80GG Deduction of the income tax act is one of the tax deductions you can claim for the rent paid by you. In this article, we shall see the eligibility criteria to claim Deduction under section 80GG, the maximum limit allowed and how to claim.

Table of Contents

What is 80GG Deduction?

80GG Deduction is one of the deductions allowed under Chapter VI-A of the Income-tax Act to the taxpayer to enjoy the tax benefit for the rent paid. The accommodation may be furnished or unfurnished. However, there are specific eligibility criteria or conditions to avail of this tax deduction.

Eligibility to Avail Deduction under Section 80GG

You are eligible to claim income tax deduction under section 80GG if you satisfy the below criteria.

- You are a salaried person but there is no HRA component in your pay slip.

- You are a salaried person who is not availing House Rent Allowance (HRA) under section 10(13).

- You run your own business.

- You or your spouse should not own any residential accommodation at the place where you currently live.

- You should not be receiving rental income from owning a property anywhere else.

Now that we have seen who is eligible to claim the Deduction under section 80GG, we will calculate the 80GG amount.

80GG Calculation

You can claim least of the below three amounts:

- Rental expenses of Rs 5,000 per month

- 25% of your gross total income before tax deduction.

- Actual rent paid by you less 10% of adjusted total income.

Example of 80GG Deduction for AY 2020-21 Calculation

Let’s see an example to understand how to calculate the 80GG amount.

Suppose Rahul earns Rs 8,00,000 per year and pays a monthly rent of Rs 10,000. He also has a tax deduction of Rs 1,50,000 under section 80C and Rs 5,000 under section 80D.

We will see the conditions:

(1) Rs 5,000 per month

That is 5,000 x 12= Rs 60,000

(2) 25% of gross total income

That is 25% X 8,00,000= Rs 2,00,000

(3) Actual rent paid less 10% of gross total income

That is Actual rent= Rs 15,000 x12=1,80,000

10% of total income= Rs 10% X 8,00,000= Rs 80,000

So as per condition: 1,80,000-80,000= Rs 100,000

We find that the 1st option Rs 60,000 is the least amount. So, the maximum amount pf deduction that can be claimed under section 80GG is Rs 60,000 in this case.

How to Claim 80GG Deduction?

To claim a deduction under section 80GG, firstly, you need to fill the form 10BA online before filing your income tax return. Also, you need to declare the deduction amount while filing your income tax return.

Let’s quickly see how to fill form 10BA

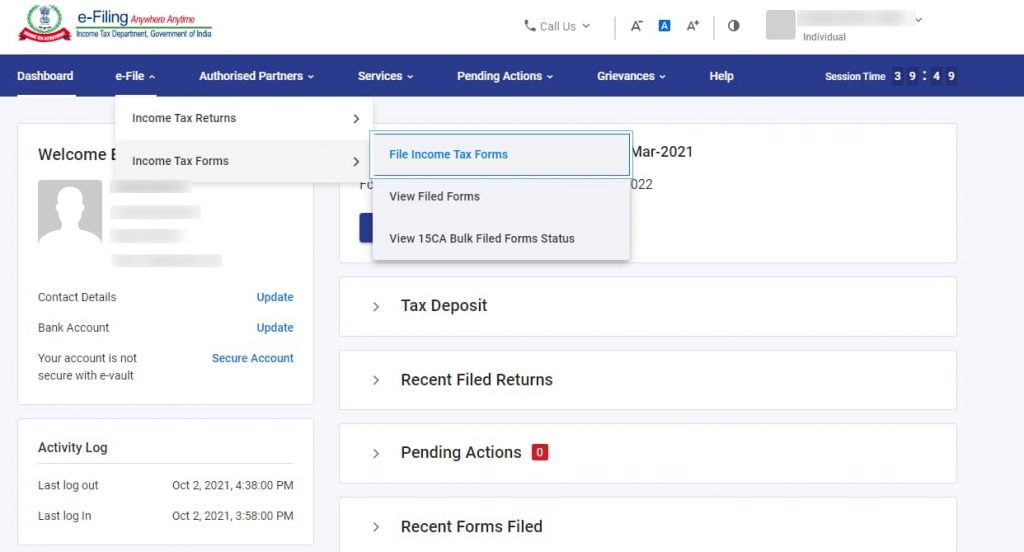

- Go to the new income tax portal https://eportal.incometax.gov.in/iec/foservices/#/login

Login with your credential, and then under the drop-down of e-file, select income tax forms> file income tax forms.

