80TTB Deduction is a tax deduction given to senior citizens on the interest earned. The interest may be in the form of interest on a savings account or fixed deposits. The maximum amount of Deduction under section 80TTB is Rs 50,000.

Table of Contents

Key Points

| – 80TTB Deduction for AY 2022-23 limit is Rs 50,000. |

| – Only Senior citizens are eligible to claim the deduction. |

| – Deduction is available only on Interest income. |

| – You can claim deduction on Fixed deposits, Savings Accounts, Post-office deposits and Cooperative society deposits. |

| – You must be an Indian citizen. |

What is 80TTB in Income tax?

Section 80TTB of income tax act is a tax deduction provided to Senior citizens. 80TTB Deduction was announced in the Budget 2018 to provide a tax benefit to senior citizens.

80TTB Deduction for AY 2022-23

As per the Income Tax Act, 1961, the 80TTB limit for AY 2022-23 is Rs 50,000

80TTB Deduction for AY 2021-22

As per the Income Tax Act, 1961, the 80TTB limit for AY 2021-22 is Rs 50,000

Type of Accounts Eligible for 80TTB Deduction

You can avail of a tax deduction on the below type of accounts:

- Interest on Fixed Deposits.

- Interest on Savings Account.

- Interest on Recurring Deposits.

- Interest on Post office deposits.

- Interest on Cooperative society deposits.

Who can Claim 80TTB Deduction?

Only senior citizens who are residents of India can take the benefit from the 80TTB Deduction. If you are below 60 years, you can avail of a tax deduction on the interest income from certain accounts under section 80TTA.

Who Cannot Claim 80TTB Deduction?

You are not eligible to claim an 80TTB deduction if

- You are not a resident of India.

- You are not a senior citizen.

- The interest income is earned on behalf of a firm, Association.

- You are an NRI.

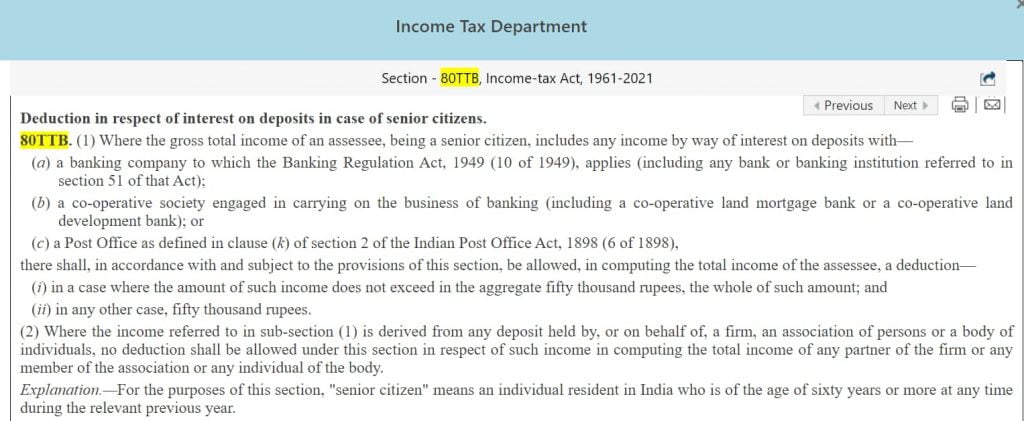

Section 80TTB of Income Tax Act Extract

How to Claim 80TTB Deduction?

Below are the steps to claim deduction under section 80TTB:

1.Login to the new income tax portal.

2.Go to e-file>Income Tax Returns>File Income Tax Return.

3. In the below screen, select the current assessment year and the mode of filing as online. Click on Continue at the bottom.

