Learn how to file income tax return for Salaried Employee online. It is easy and you can file your ITR at the comfort of your home. Ensure that you file your return before the Income-tax due date to avoid any penalty.

If you are a salaried individual with an income of less than Rs 50 lakhs, you must use the ITR-1 form to file your income tax return. You can choose to file your ITR either online or offline.

Table of Contents

Key Points

| – Calculate your income and tax for the financial year. |

| – While calculating your income, consider income from salary, house property, Bank interest and other sources of income. |

| – Decide whether you want to opt for New Tax Regime or Existing Tax Regime. |

| – Ensure that you collect your Form 16 from your employer. |

| – Download Form 26AS from the income tax portal to know the amount of TDS deducted. |

| – Ensure that you have the proofs handy for claiming income tax deductions. |

| – Select the form ITR-1 while filing your return. |

| – Download the latest version of the ITR filing application from the income tax portal. |

Documents required to file Income Tax Return

Having the documents required for filing income tax return handy streamlines the filing process. Below is the list of documents:

(i) Form 16

(ii) Form 26AS

(iii) Interest on housing loan certificate issued by Bank.

(iv) Rent paid receipts

(v) Proof of Investments

(vi) Insurance Policy

(vii) Medical Bills

(viii) Tuition Fee receipts

(ix) Interest income certificate from Bank.

Should I Opt for New Tax Regime or Old Tax Regime?

Opting for New Tax Regime is not mandatory. Moreover, you can weigh the benefits of the New Tax Regime Vs Old Tax Regime and opt for the one suitable to you.

Generally speaking, if you have invested in tax saving schemes, it makes sense to choose Old Tax Regime. Even though you will be paying tax at a higher rate, you can still claim tax deductions. Otherwise, you may opt for New Tax Regime and pay tax at a concessional rate.

Deductions Salaried Employee can Claim While filing the Income tax return

If you are a Salaried Individual and have opted for the Old or existing tax regime, you can claim the various tax deductions below.

(1) Deduction under section 80C

Investment in ELSS and other tax-saving investments, Life Insurance Premium, Deferred Annuity, Contributions to provident fund, Tuition Fees of Children. 80C Deduction limit for AY 2021-22 is Rs 1.5 lakhs.

(2) Deduction under section 80D

You can avail of tax deduction under section 80D if you have any health insurance policy in your name or your family’s name or have any preventive checkup expenses. 80D Deduction limit for AY 2021-22 is Rs 25,000 for yourself and your family if below 60 years. And the limit is Rs 75,000 if any of your parents is a senior citizen.

(4) Deduction under section 80GG

You can avail of the tax deduction under section 80GG on the rent paid by you if you have not claimed HRA. 80GG Deduction limit for AY 2021-22 is Rs 60,000 per year.

(5) Deduction under section 80E

If you have an Education loan, you can avail of the tax deduction under section 80E for the Interest on an education loan. There is no maximum limit of deduction under section 80E. However, note that you can claim only the interest amount and not the principal amount.

How to Calculate Income Tax on Salary?

We will see few examples to understand how to calculate income tax on salary. You may also calculate the income tax using the income tax calculator.

Example 1

Suppose Mr Krishnan who is working in an MNC earns a salary of Rs 7,00,000 per annum. He gets Rs 15,000 as interest from his Savings bank account. And he also plans to invest in shares to claim a tax deduction. He wants to do tax planning for the financial year. We will see how to do the tax planning for him.

| Particulars | Amount | Eligible Amount |

| Gross Salary | 7,00,000 | |

| Income from other sources | ||

| Interest on Savings account | 15,000 | |

| Gross Total Income | 7,15,000 | |

| Taxable Income | 7,15,000 | |

| Standard deduction | 50,000 | |

| Professional tax | 2,500 | |

| 80TTA deduction | 10,000 | |

| 80C Deduction | 1,50,000 | |

| 80D Deduction | 5,000 | |

| Taxable Income | 4,97,500 |

Note that if your taxable income is below Rs 5,00,000, you are exempt from tax. A tax relief was provided as a benefit to the middle class people. So, you will not be paying any tax in the above scenario.

Steps to file Income Tax Return for Salaried Employee

Let us now see step by step how to file an income tax return offline.

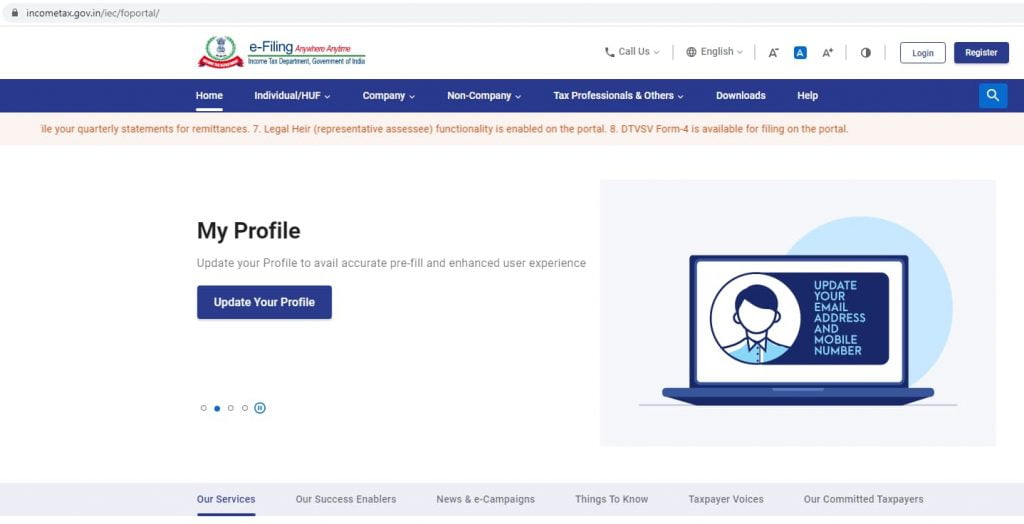

- Go to the new official income tax portal https://www.incometax.gov.in/iec/foportal/

2. Click on Downloads. Select the assessment year as 2021-22. You will find the Common Offline Utility (ITR 1 to ITR 4) on the same page. Click on Utility to download the java file to fill your ITR-1 form offline. Note that Utility is for the Windows version, and Utility for MAC is for the MAC version. Download accordingly.

You will see the below zip file downloaded.

3. Extract the file, and you will get the below ITR efiling application.

4. Double click on the efiling application and wait until it initializes. It usually takes time to initialize the first time you use the application.