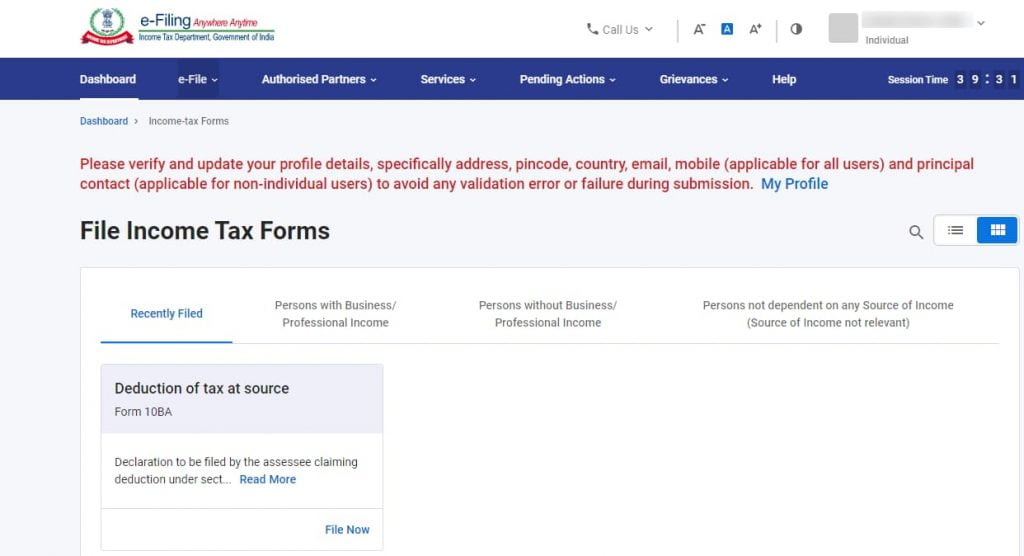

2. Once you select file income tax forms, you will see the below screen. Click on File now.

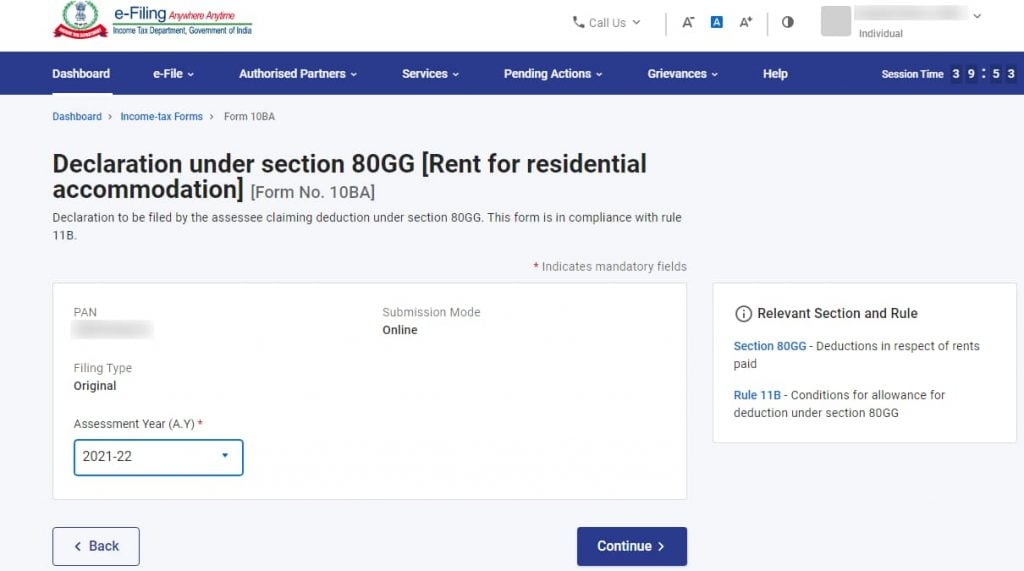

3. In the below screen, your PAN number will reflect. Select the current assessment year 2021-22 from the drop-down and click on continue.

