Leave Encashment tax exemption limit is increased to Rs 25 lakhs as per the latest CBDT notification.

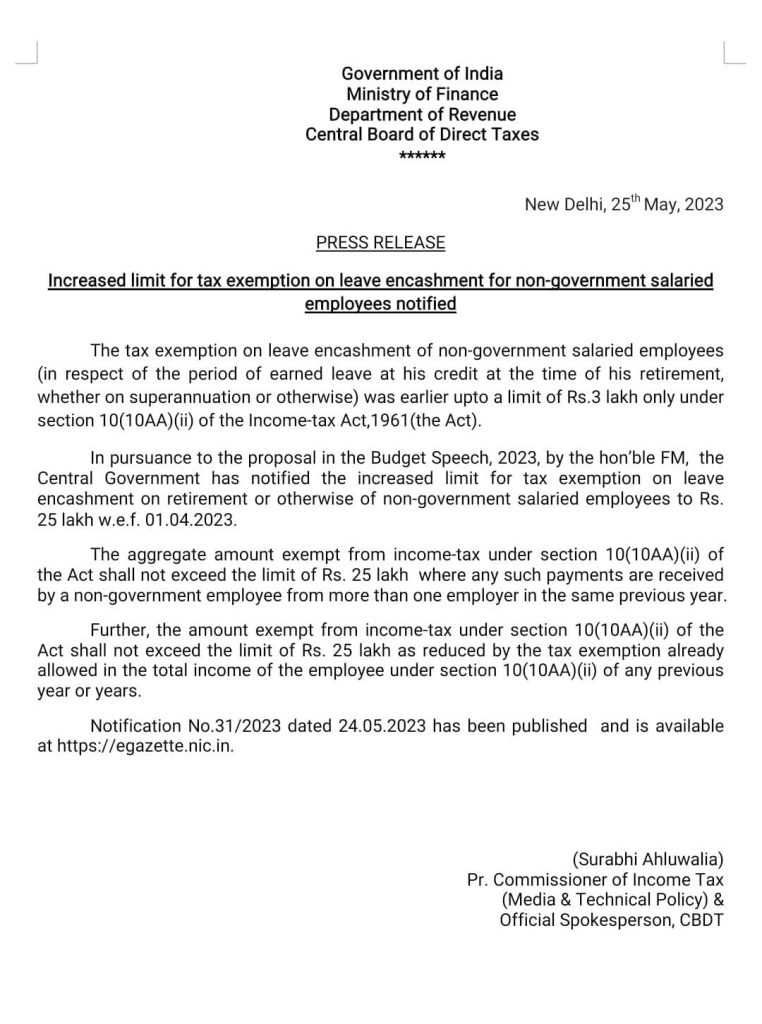

The Central Board of Direct Taxes (CBDT) increases the tax exemption limit on leave encashment for non-government employees from Rs 3 lakhs to Rs 25 lakhs. The honourable Finance Minister Ms. Nirmala Sitharaman proposed the increase in tax exemption limit on leave encashment for non-government salaried employees in the Budget Speech 2023. The new tax exemption limit will come into effect from 1st April 2023.

This will provide a huge relief to the non-government employees as the maximum tax exemption provided on leave encashment under section 10(10AA) of the income tax act, 1961 is increased from a mere Rs 3 lakhs to Rs 25 lakhs.

Table of Contents

Leave Encashment Notification

What is Leave Encashment?

Leave salary refers to the salary for the period of leave not availed by the employee. The encashment of accumulated leave can be at the time of retirement or during the tenure of employment.

Leave encashment is the amount received by an employee in exchange for the number of earned leaves not availed by the employee.

Types of Leaves Eligible for Encashment

Below are the types of leaves eligible for encashment.

- Annula leave

- Privilege leave

- Vacation/ Holiday leave

Leave Encashment Taxability

Encashing leaves is the process through which earned leave is converted to cash. Any amount received by an employee as leave encashment is taxable as per the income tax act of 1961.

Leave Encashment Rules

- Any amount received by an employee on encashing his leaves during employment is fully taxable whether employed in government or non-government sector.

- The entire amount of leave encashment received by a government employee on retirement is exempt from tax.

- For a private sector employee, the amount of leave encashment exempt will be the least of the following:

- (a) Actual leave encashment amount received

- (b) Rs 25,00,000 (previously Rs 3,00,000)

- Ten months salary on the basis of average salary of last ten months prior to retirement/ resignation from the organization.

- Cash equivalent of the earned leave based on the basis of last ten months prior to retirement. Note that an employee can have only 30 days of earned leave to his credit.

Leave Encashment Formula

Below is the formula to calculate leave encashment amount:

Leave Encashment = (Basic Salary + Dearness Allowance)/30 x (Number of Unavailed Earned leaves)

Leave Encashment Calculator

You may also use the taxable leave salary calculator provided by the income tax department to calculate your taxable leave salary.

Leave Encashment Example

Let us understand how to calculate encashment of earned leave for non-government employee through an example.

Example 1: Suppose Mr. Ram is retiring after 10 years of service.

Mr. Ram was entitled to 30 days of paid leave per annum from his employer, i.e., overall, 300 days of leave during his entire service. (30*10)

Out of the same, Mr Ram has already utilized 200 days of paid leave and is left with 100 days of unutilized leave. Mr Ram was drawing basic salary + DA of Rs 30,000 per month at the time of retirement and received Rs 1,00,000 as leave encashment calculated based on 100 days * Rs. 1,000 (salary per day = Rs.30,000/30 days).

| Particulars | Amount (In Rs) |

| Leave Encashment received | 1,00,000 (100 x Rs 1,000) |

| Less: Exempt | 1,00,000 |

| Least of the following 1.Actual Leave Encashment received 2.Maximum amount specified by Government 3.Average salary for 10 months= 30,000 x 10 months 4.Rs 1,000 x (30 days x 10 years of service completed – 200 days of unused leave) | 1,00,000 25,00,000 3,00,000 1,00,000 |

| Leave Encashment Taxable | 0 |

Faqs

1. What is the CBDT leave encashment limit?

As per the latest CBDT notification, leave encashment limit is increased from Rs 3 lakhs to Rs 25 lakhs for non-government employees.

2. Is encashment of annual leave mandatory?

It is not mandatory to encash your annual leave. Employees encash leave to avail of the tax benefit. You may choose to utilize the leave for a vacation if you wish.

3. Is the new leave encashment tax exemption applicable to Non-Government employees during employment?

The new leave encashment tax exemption is applicable to Non-Government employees only after retirement or resignation from the company.

4. Which leaves cannot be encashed?

Maternity leaves cannot be encashed.

5.Can the casual leaves be encashed?

No, you cannot carry forward casual leaves. Unlike annual leaves, the casual leaves will lapse at the end of the year if not used by the employee.

6. Can leave encashment be part of CTC?

Yes, earned leave is part of the CTC.

7.What is the maximum number of leaves that can be encashed?

An employee can encash a maximum of 30 earned leaves.

8. Can Sick leaves be encashed?

It depends on the company’s policies. Few companies do not allow encashment of sick leaves.

9 What is the limit of section 10 (10AA)?

Under section 10 (10AA) of the income tax act, 1961, the amount of tax exempt shall not exceed Rs 25 lakhs as per the latest CBDT notification.

Leave encashment policy varies from company to company. Some companies have a limit on the number of earned leaves that can be carried forward to the next year.