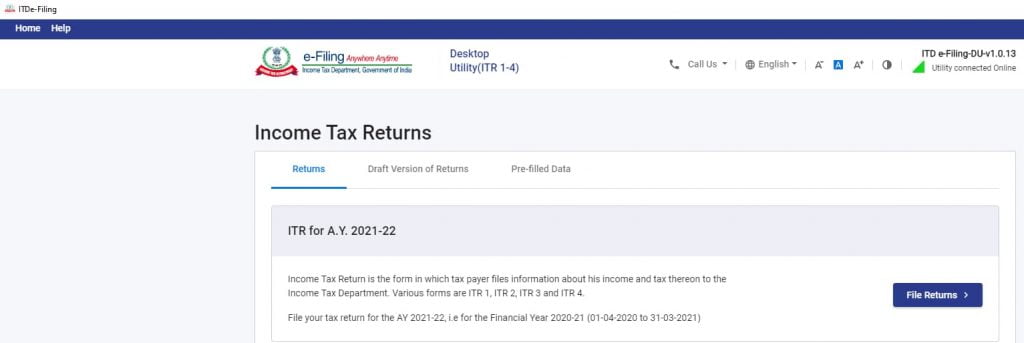

5. The below screen appears with tabs Returns, Draft version of Returns and Pre-filled data. Click on File Returns.

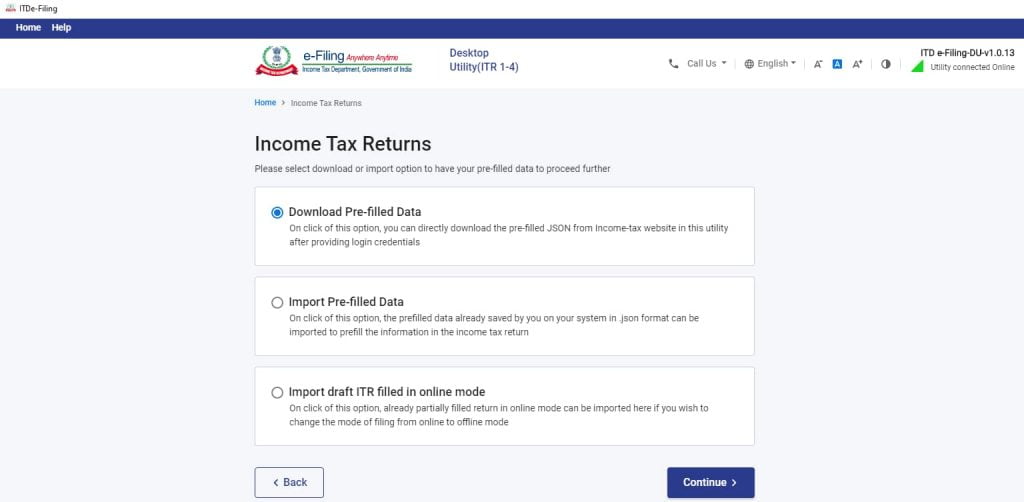

6. The below screen appears. Select Download Pre-filled Data and Click on Continue.

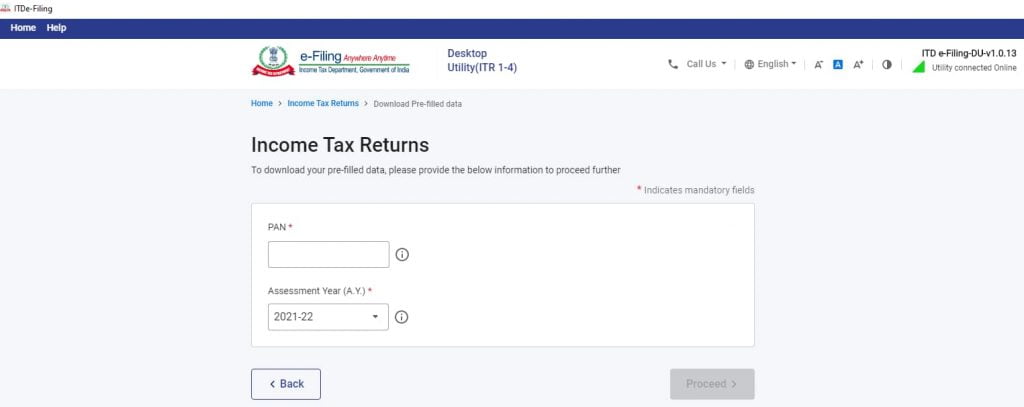

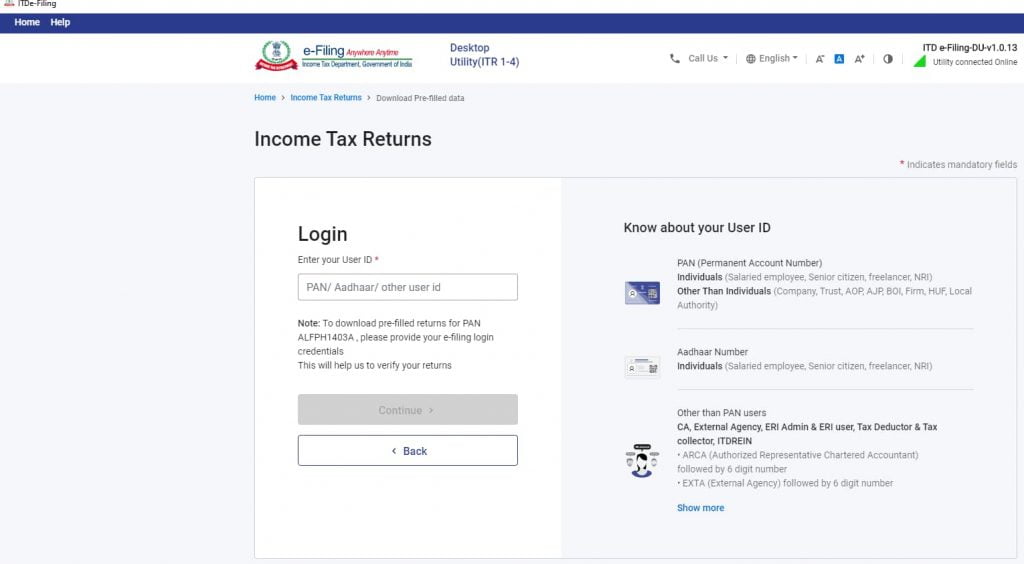

7. The Login screen of the Income-tax website appears. Enter your PAN number and select the current assessment year 2021-2022 as below.

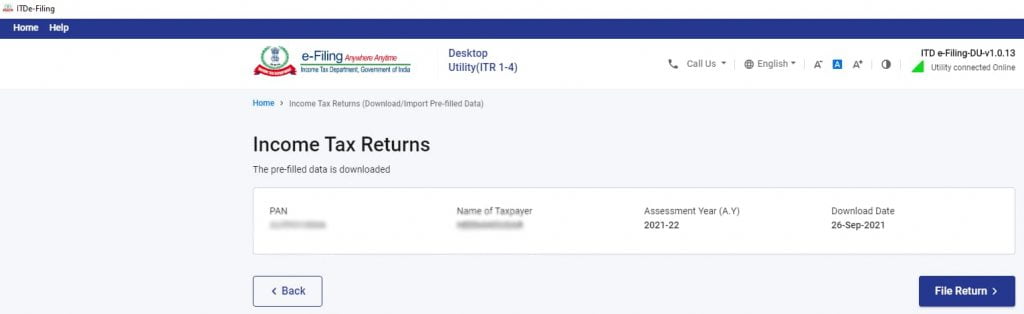

9. Below screen appears. Click on File Return.

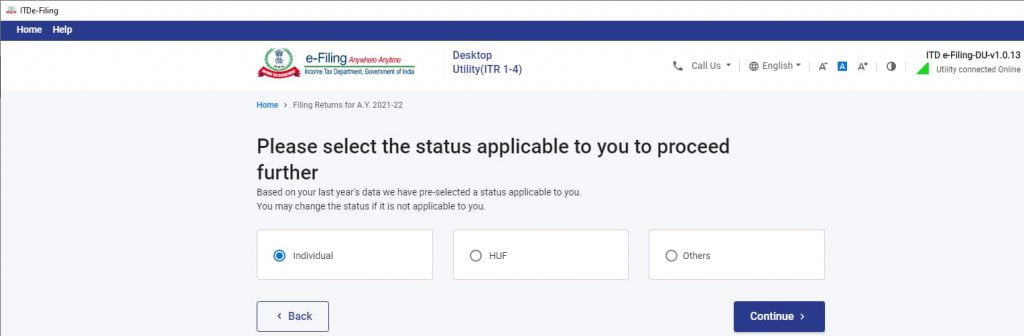

10. The below screen appears. Select individual as we are now filing an income tax return for a salaried individual. Click continue.

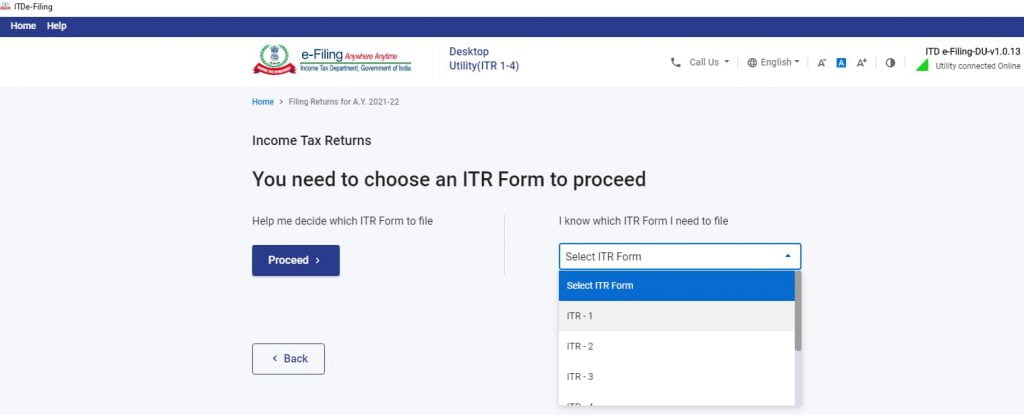

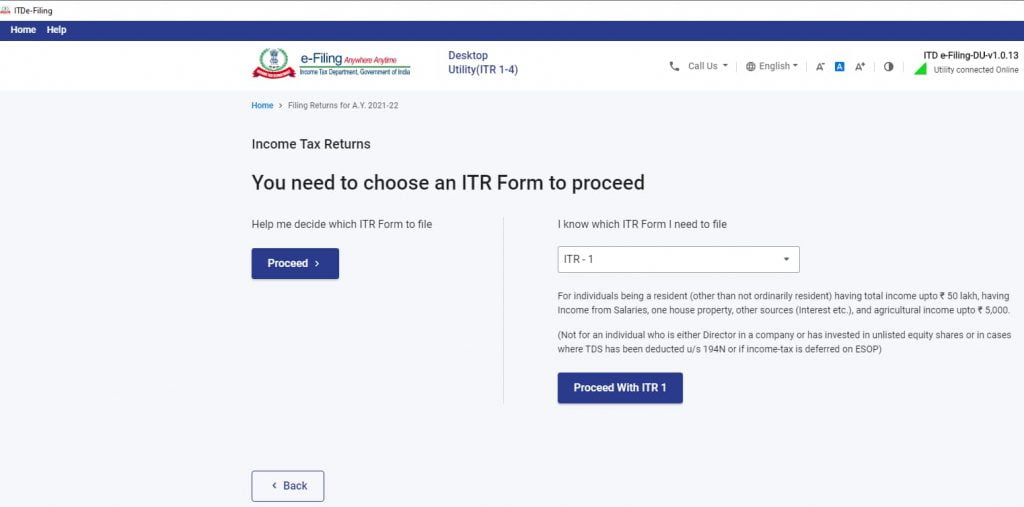

11. From the Select ITR Form dropdown-select ITR-1.

12. After selecting the ITR-1 form, click on proceed with ITR-1.

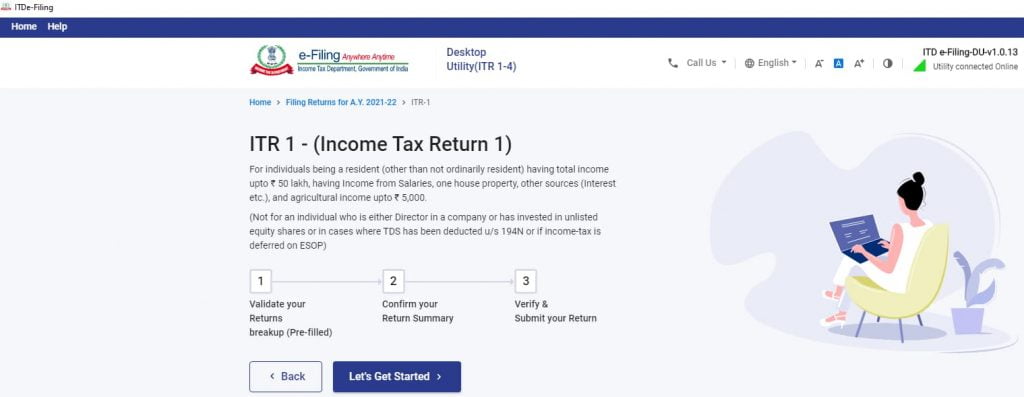

13. The below screen will appear. Click on “Let’s Get Started”.

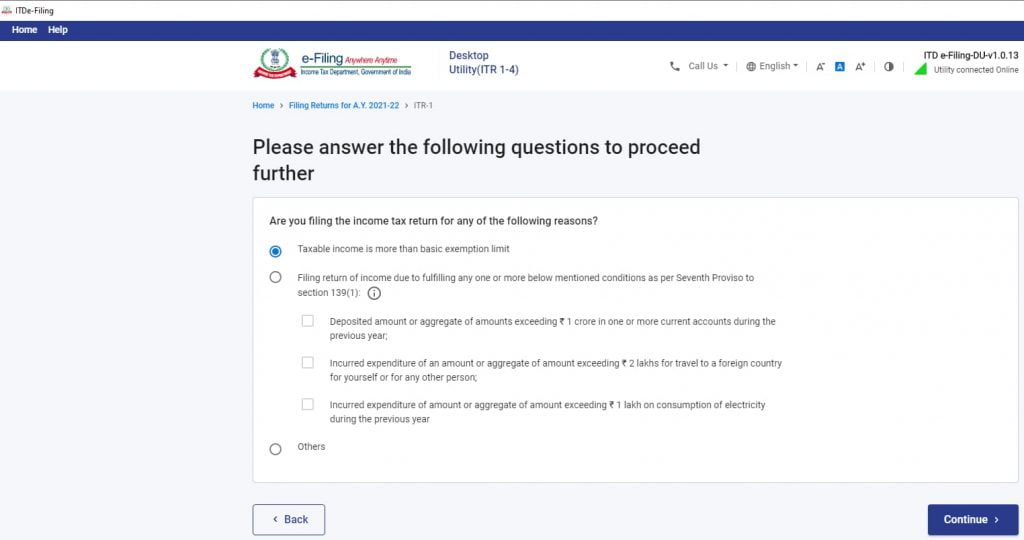

14. Select the 1st option, “Taxable income is more than the basic exemption limit,” if you are an individual having taxable income from salary. If not, select the option that applies to you. Click on Continue.

