Section 80TTA provides a deduction of Rs 10,000 on interest earned on the Savings account. However, only individuals and HUFs can claim deduction under this section.

So, Senior citizens can claim deduction under section 80TTB, which has a higher deduction limit of Rs 50,000. Furthermore, you cannot claim an 80TTA deduction for interest earned on time deposits such as fixed deposits or recurring deposits.

Table of Contents

Key Points

| – Maximum deduction that you can claim under section 80TTA is Rs 10,000. |

| – Deduction is allowed on interest income. |

| – Only Interest earned on a Savings account is allowed as a deduction. |

| – Savings account with a bank, cooperative society, or post office is eligible for this deduction. |

| – Interest income on fixed deposits, recurring deposits, or other time deposits is not allowed as a deduction. |

| – Only Individuals and Hindu Undivided Families (HUF) can avail of this deduction. |

| – Senior citizens cannot claim deduction under this section. |

| – Mandatory to disclose interest income while filing your income tax returns. |

| – Cannot claim this deduction under the new tax regime. |

80TTA Deduction for AY 2023-24 Maximum Limit

As per the Income Tax Act, the 80TTA limit for AY 2023-24 is Rs 10,000.

Suppose your interest income from the Savings account and post office savings account is less than Rs 10,000; you can claim the entire amount as your deduction.

However, if your interest income is more than Rs 10,000, you can claim only up to the maximum limit of Rs 10,000.

You can also calculate the maximum amount you can claim as a deduction under this section for AY 2023-24 using the calculator available on the official income tax website.

Type of interest Income on which Claiming 80TTA deduction is Allowed

You can claim tax deduction under 80TTA on

- Interest income from Savings Bank account.

- income from Cooperative Bank Savings Account.

- Interest income from Post office saving account

Deduction under 80TTA Is Not Allowed on

- Interest Earned from Fixed Deposits.

- Interest in any Time deposits.

- Interest in Recurring deposits.

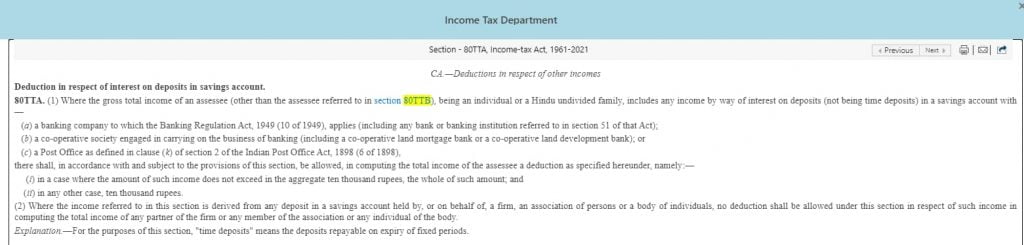

Section 80TTA of Income Tax Act Extract

Who can claim 80TTA deduction?

Individuals below the age of 60 years and HUFs can claim tax deduction under this section on the interest earned on savings account.

How to claim deduction under section 80TTA?