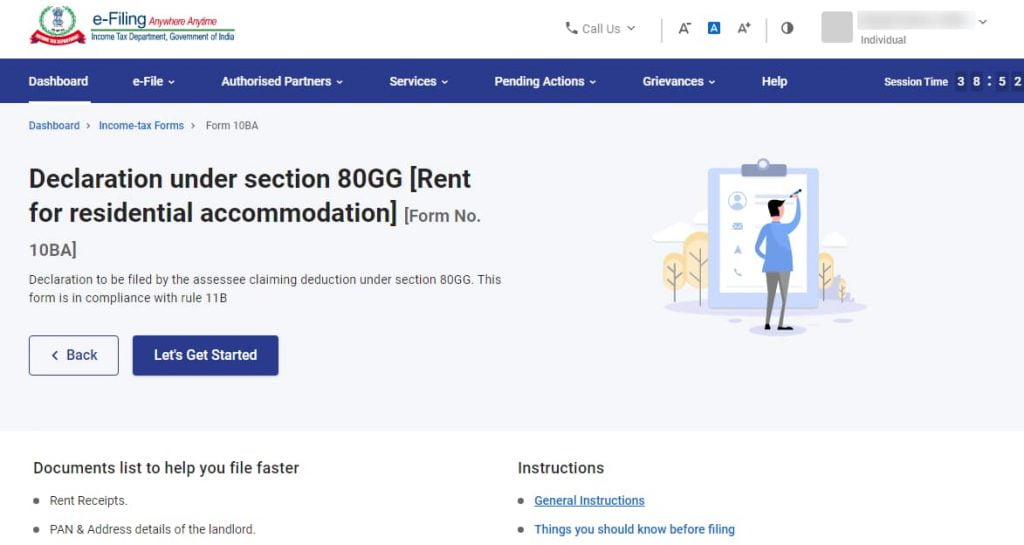

4. You will reach the below screen. Click on Let’s get started.

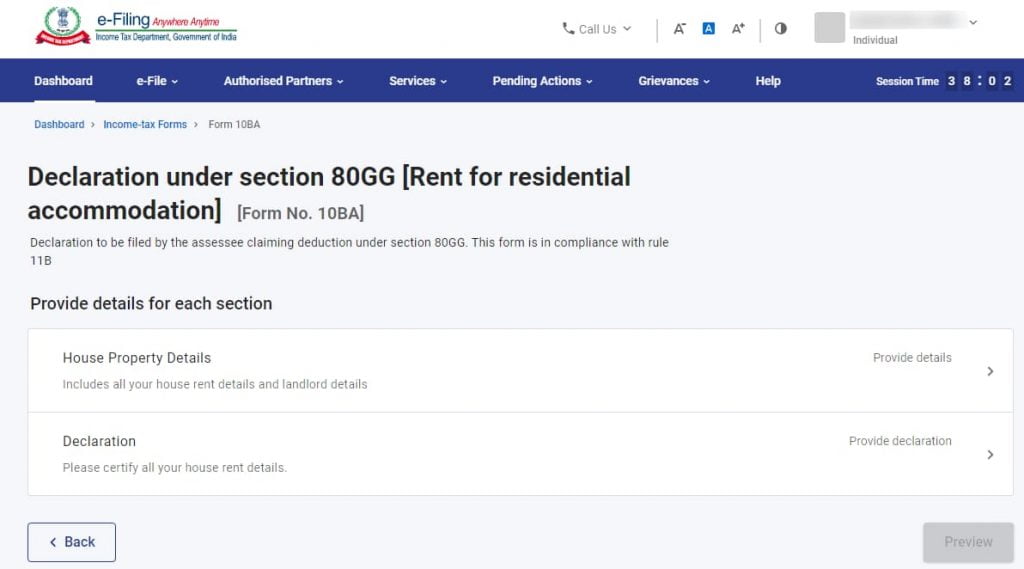

5. The below screen will reflect with two sections, namely House Property Details and Declaration. Firstly click on House Property Details.