15. You will get the below confirmation message. Click on OK.

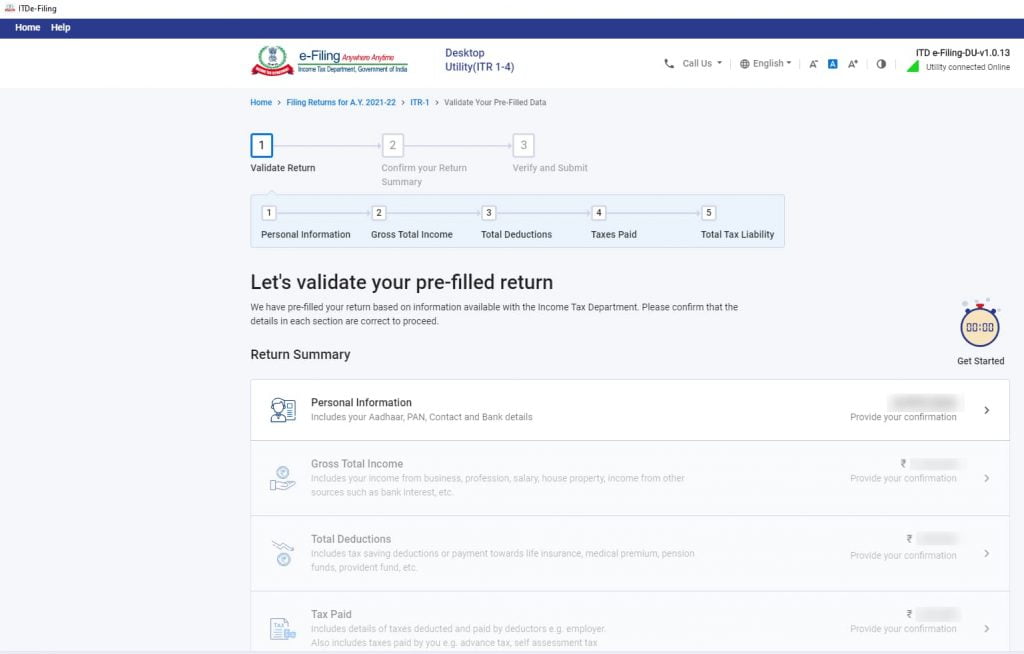

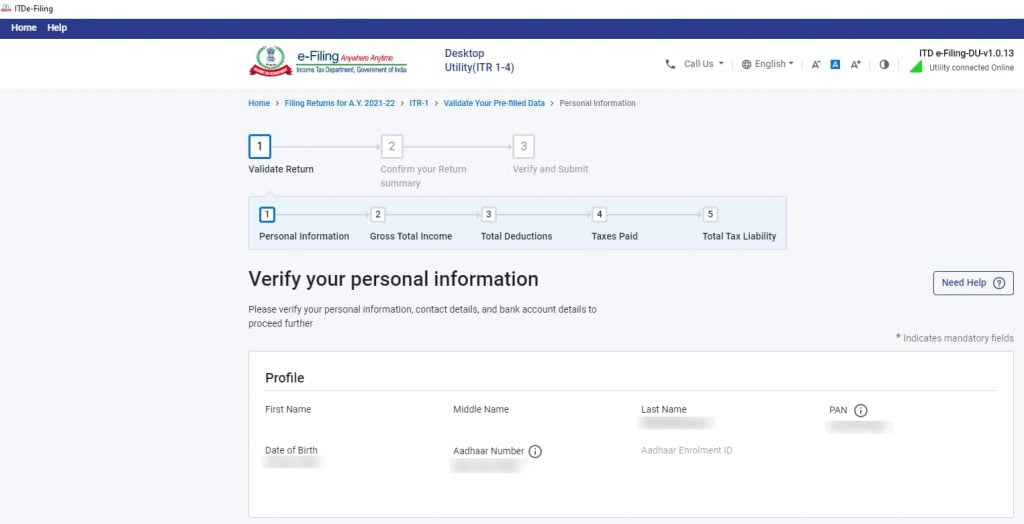

16. In the below ITR-1 filing screen, you need to validate the pre-filled data.

17. Now, we will start with personal details. Click on Personal information and confirm the details.

(i) Confirm your Name, Date of Birth and PAN under Profile.

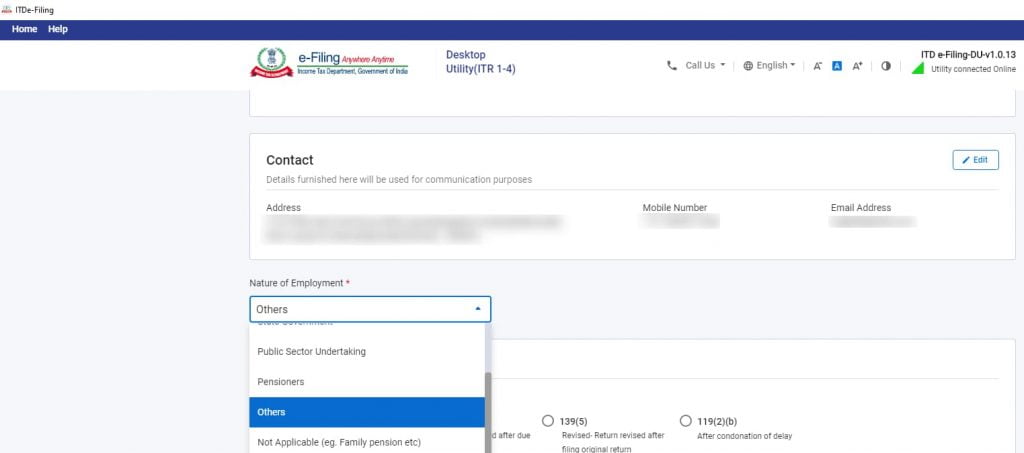

(ii) Confirm your address, mobile number and email address. Also, select “Others” under Nature of Employment.

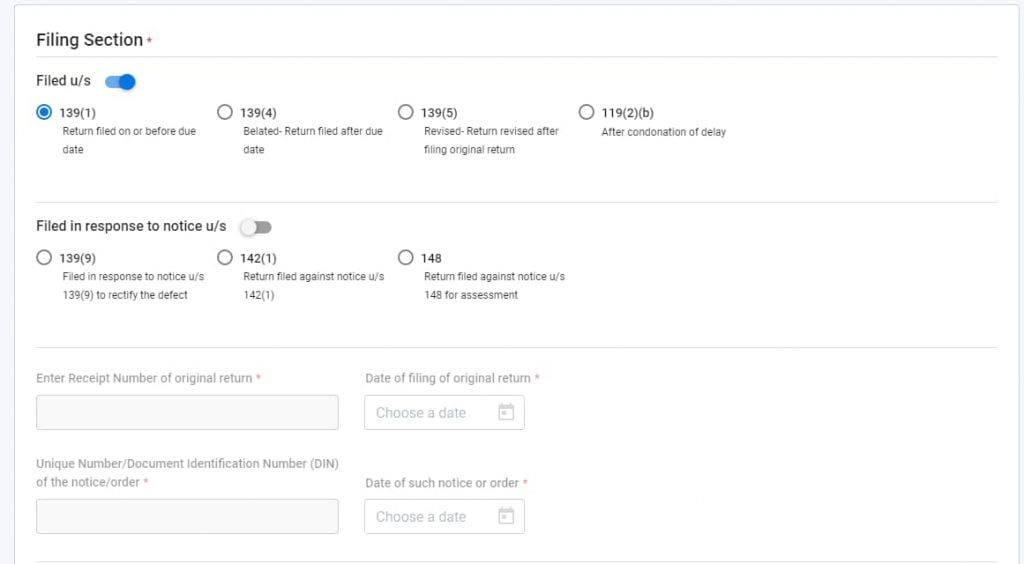

(iii) Select “filed u/s” as 139(1) if this is the original income tax return that you are filing. Otherwise, select the option that applies to you.

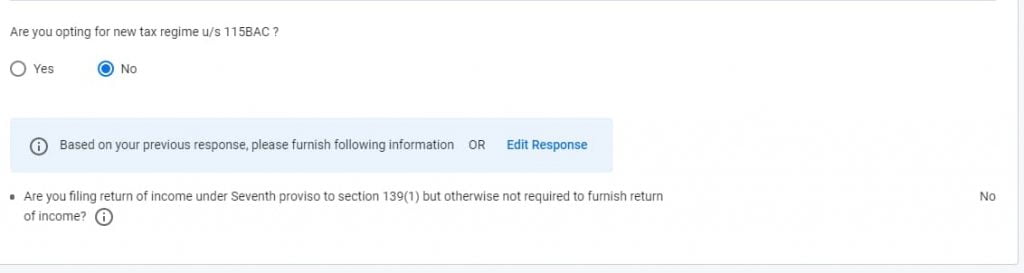

(iv) To opt for New Tax Regime, select Yes and opt for old tax regime .-select ‘No’ in the below field.

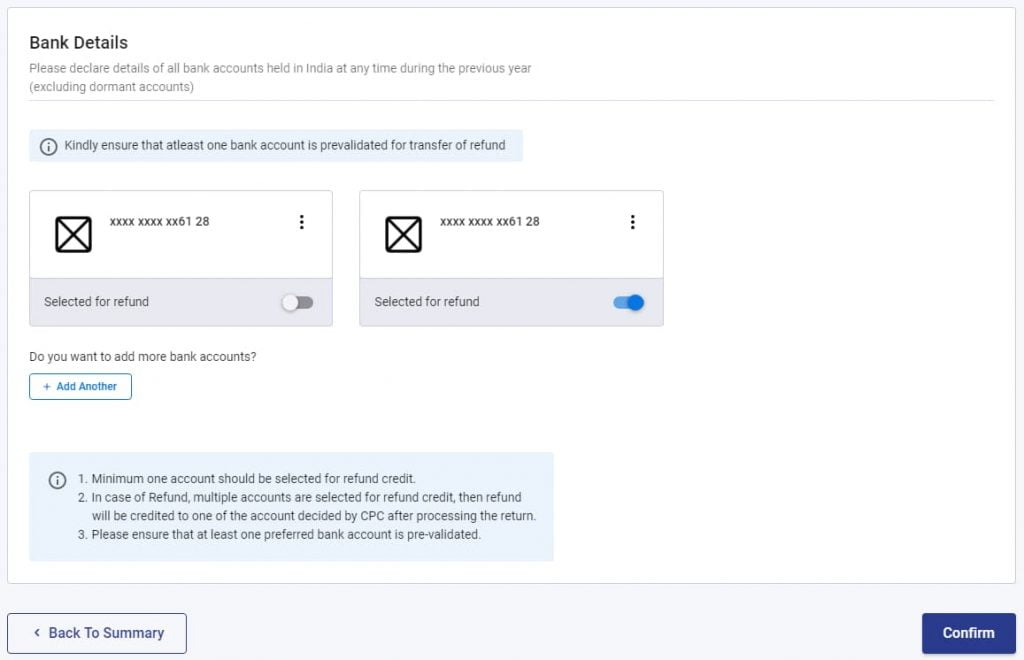

(v) Confirm your bank details by clicking on the button next to Selected for refund. Click on Confirm at the bottom of the page.

