporter to the tax authorities that he will comply with all the requirements prescribed under the GST while exporting goods or services without paying IGST. It helps facilitate smoother international trade.

Purpose of LUT

Letter of undertaking can be used for several key purposes:

1.Zero rated supply to Special economic zones (SEZ) without payment of IGST.

2.Export of goods to a country outside India without payment of IGST.

3.Providing services to a client outside India without payment of IGST.

Eligibility for Filing a Letter of Undertaking

To be eligible to file Letter of undertaking, an exporter must meet the below criteria:

- The exporter must be registered under GST and have a valid GSTIN.

- He/ She must have business involving export of goods and services and a good track record of co adherence to relevant export laws.

- The taxpayer must not have any outstanding tax liability including arrears or dues from the previous financial years.

How to Apply for LUT in GST for 2024-25?

Below are the steps to apply for a Letter of Undertaking on GST portal for FY 2024-25

1.Official GST Website

Go to the official GST website https://www.gst.gov.in/

2.GST portal Login

Login to the GST portal with your credentials.

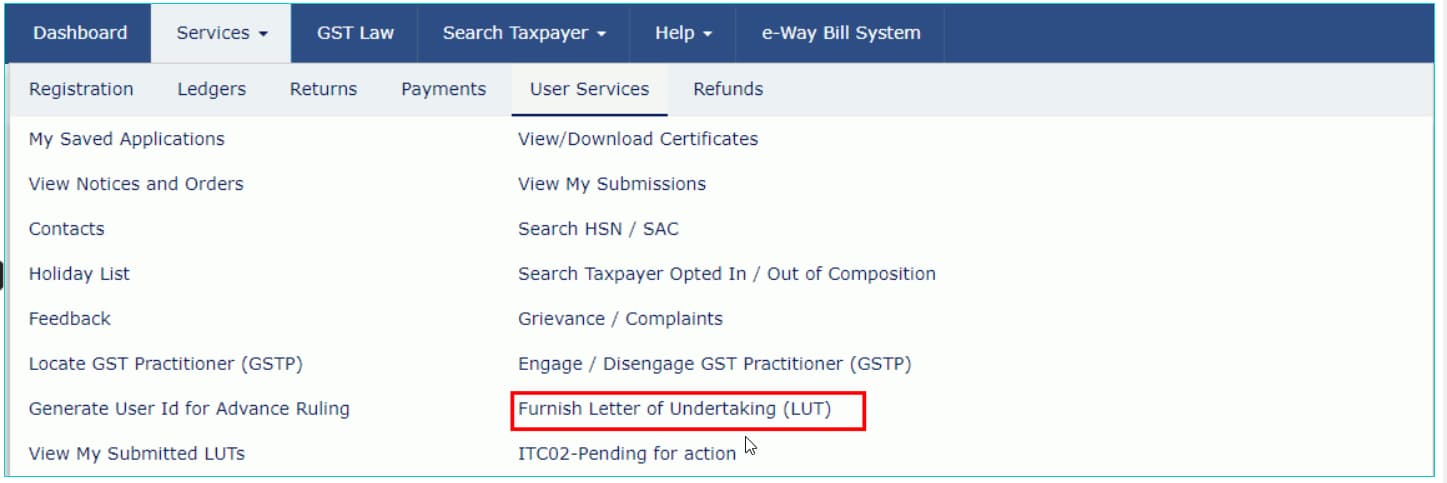

3. Navigation

Follow the path: Under dashboard>Service>User services>Furnish Letter of Undertaking (LUT).

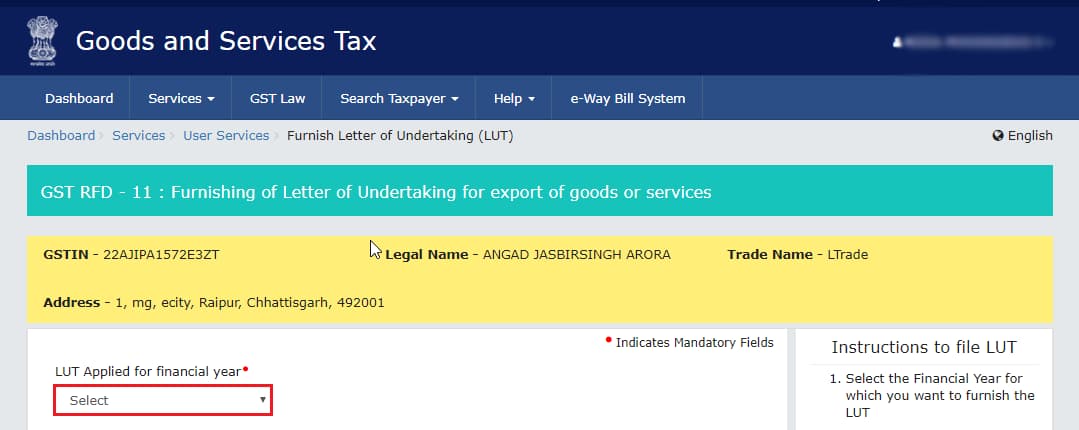

4. Form GST RFD-11

You will see form GST RFD-11. Select the financial year for which you want to apply LUT from the drop down.