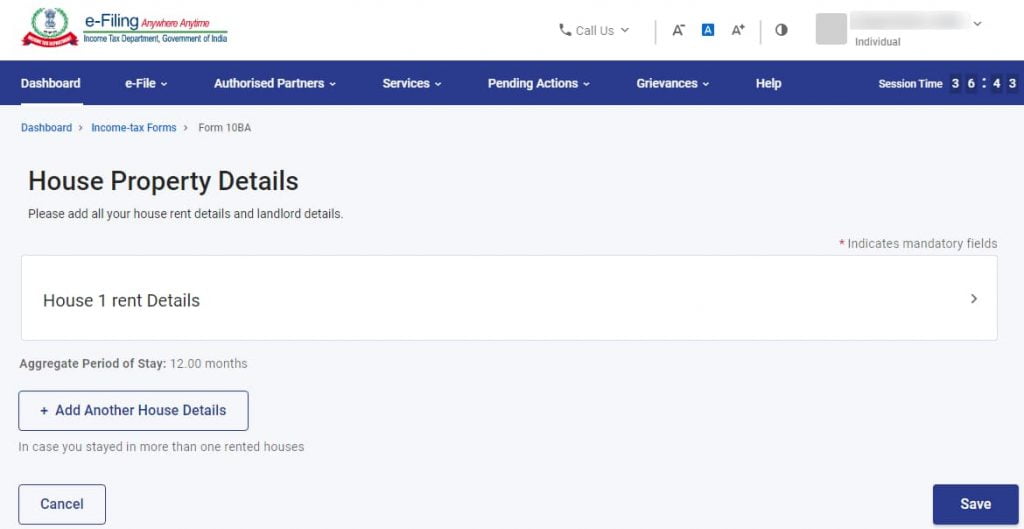

6. You will see the below screen. If you rented only one house for the entire financial year 2020-21, then click on House 1 rent details and start entering the details. On the other hand, if you rented two or more houses, click add another house details.