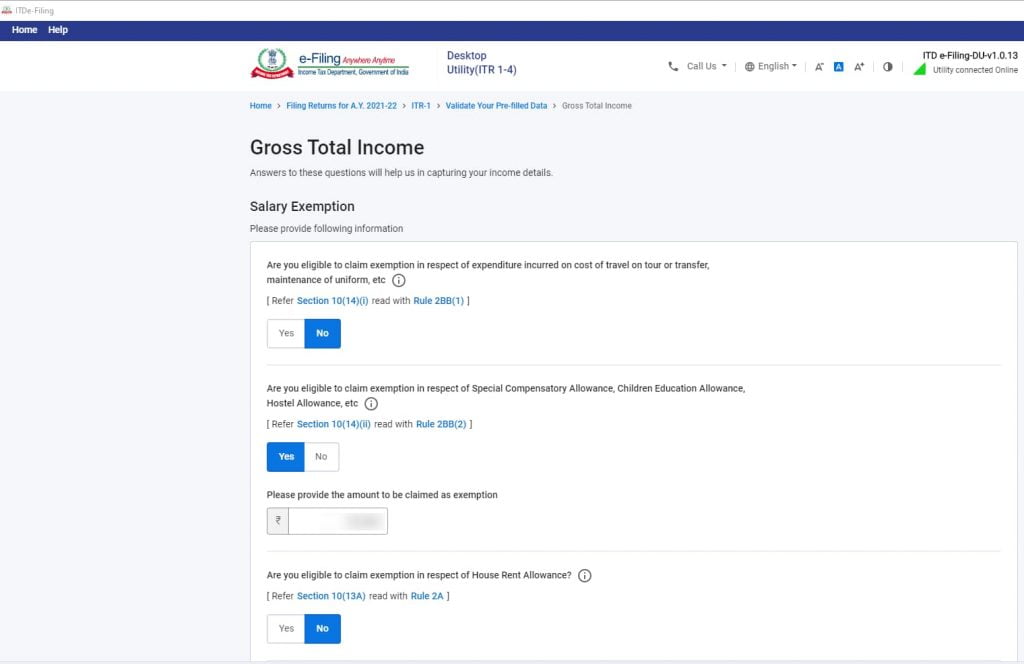

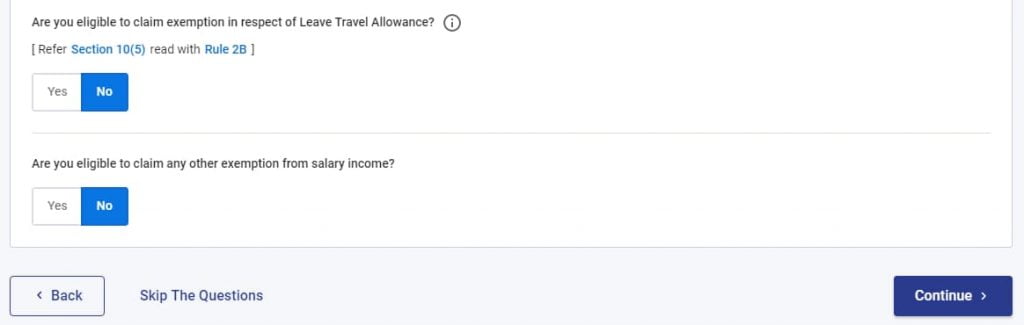

18. Click on Gross Total Income and confirm the details. If you want to claim any tax deductions such as HRA allowance, Leave Travel Allowance and Children Education Allowance, you must select ‘Yes’ corresponding to the specific tax deduction. Click on Continue at the bottom of the page.

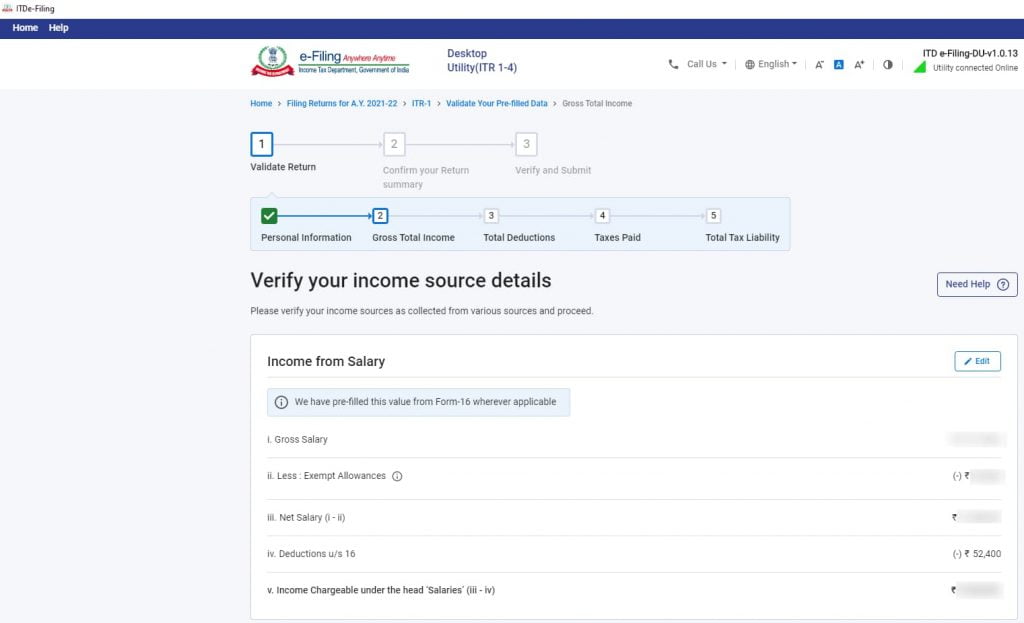

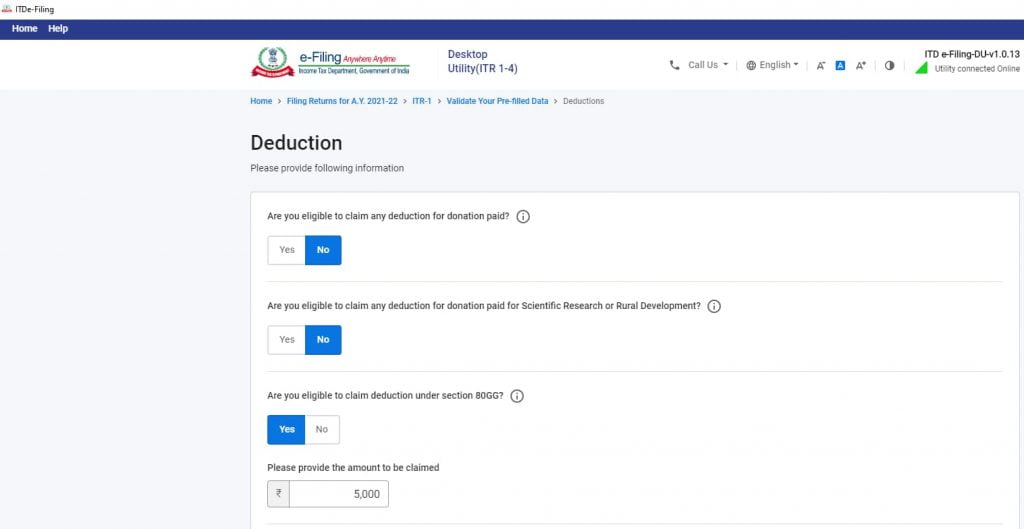

19. The below screen, ” Verify your income source details”, appears once you click continue.

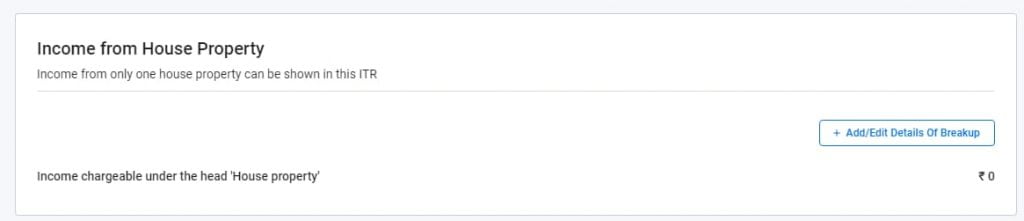

(i) Summary of your Income from Salary reflects. If you want to claim a deduction for Home Loan Interest, you can click on edit and enter the Home Loan Interest amount details.

(ii) If you receive any income from house property, you can click on “Add/ Edit details of Breakup” and enter the income details received from house property.

(iii) If you have received any income exempt from tax, you can click on “Add details” to enter the details of Exempted income. Click on Continue at the bottom of the page.