Steps to claim deduction under this section are as follows

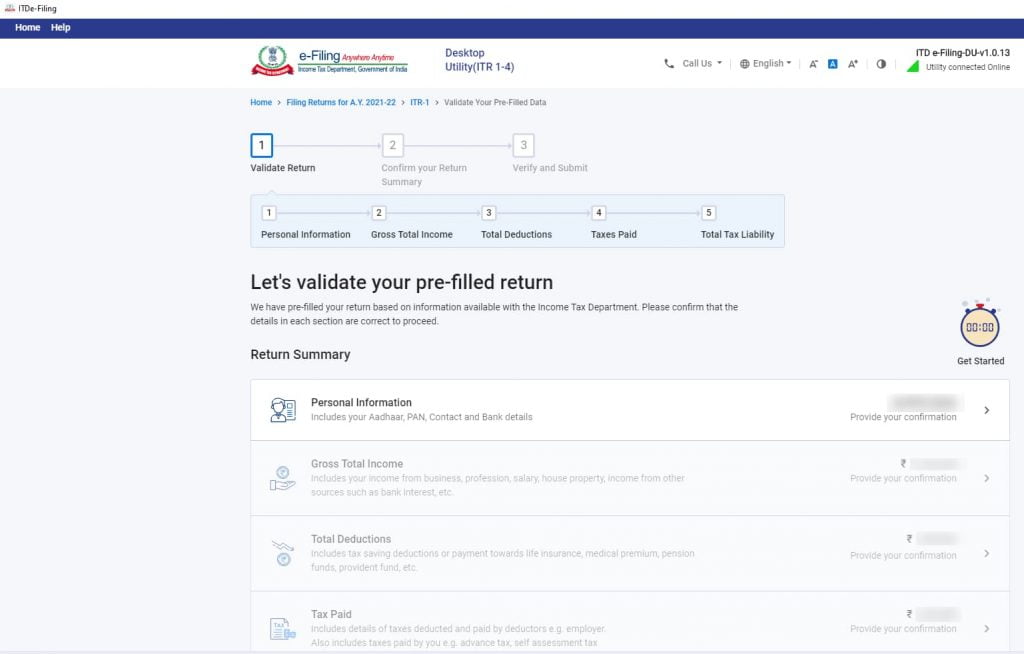

(1) Go to the new income tax portal and download the common offline utility.

(2) Double click on the efiling application and click on File Returns.

(3) Select Download Pre-filled Data and Click on Continue.

(4) Login with your credentials and select status and ITR-1 form. And your data from Form 16 will auto-populate. You need to confirm the details under the fields personal details, Gross Total Income, Total Deductions, Tax Paid and, Total Tax Liability.

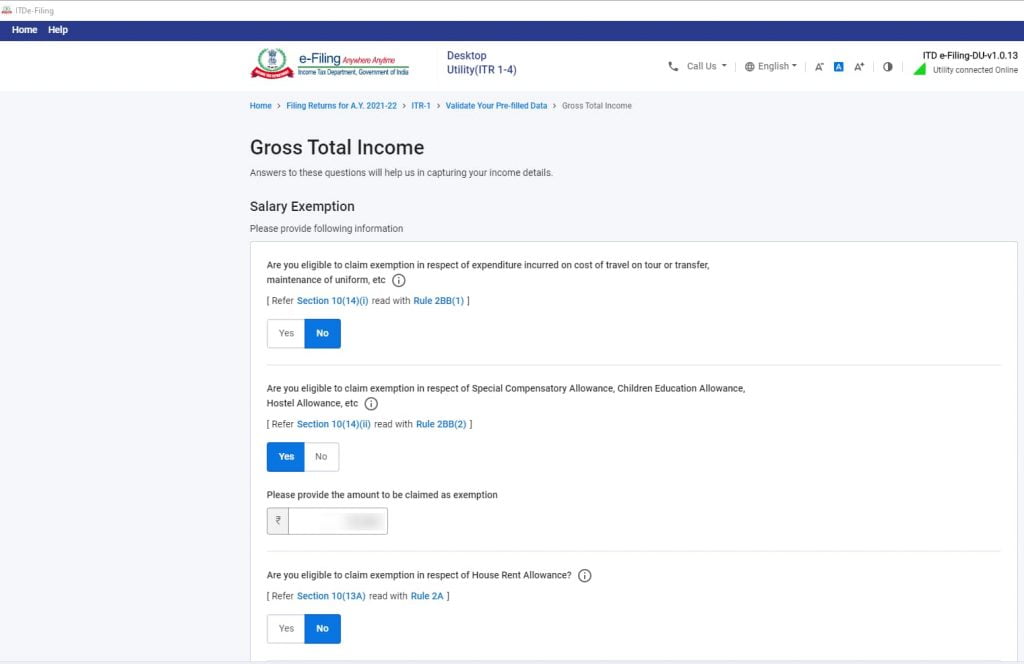

(5) For the purpose of this article we shall be seeing in detail ” Total Deductions”. To claim an 80TTA deduction, firstly you must declare Interest income under the head “Income from Other Sources”. We will see how to do that. Click on Gross Total Income, check the options applicable to you and click on continue. Below is an example of a typical Gross Total Income.