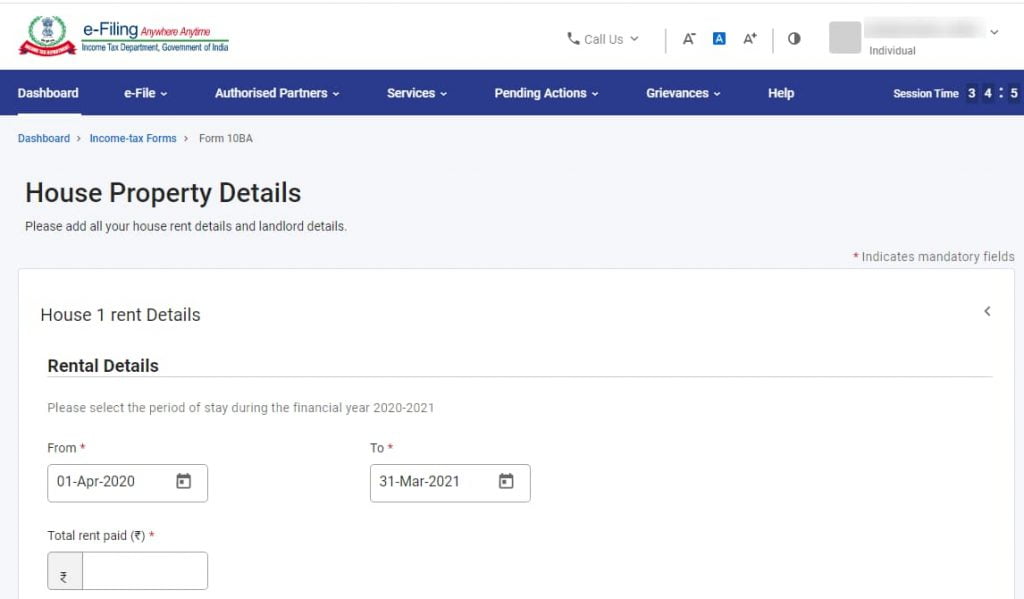

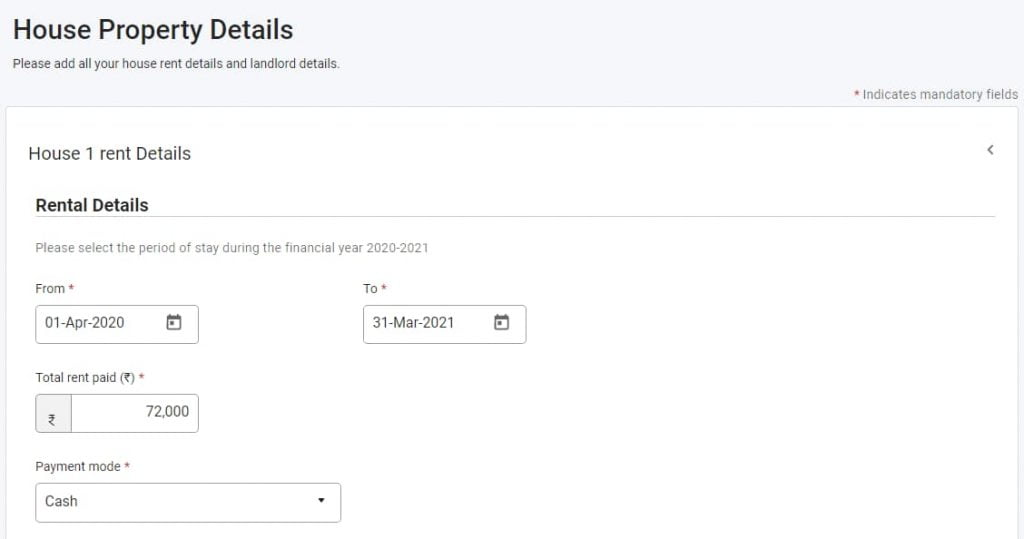

7. When you click on House 1 rent details, you will see the below screen. Ensure that the current financial year that is 1st April 2020 to 31st March 2021 is selected.