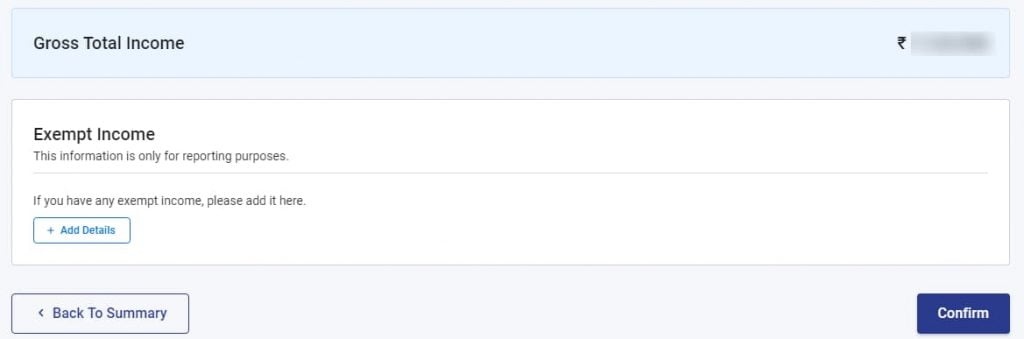

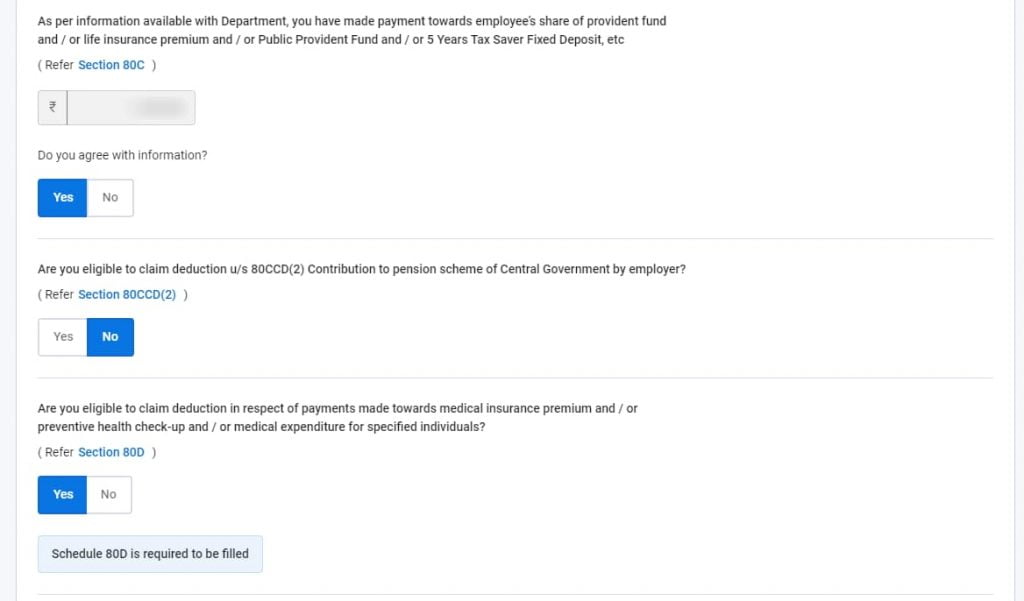

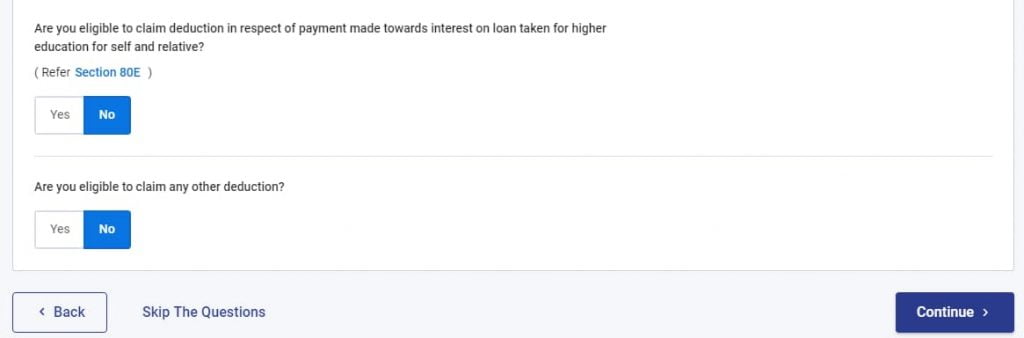

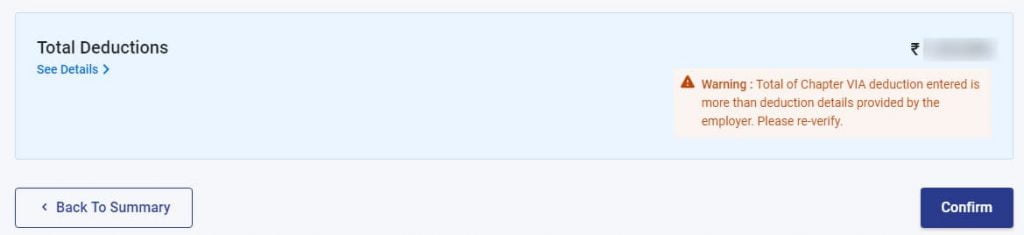

20. Click on Total Deductions. You must click on’ Yes’ corresponding to the specific deduction if you claim any deductions under section 80, such as section 80C, 80D, 80GG, 80E, 80CCD. You must declare the tax deduction under sections 80C and 80GG here itself.

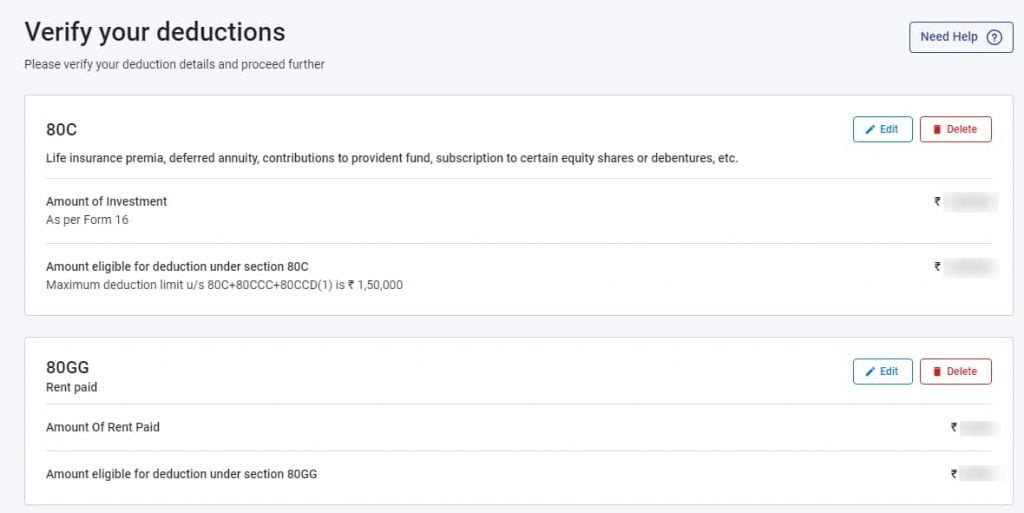

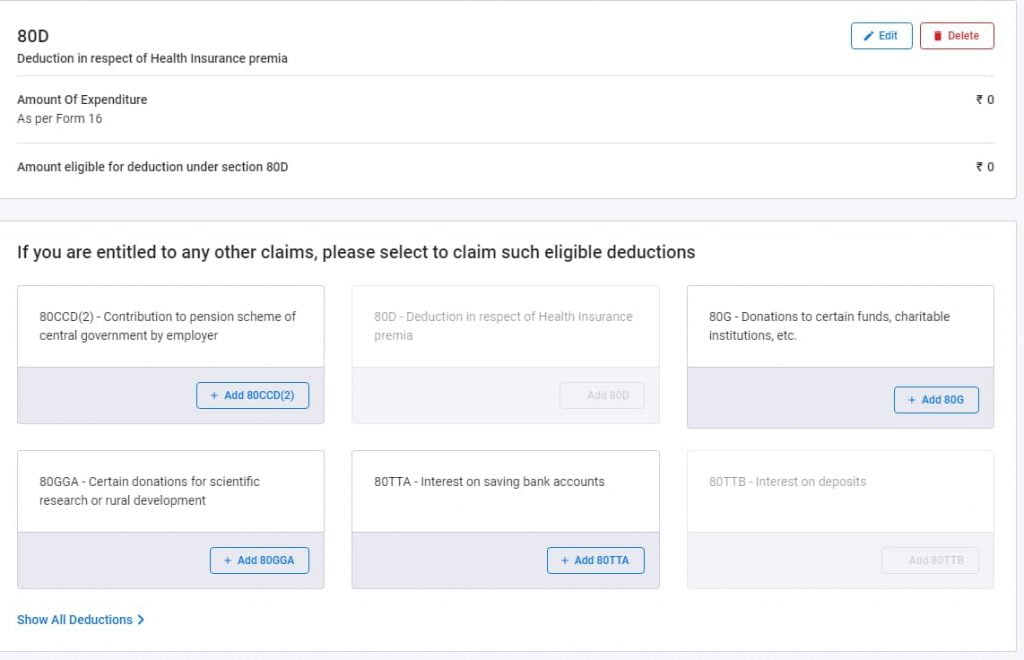

21. You get the below screen ” Verify your deductions” once you click on Continue. You need to fill schedule 80D by clicking on edit. Again if you would like to change the deduction amount under section 80C or 80GG, you can click on edit to do the same. Click on Confirm at the bottom of the page.

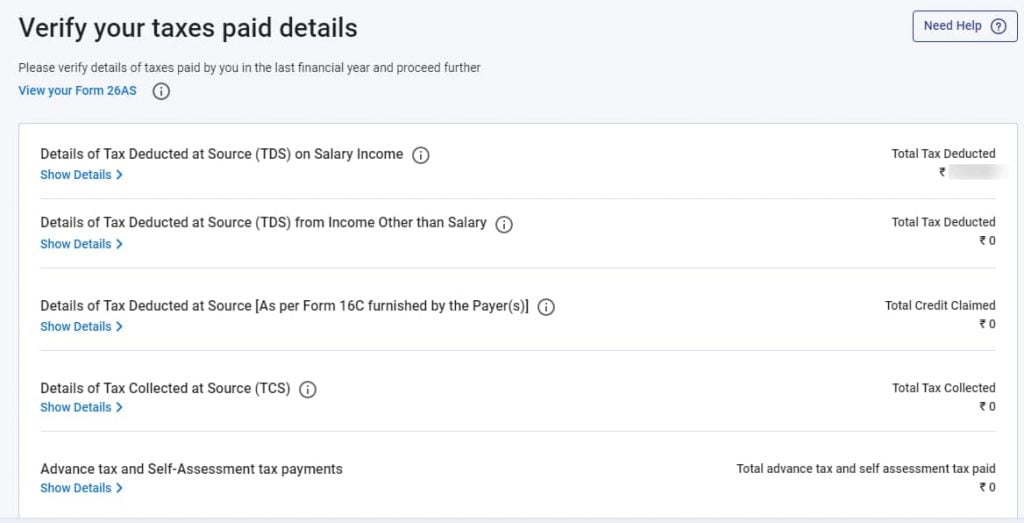

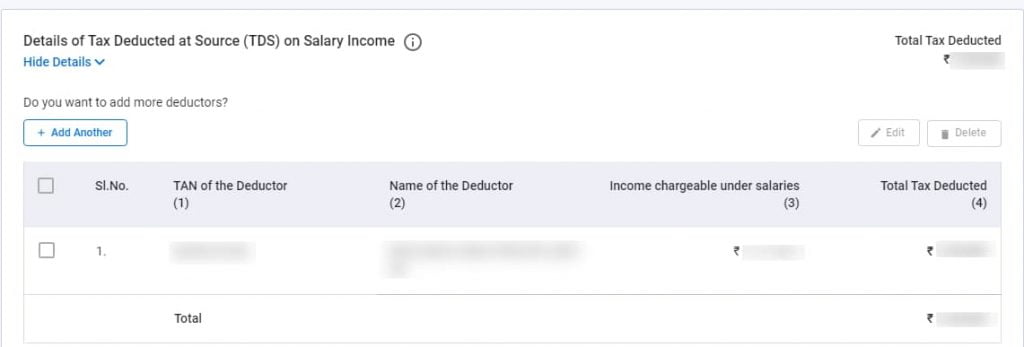

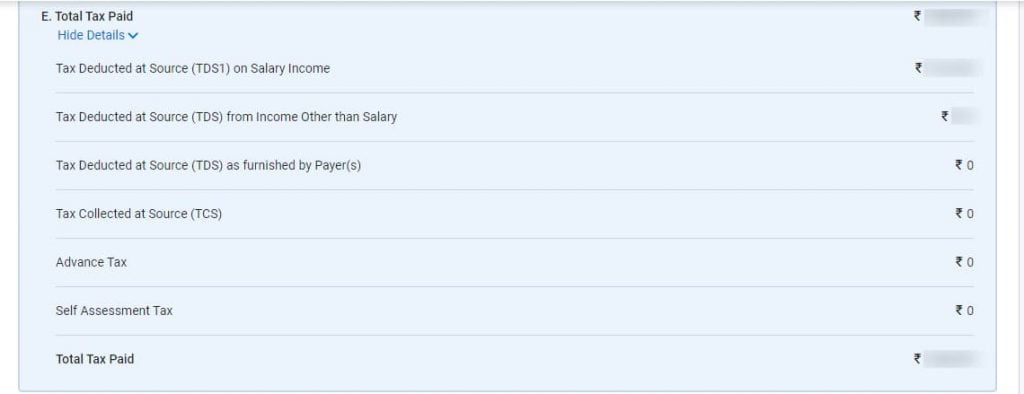

22. Click on Tax Paid and the below screen “Verify your taxes paid details” will appear. Here, you will find the tax deducted at Source on Salary and Dividend if you have invested in shares.