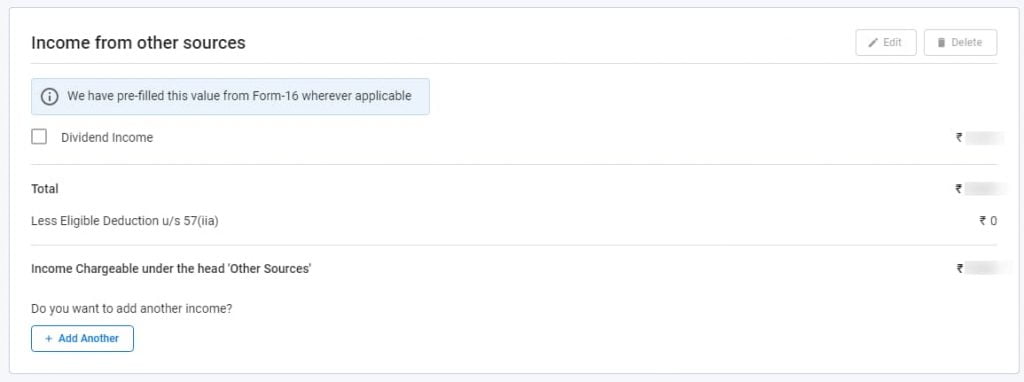

(6) Once you confirm you will get the screen with details under the heads “Income from Salary”, Income from House Property”, “Income from Other Sources” and “Exempt Income”.