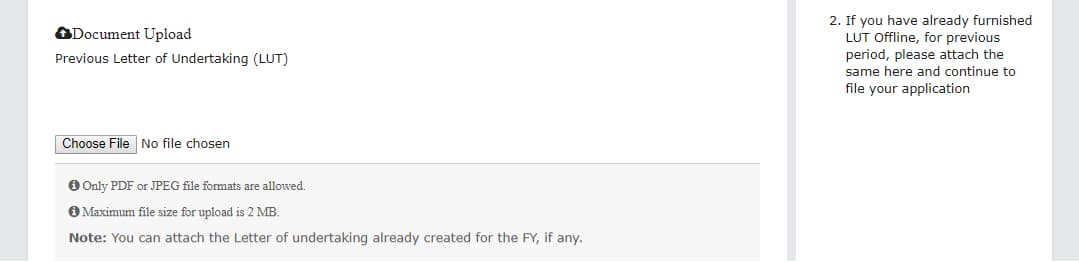

5. Upload Previous Letter of Undertaking

If you have already filed Letter of Undertaking for the previous financial year, you may upload the same by clicking on the Choose file button. Note that the GST portal allows only pdf and jpg formats, and the file size should not exceed 2MB.

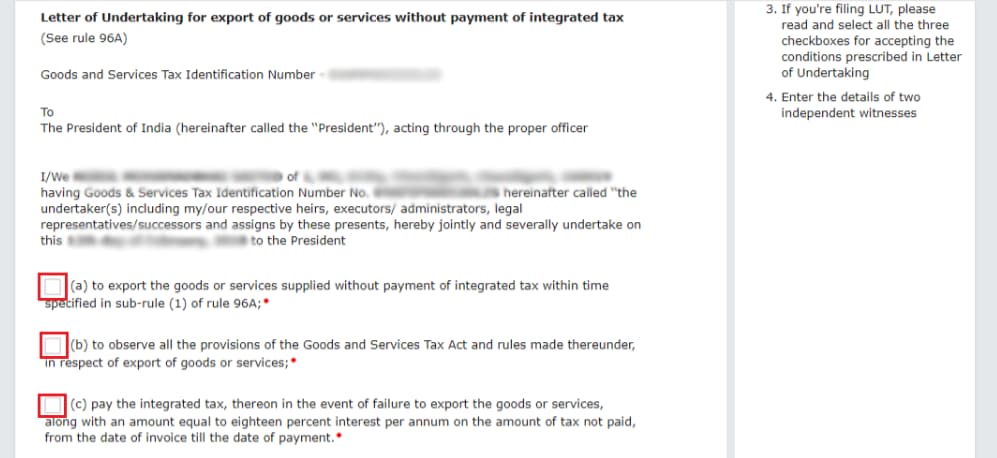

6. Letter of Undertaking Declaration

Select the check boxes to self-declare that you agree to below conditions.

7.LUT Witness

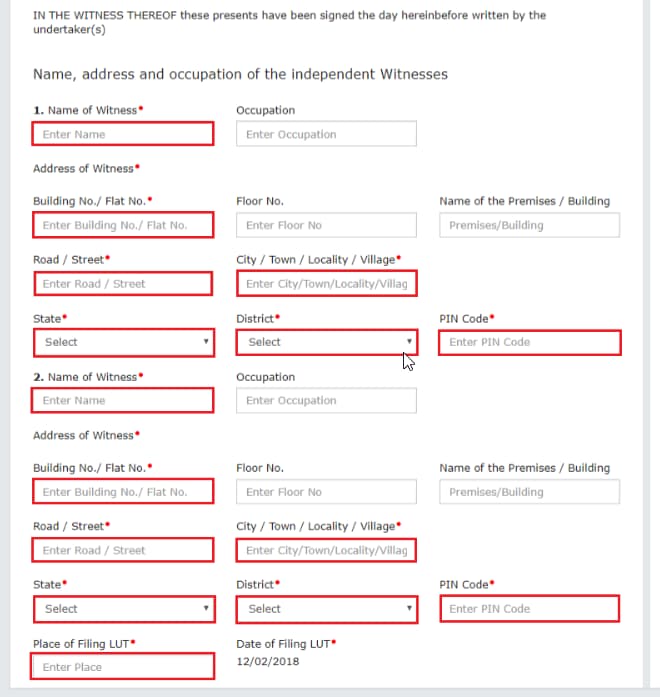

Enter the names, addresses, and occupations of two witnesses.