23. Click on Show details to know the TDS details as in the below screen.

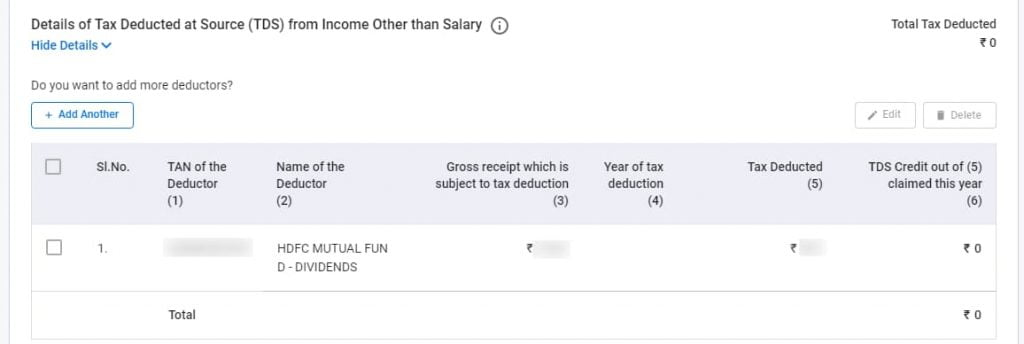

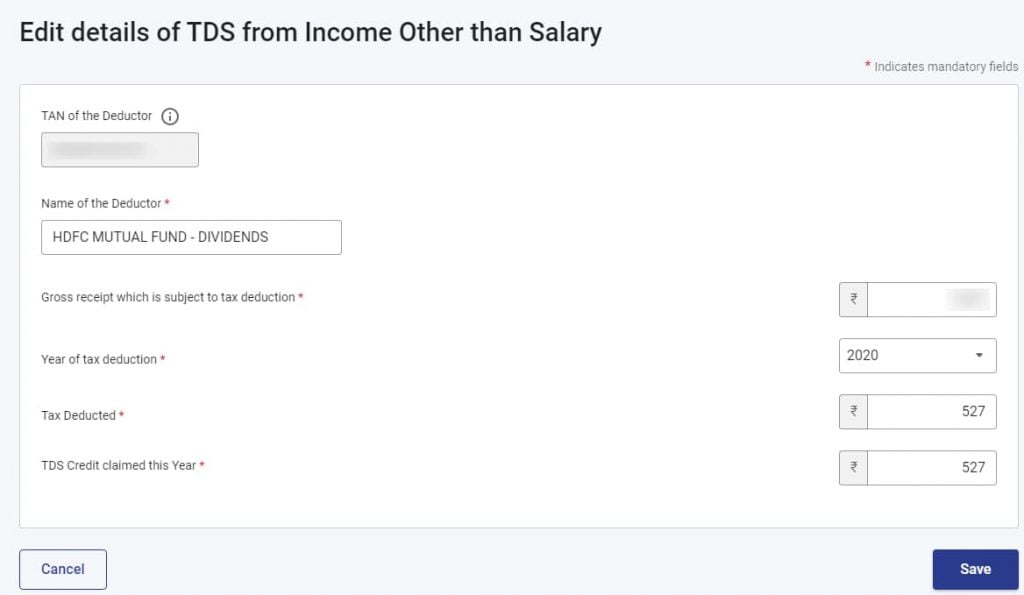

24. If you have any dividend income on which TDS is deducted, you must claim the TDS. Otherwise, it will not reflect as paid by you.

(i) Claim the TDS by editing in the below screen.

(ii) Enter the TDS amount in “TDS Credit claimed this year” to claim your TDS. Otherwise, this TDS amount will not appear as tax paid by you.