4. Select Individual as the status and click on continue.

5. Select form ITR-1 and click on proceed with ITR-1.

6. Click on Let’s Get Started.

7. Select the 1st option “Taxable income is more than basic exemption limit” and click Continue.

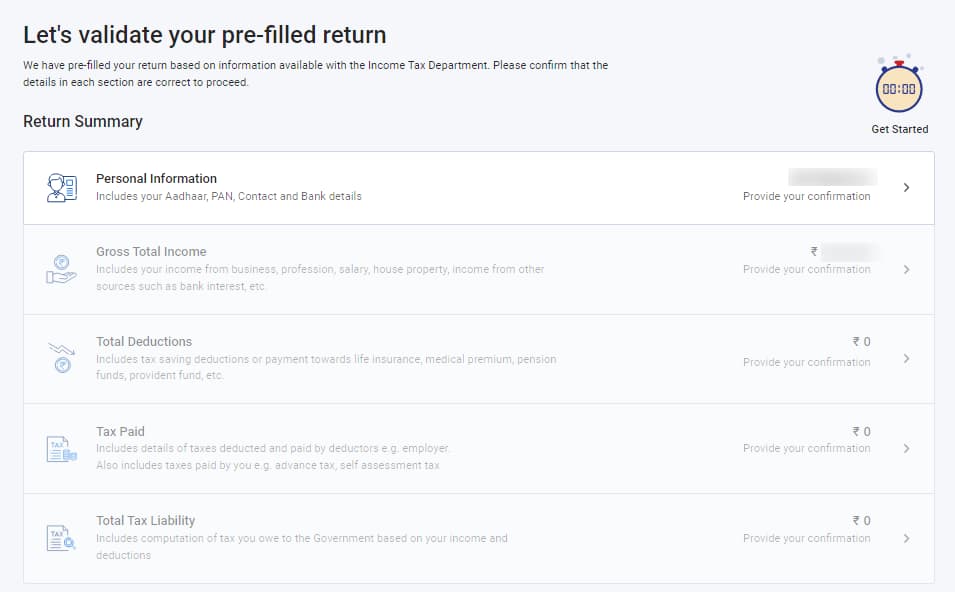

8. Your data will auto-populate according to form 16. To file your income tax return you must confirm all the fields such as Personal Information, Gross Total Income, Total Deductions, Tax paid, Total tax Liability.

9. For the purpose of this article, we see in detail Total Deductions

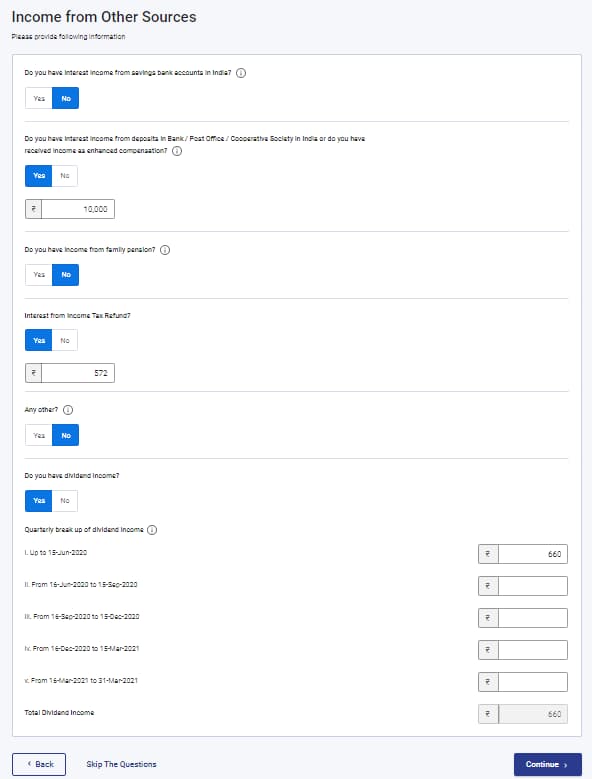

To claim deduction under section 80TTB, you must first declare your interest income under the head “Income from Other Sources”. Secondly, you must enter the interest amount in Deductions under section 80TTB.