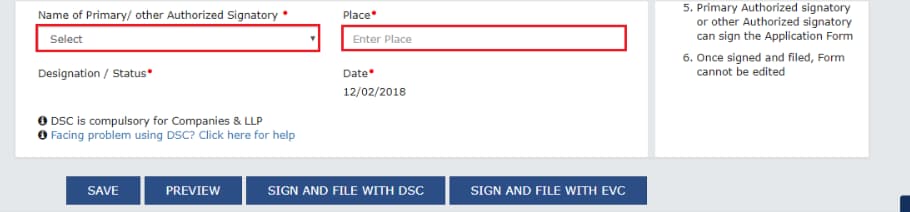

8.Sign and file with DSC or EVC

Select the primary authorized signatory from the drop down. And Sign with DSC or EVC and file your application.

Documents Required for LUT Under GST

The main document required for filing an LUT is the completed Form GST RFD-11.

LUT Certificate Download

Once your LUT application is approved, you can download the LUT certificate from the GST portal. This certificate serves as proof that you are authorized to export goods or services without paying IGST under the LUT conditions.

Letter of Undertaking Under GST Example

A typical LUT includes the exporter’s details, a declaration of compliance, witness information, and the signature of the authorized signatory. It must clearly state the commitment to abide by all GST regulations associated with exports and confirm that no IGST will be paid on the exported goods or services.

LUT Application Status

Below list provides the list of Letter of Undertaking Application Status:

| LUT Application Status | Meaning |

| Submitted | Status of application after Taxpayer submits the application successfully. |

| Pending for Clarification | Status of application after LUT Processing officer issues notice for seeking clarification. |

| Pending for Order | Status of application after Taxpayer submits the reply for notice within 15 working days Or Taxpayer does not submit the reply for notice after completion of 15 working days and then GST Portal changes the status from pending for clarification to pending for order. |

| Approved | Status of application after Tax Official accepts the undertaking furnished by Taxpayer. |

| Rejected | Status of application after Tax Official rejects the undertaking furnished by Taxpayer. |

| Deemed Approved | Status of application in case Tax Official doesn’t take any action within 3 working days. |

| Expired | The status of the application will get changed to Expired at the end of the respective FY. |

Faqs

1. What is the LUT due date for fy 2024-25 GST?

The due date to file LUT for FY 2024-25 is 31st March 2024.

2.Who is eligible to apply for Letter of undertaking?

All registered taxpayers exporting goods or services who desire to use the zero-rated supply must apply for Letter of undertaking.

3.Is it mandatory to file Letter of Undertaking?

It is mandatory to file Letter of undertaking every financial year for the taxpayers availing the benefit of zero-rated exports. For others, it is not mandatory.

4.How to file Letter of Undertaking?

In the GST portal, you may navigate to Services > User Services > Furnish Letter of Undertaking (LUT) to file Letter of undertaking.

5.Is letter of undertaking mandatory for export?

It is mandatory to furnish Letter of undertaking to export goods or services without paying GST.

6. What is the validity of Letter of Undertaking?

A letter of undertaking is valid for one financial year. You must renew the letter of undertaking every financial year to continue exporting goods and services without paying IGST.

7.What are the consequences of not filing LUT on or before the due date?

If Letter of undertaking is not filed on time, you as an exporter must pay the IGST while exporting the goods or services. And, after filing Letter of undertaking, you may claim refund to avail the benefit of zero-rated export.

8.Is It Mandatory to Mention LUT Number on Invoice?

Yes, it is mandatory to mention the LUT number on the invoice when exporting goods or services under this scheme. This facilitates the tracking and validation of exports conducted under the LUT provisions.

The Letter of Undertaking (LUT) plays a significant role in facilitating the export process and providing relief to exporters from paying taxes at the time of export. However, you must report the export sales under the category zero-rated supply while filing GSTR-3B. Also, you must report the same under Exports while filing GSTR-1. Keep yourself updated on the upcoming GSTR Return Due Date 2023.