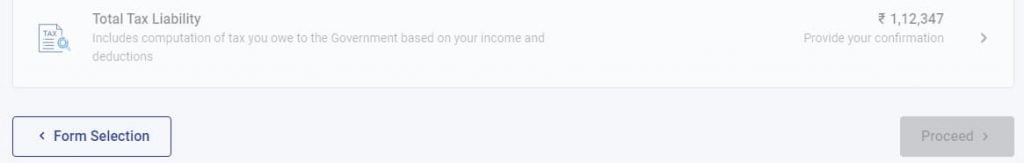

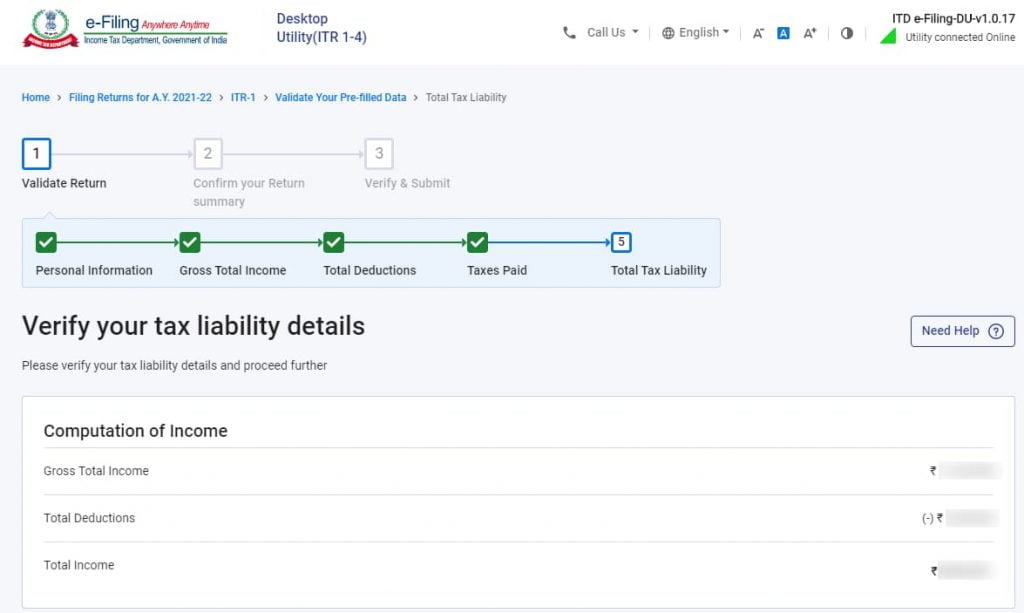

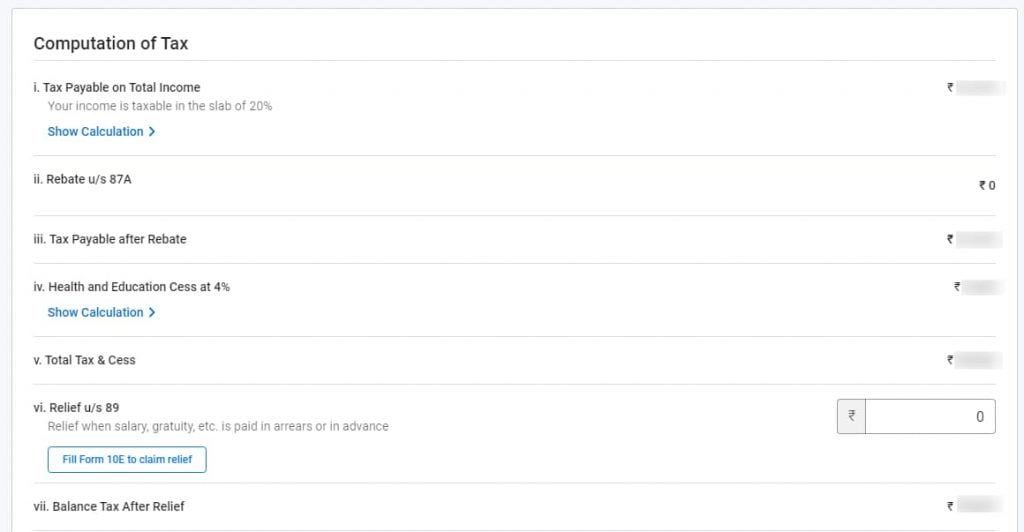

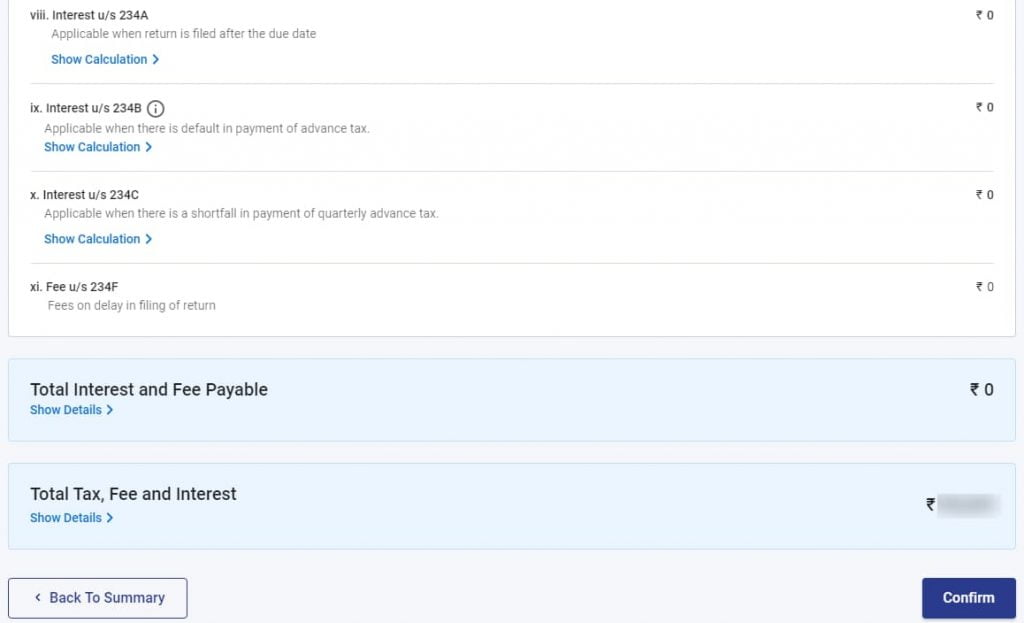

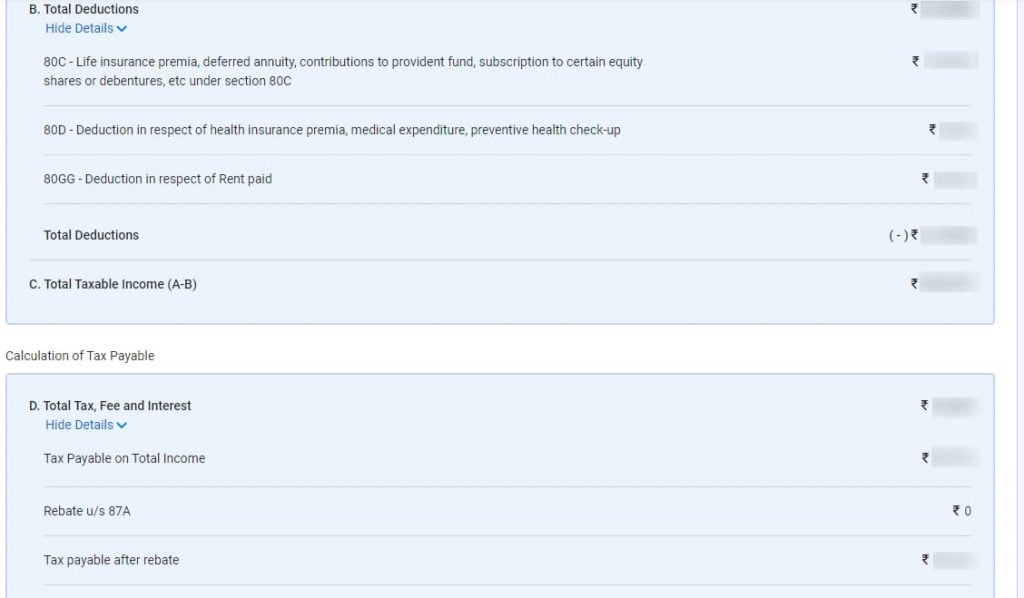

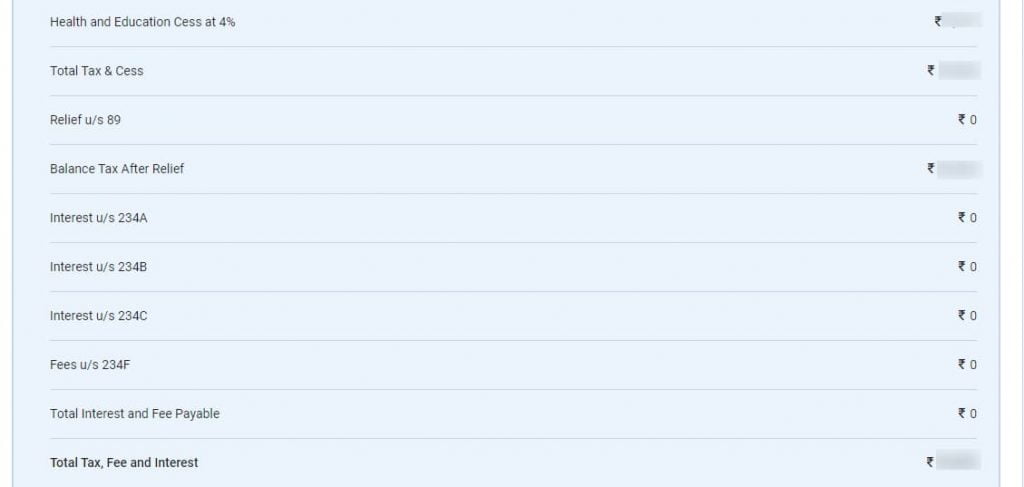

25. Click on Total Tax Liability

The below form shows your total taxable income, tax computation based on the income tax slab that you fall under and Interest or penalty if any. If your total tax liability is less than the tax paid by you, you are eligible for a tax refund. On the other hand, if your total tax liability is more than the tax you pay, you will be required to pay the tax amount to meet your total tax liability.

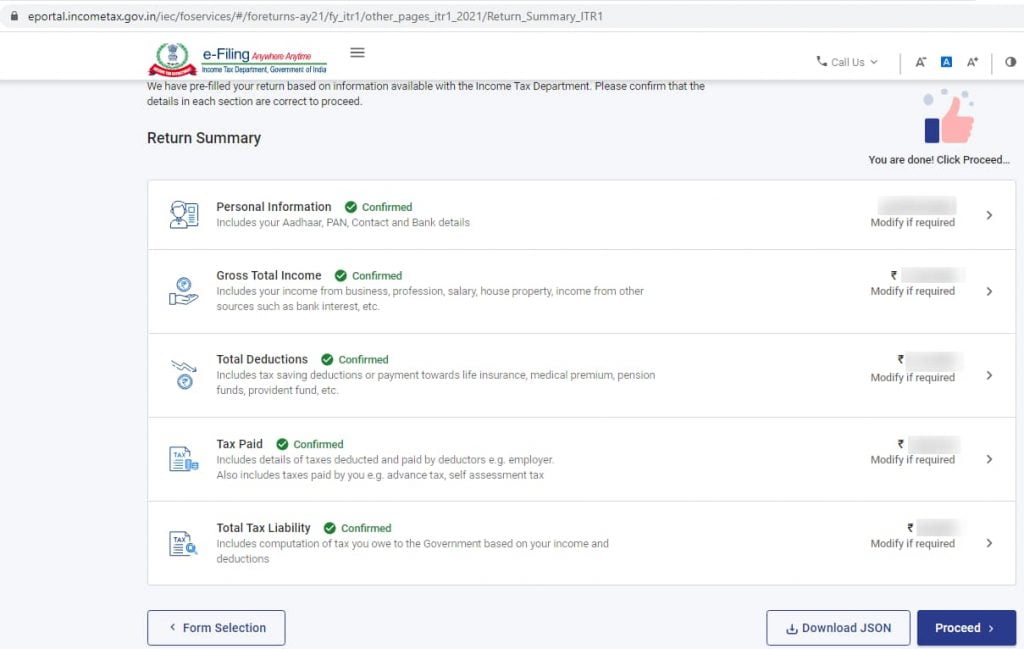

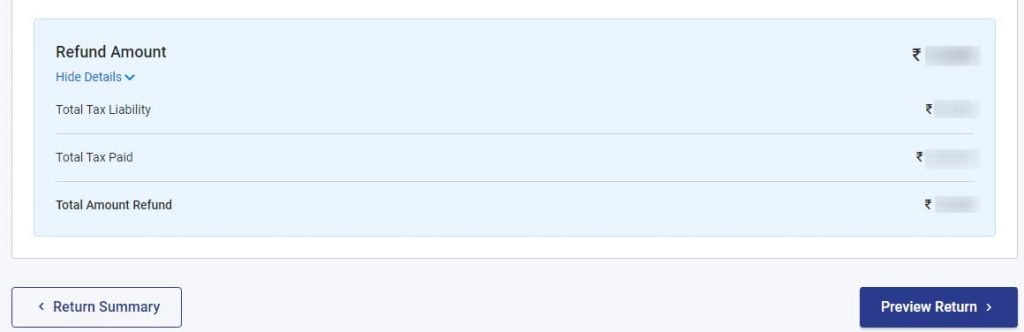

26. Return Summary

Once you have validated all the fields, the Return Summary will reflect as follows. Click on Proceed.

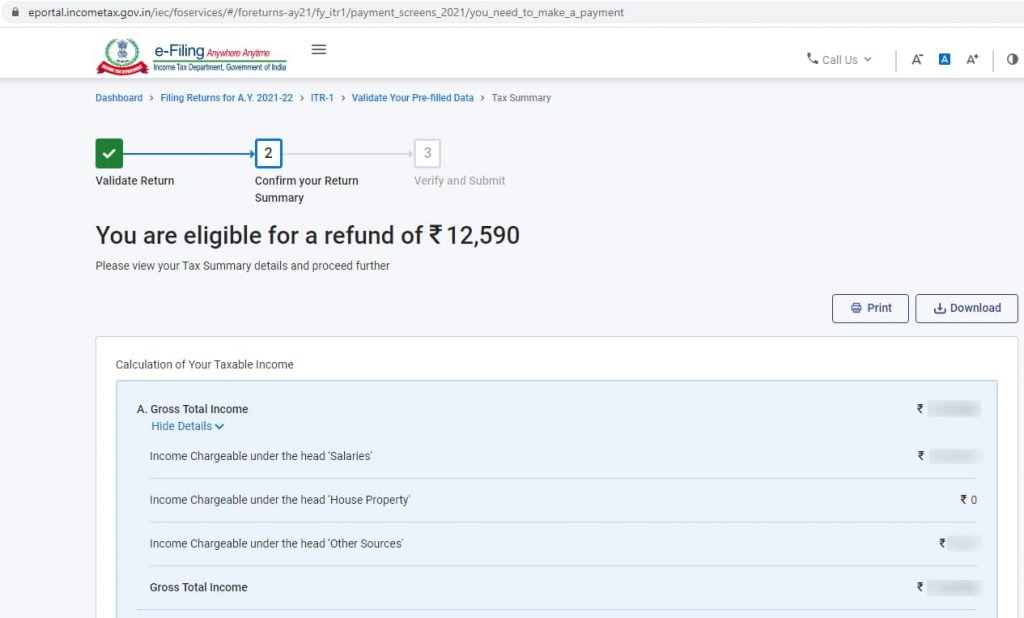

27. Tax Summary

You will see the below screen with details.

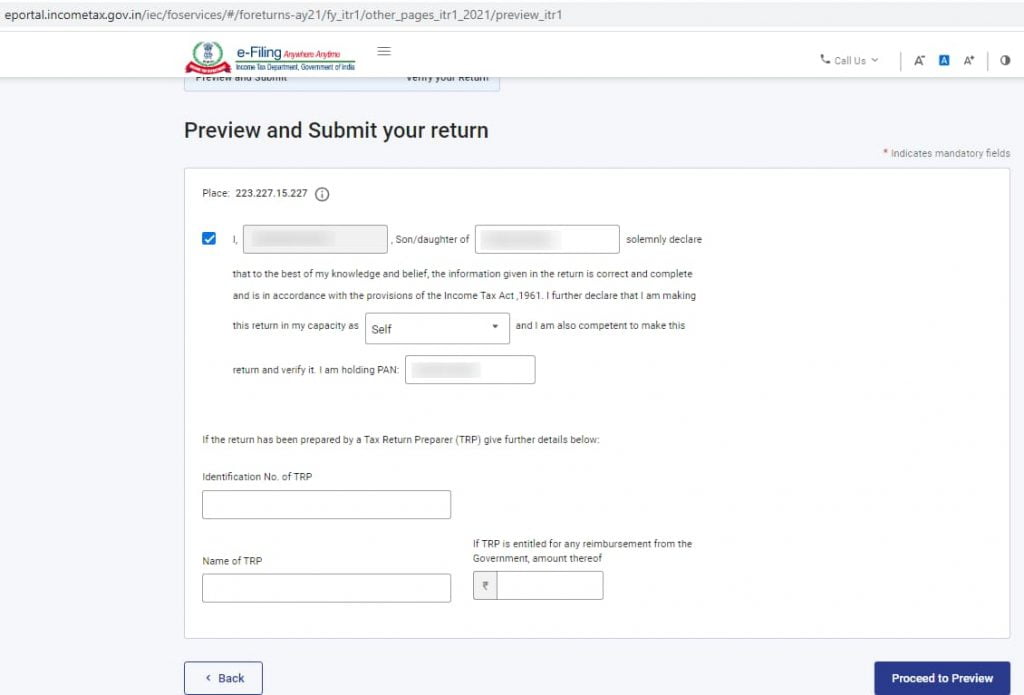

28. Declaration

Click on Preview Return. Once you have validated all the fields, fill in your name, father’s name, place, time and click on “Proceed to Preview” in the Declaration form.