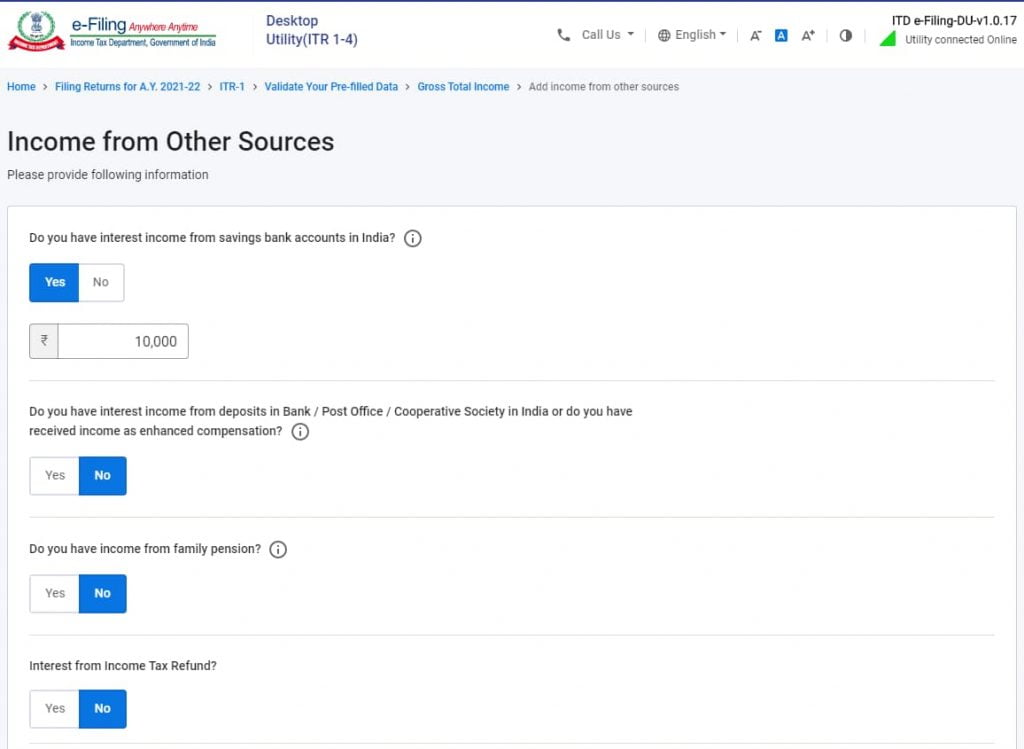

(7) Click on Add Another in the above screen and the below details will appear. Here you must declare your total interest income from your savings bank account. Select “yes” on the one applicable to you, enter the amount and click on continue.

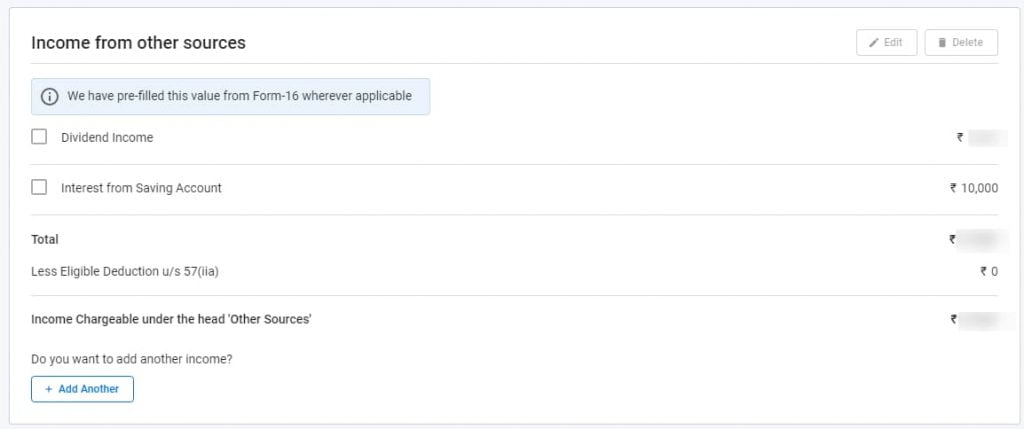

(8) It will reflect as below. Click on confirm.

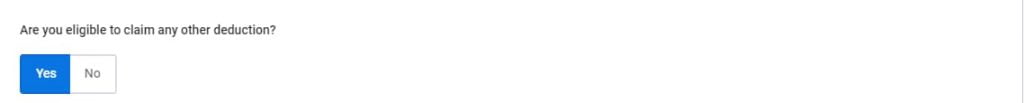

(9) Now click on Total Deductions. Scroll down to the option ” Are you eligible to claim any deduction”