We will see the first step below

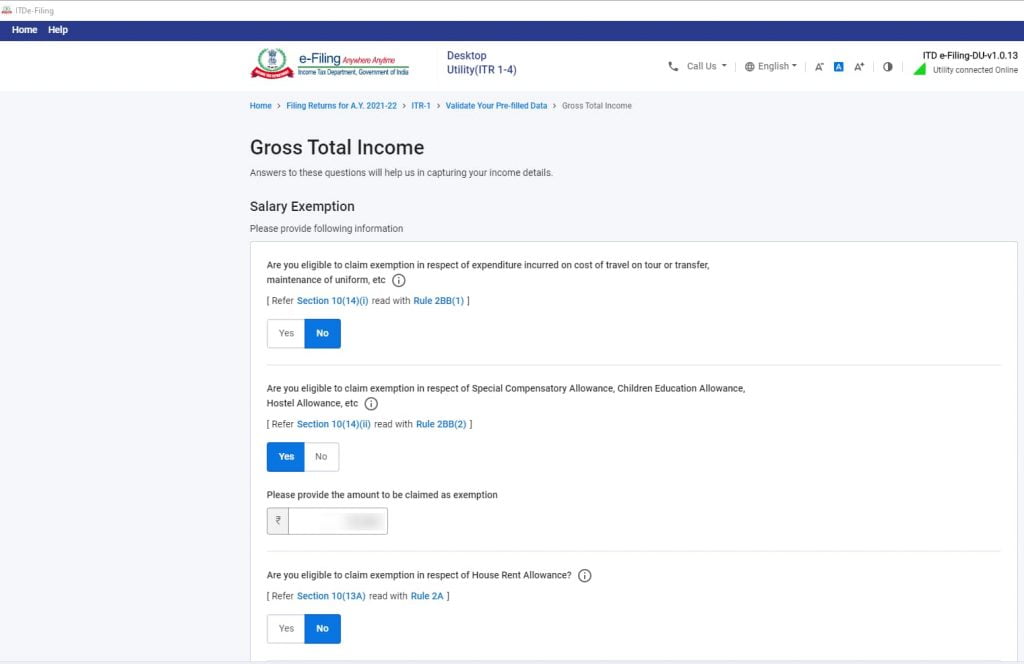

(5) For the purpose of this article we shall be seeing in detail ” Total Deductions”. To claim an 80TTB deduction, firstly you must declare Interest income under the head “Income from Other Sources”. We will see how to do that. Click on Gross Total Income, check the options applicable to you and click on continue. Below is an example of a typical Gross Total Income.

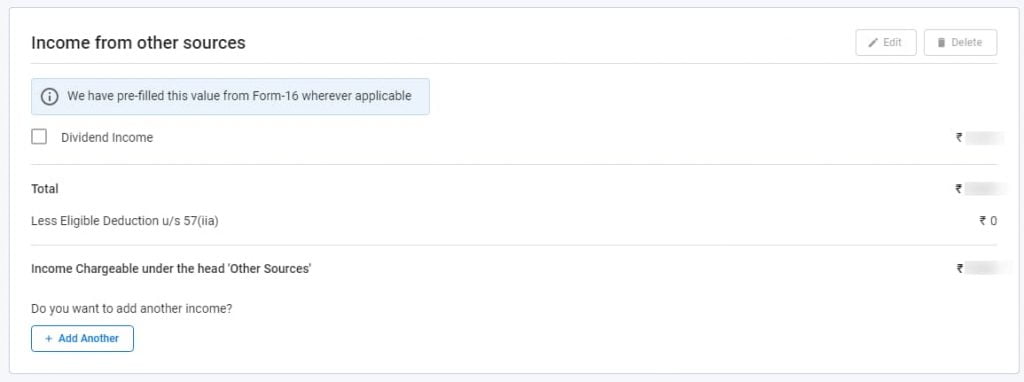

(6) Once you confirm you will get the screen with details under the heads “Income from Salary”, Income from House Property”, “Income from Other Sources” and “Exempt Income”.

(7) Click on Add Another in the above screen and the below details will appear. Here you must declare your total interest income from your savings bank account. Select “yes” on the one applicable to you, enter the amount and click on continue.

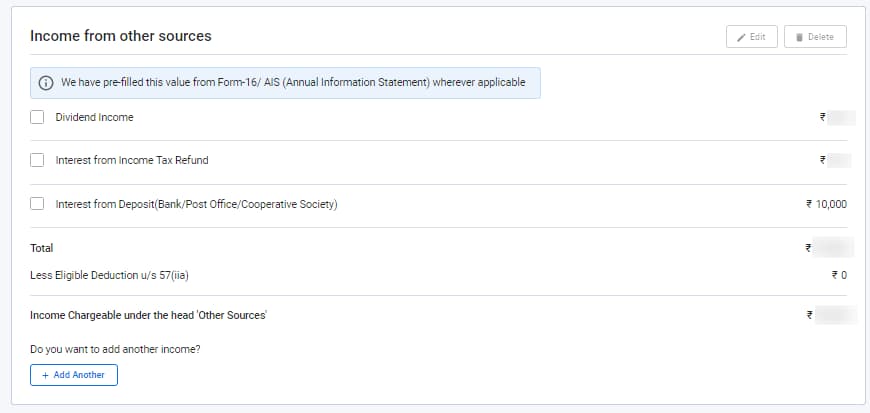

(8) It will reflect as below. Click on confirm.