8. Enter total rent paid for the financial year and the mode of payment.

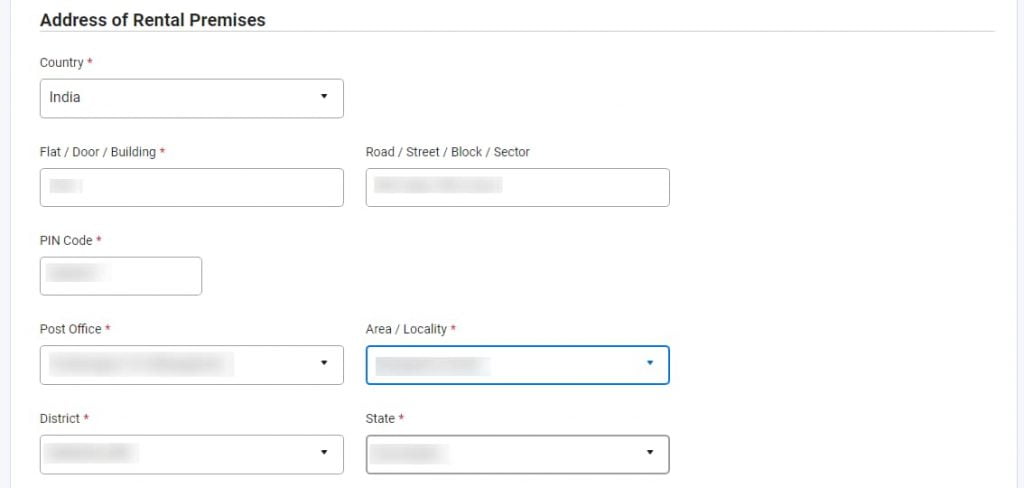

9. Enter the address of your rental accommodation.

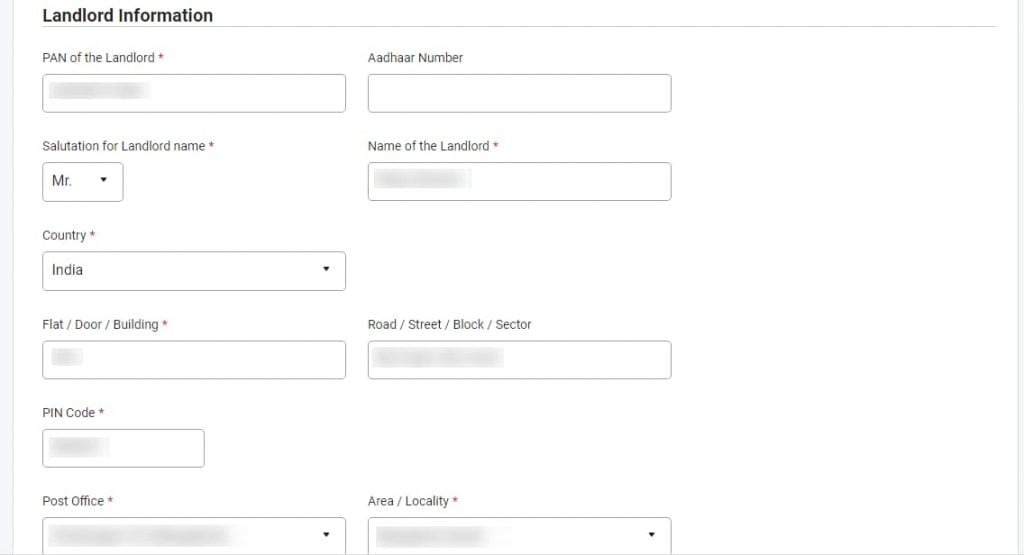

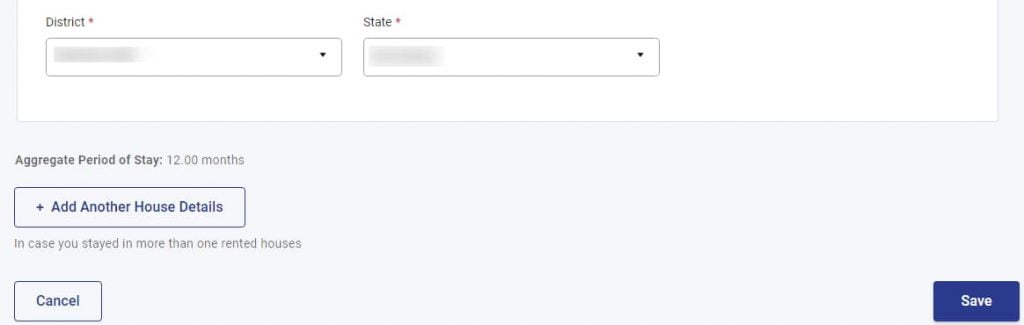

10. Enter the mandatory details of your Landlord, such as PAN card, Name and Address. Then click on Save at the bottom of the page.

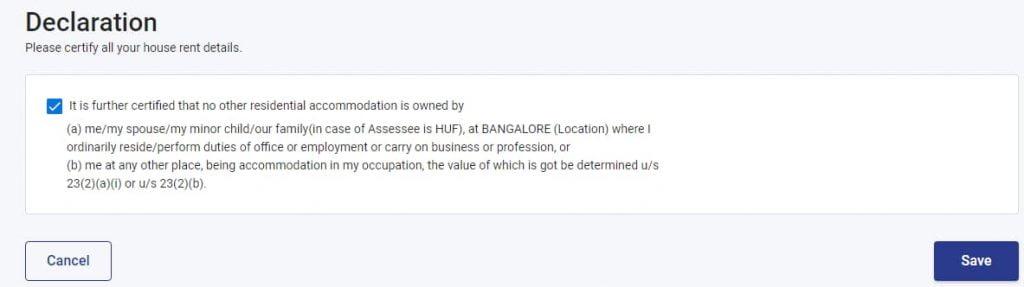

11. Click on the section Declaration; you will see the below screen. This is just a self-declaration form. Select the checkbox next to the declaration and click on Save.

12. Download the PDF format of your 10BA form and e-verify the form via OTP, and you are good to go.

By now, you must have got a good idea of Deduction under section 80GG. However, if you still have any doubts, we have listed some Faqs that may clarify your lingering questions.

Faqs

(1) What is 80GG of the Income-tax Act?

80GG is a deduction provided under chapter VI-A of the Income Tax Act, 1961 to avail of the tax benefit for the rent paid in the absence of HRA. Also, this is one of the tax deductions provided along with other section 80 deductions.

(2) Who can claim section 80GG Deduction?

It doesn’t matter if you are salaried or run a business. You are eligible to claim Deduction under section 80GG if you do not avail of HRA under section 10 (13A).

(3) What is the 80GG deduction limit?

The 80GG deduction limit is the least of the below

(a) Rs 5,000 per month

(b) 25% of your total income before any deductions.

(c) Actual rent paid -10% of total income.

(4) How do I claim the Deduction under section 80GG?

To claim an 80GG deduction, you must submit the form 10BA online and declare the amount under deductions while filing your income tax return.

(5) Can I avail of HRA and section 80GG deduction?

No, you can avail of any one of the two tax benefits as both are about rent paid.

(6) Is section 80GG Deduction allowed if I own a house?

You cannot claim an 80GG deduction if you or your spouse own a house that is either self-occupied or let out.

(7) Is the 10BA form mandatory?

You must file 10BA Form if you want to claim an 80GG Deduction.

(8)Can I claim both 80GG and 10(13a)?

No, You can claim either 80GG or 10(13a) as both relate to availing of tax benefit for rent paid.

(9) Can a salaried person claim 80GG?

Salaried individuals and self-employed individuals can claim 80GG deduction for the rent paid.