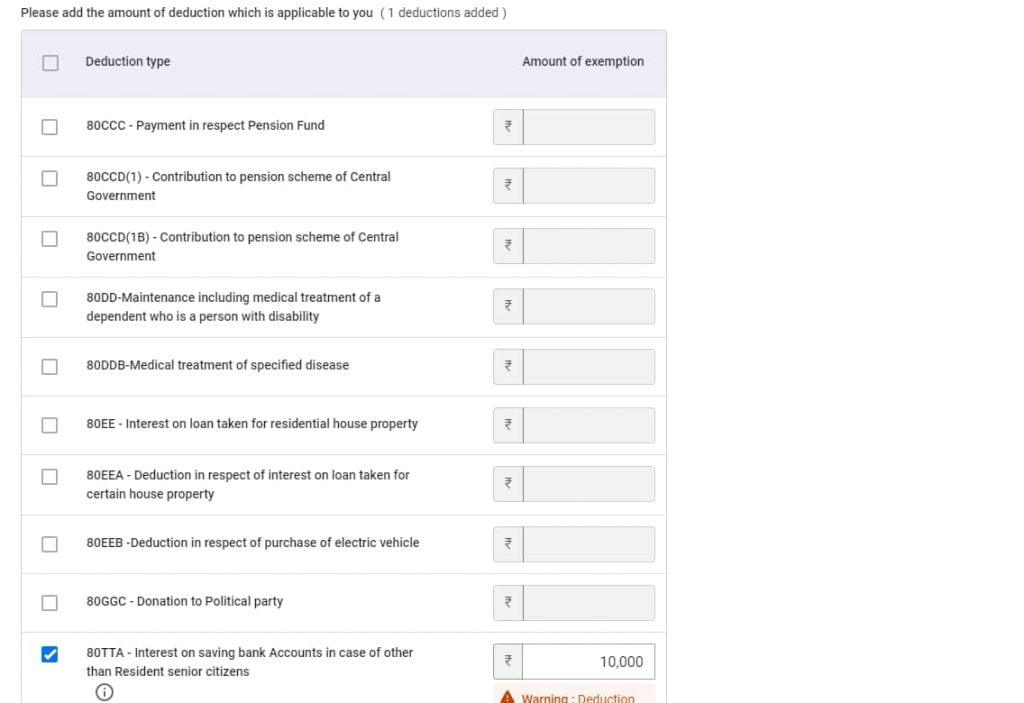

Note that you will get a warning message. Just ignore that and click on Continue.

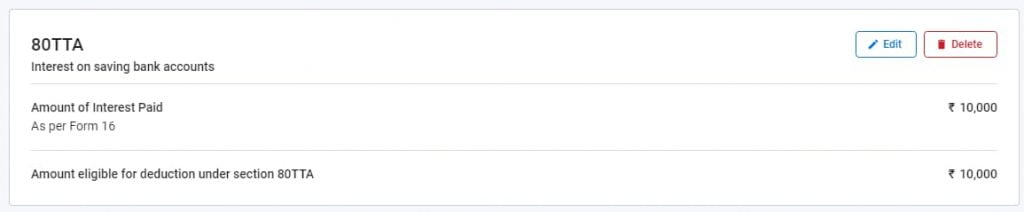

(10) You can see the 80TTA deduction under Verify your deductions along with other deductions. You may edit if you like.

Note that without showing interest income under Income from other sources, you will not be able to claim the deduction.

Example

Suppose Mr Krishnan who is working in an MNC earns a salary of Rs 7,00,000 per annum. He gets Rs 15,000 as interest from his Savings bank account. He wants to know how much he can claim under section 80TTA so that he can decide on how much to invest in other sections.

| Particulars | Amount | Eligible Amount |

| Gross Salary | 7,00,000 | |

| Income from other sources | ||

| Interest on Savings account | 15,000 | |

| Gross Total Income | 7,15,000 | |

| Taxable Income | 7,15,000 | |

| Standard deduction | 50,000 | |

| Professional tax | 2,500 | |

| 80TTA deduction | 10,000 | |

| Taxable Income | 6,52,500 |

Explanation:

In the above scenario, even though the interest income is Rs 15,000, he is eligible to claim only Rs 10,000. If he has to reduce his tax liability, he can invest in 80C, 80D or any other sections under chapter VI-A of the income tax act. If you do not want to end up paying more taxes, you can view a detailed tax plan in “How to file Income Tax Return for Salaried Individual?“

80TTA Deduction for AY 2023-24 for Non Resident

A Non-Resident Indian (NRI) with a Non-Resident Ordinary (NRO) account can claim an 80TTA deduction of Rs 10,000 for AY 2023-24 on the interest income from the Savings Account only. They cannot claim a deduction on fixed deposits.