29. Preview and Submit

When clicking Preview and Submit- the tax form is generated with all the details that you just filled in. If you are sure that the details entered are correct, click on “Proceed to Validation”.

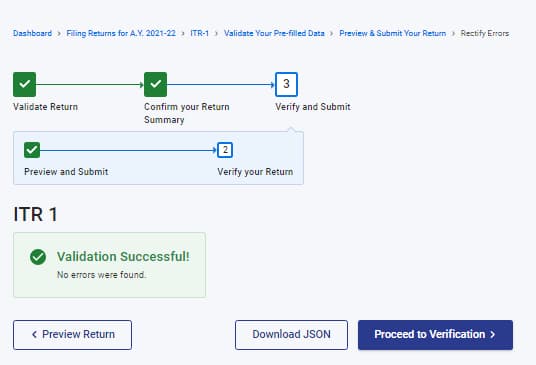

30. Verify and Submit

Now, it will give the message “Validation Successful” if everything is fine. Otherwise, you will get an error message. Then, you must edit the fields that are showing as errors and again try to validate. Once the form is validated, you click on “Proceed to Verification”.

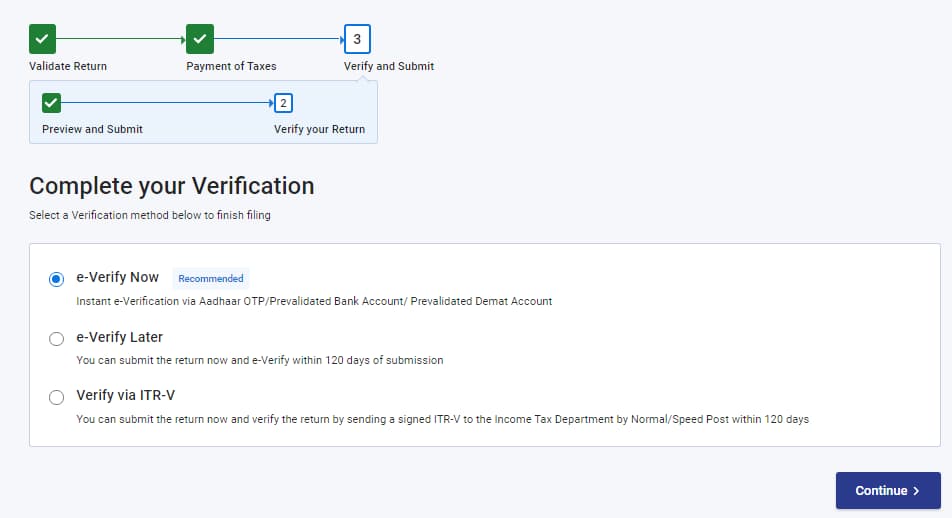

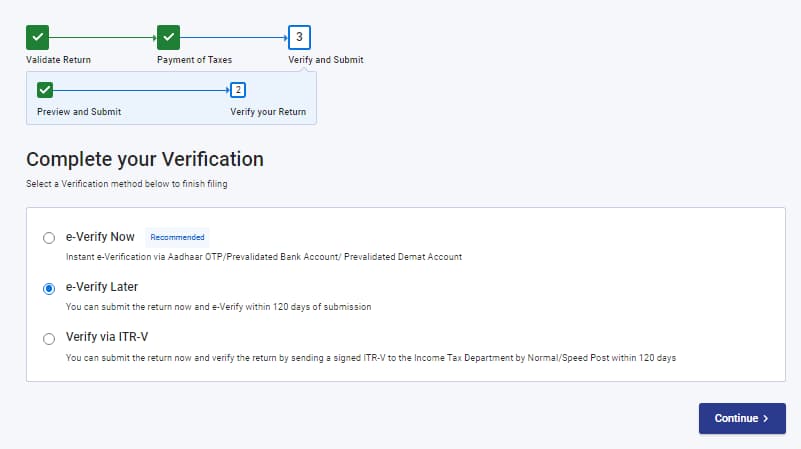

31. Complete your Verification. Select e-verify now or e-verify later and click on Continue.

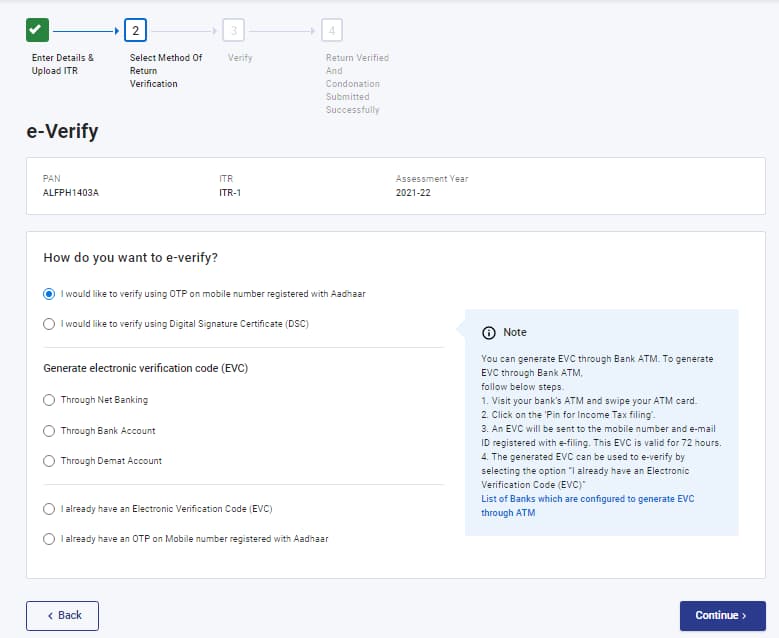

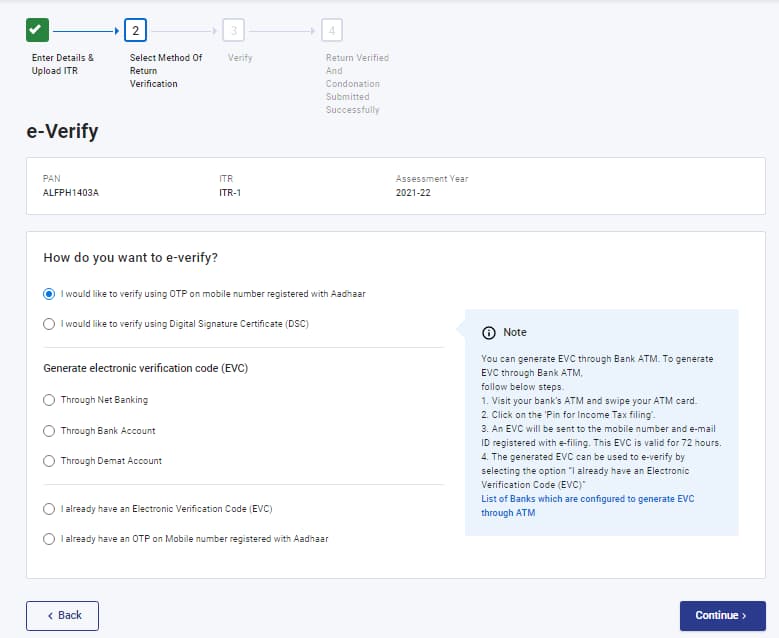

32 E-Verification

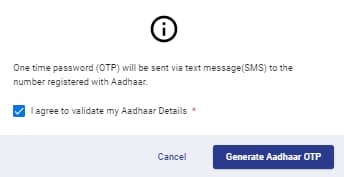

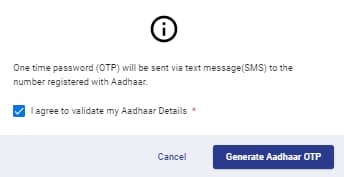

After submitting your income tax return, you must e-verify the same. E-Verification of income tax return may be done electronically through Aadhaar OTP, net banking, Demat account. You can sign it and send it offline to CPC within 120 days of filing your ITR.

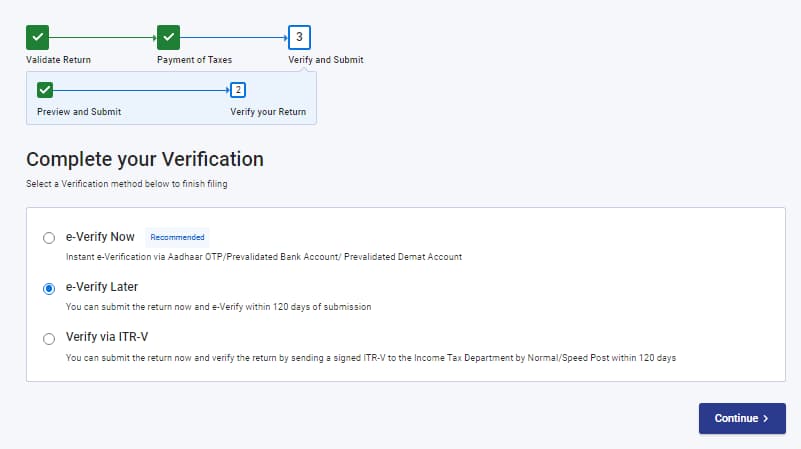

You can either select e-verify later or e-verify now.

(i) e-verify now

(ii) e-verify later

(ii) e-verify later

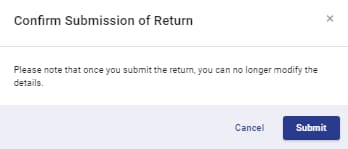

33. Submission of Return

When you select the option “e-verify later”, you will get the below screen. Click on Submit.

You will get the message “ITR Submission Successful”.

If your income tax return is filed successfully, you will receive an intimation of the same on SMS and your registered email id.

Faqs

(1) Is it mandatory for a salaried employee to file an income tax return?

If you are a salaried employee with an income above Rs 2,50,000 per annum it is mandatory to file an income tax return. On the other hand, if your salary is less than Rs 2,50,000, it is not mandatory. Income below Rs 2,50,000 is exempt from income tax.

(2) How to file income tax return for salaried employee?

Visit the official income tax website https://www.incometax.gov.in/iec/foportal and file your ITR either online or offline.

(3) Which ITR form should a salaried person use to file the income tax return?

If you are a salaried employee with an income below Rs 50 lakhs must use form ITR-1 to file your income tax return.

(4) What will happen if I do not file my income tax return?

If you are a salaried employee who wants to claim any refund for the taxes paid then it is possible only if you file your income tax return. Furthermore, if you have any tax liability and you do not file your ITR, the IT department will send you a notice. Also, the interest on nonpayment of tax will accumulate till the time you pay your taxes. It becomes critical when you are required to pay taxes to the government.

(5)Which ITR to file for salary?

If your income from salary is below Rs 50 lakhs, you need to use form ITR-1 to file your returns. And if your salary is above Rs 50 lakhs, you need to use form ITR-2 to file your returns.