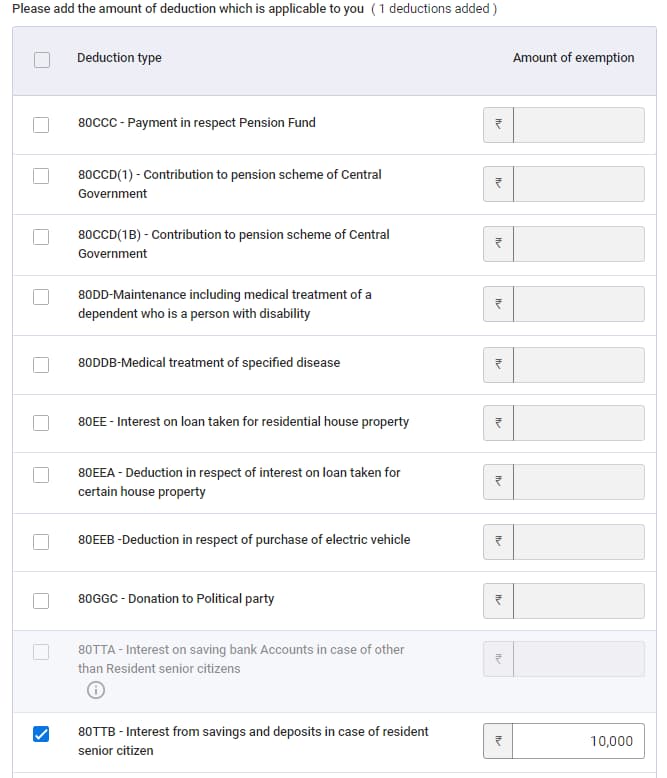

(9) Now click on Total Deductions. Scroll down to the option ” Are you eligible to claim any deduction”

Note that you will get a warning message. Just ignore that and click on Continue.

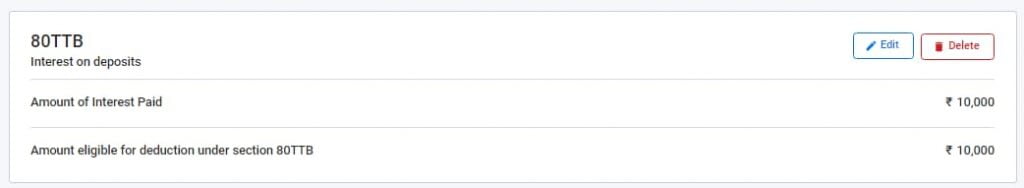

(10) You can see the 80TTB deduction under Verify your deductions along with other deductions. You may edit if you like.

Note:

(1) Without showing interest income under Income from other sources, you will not be able to claim the deduction.

(2) 80TTB Deduction will be greyed out if you are not a senior citizen as only senior citizens are eligible to avail of tax deduction under this section.

Difference between 80TTB and 80TTA

| 80TTB Deduction | 80TTA Deduction |

| – Deduction is available on all types of accounts including fixed deposits. | – Deduction is available only on the Savings account. |

| – Only Senior citizens can claim. | – Only individuals below 60 years and HUFs can claim. |

| – Maximum limit is Rs 50,000. | – Maximum limit is Rs 10,000. |

| – Only Indian citizens can avail of this tax deduction. | -NRIs and Indian citizens can avail of this tax deduction. |

FAQs

(1) Does 80TTB include both Savings account and Fixed Deposits?

Yes, You can claim interest income earned from Savings accounts and Fixed deposits.

(2) Can senior citizen claim both 80TTA & 80TTB?

Senior citizens can claim deduction only under section 80TTB. And individuals below 60 years can claim deduction only under section 80TTA.

(3) Are term deposits eligible for 80TTB deduction?

Yes, you can avail of an 80TTB deduction on all types of term deposits.

(4) I am a partner in a firm and a senior citizen. So, can I claim tax deduction under section 80TTB?

You can claim deduction under 80TTB only on the interest earned on the deposits held by you individually. Deduction under section 80TTB is not allowed for any deposits held on behalf of the partnership firm.

(5)Who cannot claim 80TTB?

Resident individuals below 60 years and non-resident senior citizens cannot claim tax deductions under section 80TTB.

(6) Is 80TTB applicable in the new regime?

You cannot claim tax deduction under section 80TTB in new tax regime as you will be paying tax at a concessional rate under the new regime.

(7) How do I claim 80TTB deduction in ITR?

Firstly, you must declare your total interest income from your savings bank account in the ITR form. Then, select 80TTB under the Deductions to claim an 80TTB deduction.

(8) Is FD interest tax free for senior citizens?

Fixed Deposit Interest is exempt up to INR 50,000 for senior citizens under section 80TTB.

In a nutshell, 80TTB deduction for AY 2022-23 can be claimed only by senior citizens and super senior citizens on interest earned on any type of account.