Differences between 80TTA and 80TTB

Below are the key differences

| Section 80TTA | Section 80TTB |

| Can avail deduction only on the interest earned on Savings Account. | Can avail deduction on both fixed deposit and Savings account. |

| Individuals and HUFs are eligible to claim the deduction. | Only Senior citizens are eligible to claim the deduction. |

| The maximum limit under this section is Rs 10,000. | The maximum limit under this section is Rs 50,000. |

| NRI with NRO account can claim this deduction. | NRI cannot claim this deduction. |

80TTA of Income Tax Act

| Deduction | Amount that can be claimed |

| For AY 2020-21 | Rs 10,000 |

| For AY 2021-22 | Rs 10,000 |

| For AY 2022-23 | Rs 10,000 |

FAQs

1. Does 80TTA include FD interest?

The deduction is not allowed on interest earned on time deposits such as fixed deposits or recurring deposits.

2. Can 80TTA and 80TTB both be claimed?

Individuals and HUFs can claim deduction only under section 80TTA, and Senior citizens can claim deduction only under section 80TTB.

3. What are Time deposits?

Time deposits are those deposits repayable on the expiry of fixed periods.

4. Can Non-Residential Indians avail of the tax deduction under section 80TTA?

80TTA deduction for AY 2023-24 for non-resident can be claimed on the Non-Resident Ordinary or NRO Savings bank account. However, this deduction is not available on the NRO Fixed Deposit account.

5. If an assessee earns interest from multiple savings accounts, will they be able to claim tax deduction under section 80TTA?

Yes, of course, you can claim a maximum deduction of Rs 10,000 on interest earned on savings accounts.

6. What is the difference between 80TTA and 80TTB?

Section 80TTA provides relief to individuals and HUFs, excluding senior citizens for interest income from savings accounts. But, Section 80TTB offered relief only to senior citizens for interest income from the savings account and fixed deposit account.

7. Is interest in savings account taxable?

Yes, the interest earned on your savings account is taxable. So, even if it is not a considerable amount, you must disclose the same under the head “Income from other sources” while filing your income tax return.

8. What is the deduction limit available under section 80TTA for the financial year 2022-23?

A maximum limit of Rs 10000 is available under sec 80tta for fy 2021-22.

9. Do I need to declare bank interest on my tax return?

Declaring your interest income on your tax return is mandatory.

10. What is 80TTA?

It means a section under Income Tax Act 1961 wherein any individual can claim a deduction for interest income from savings account except senior citizens.

11. What if I do not disclose the interest income in my ITR?

If you do not disclose the interest income, if the authorities pick your ITR for scrutiny and find out, you will be liable to pay the penalty in addition to the tax amount for non-compliance.

12. Is 80TTA deduction allowed in new tax regime?

No, if you opt for new tax regime, you will not be able to claim any tax deductions under section 80. Deduction under section 80TTA can be availed of only in the old tax regime.

13. How much can be claimed as 80tta deduction for ay 2023-24?

You may claim a maximum of Rs 10,000 as 80tta deduction for AY 2023-24.

14. How do I submit 80tta proof?

You need not submit any proof while filing your income tax return. However, it is advisable to keep your Savings Bank Account Statements handy to be sure of the interest amount.

15. Why is the Deduction under section 80TTA not reflecting under Chapter VIA deductions?

The Income Tax Act allows set-off of losses from non-speculative business income against income from other sources. The interest on savings account is reported under the head income from other sources. So, it is set-off against the losses and so it will not reflect under Chapter VIA deductions.

16. What is 80TTA proof?

Bank Statement or Pass book is 80TTA proof as provides information about interest earned on savings account.

17. What is the maximum number of bank account on which 80TTA deduction can be claimed?

There is no limit on the number of bank accounts on which 80TTA deduction can be claimed.

18. Can you claim 80TTA deduction in new tax regime?

Under the new tax regime, you cannot claim this deduction.

whether deposits made in MOD form is taken as time deposit for 80TTA

MOD deposits are also a type of term deposits. Even though it is linked to the Savings account it is not a Savings account. So, you cannot claim a deduction on the interest earned on such deposits under section 80TTA.

Can one claim 80TTA without form16? Current form gives us an error.